Lease Liabilities

Index Report

2021 UPDATE

What a difference a year makes

Many public companies just filed their second annual report under the new lease accounting rules, and as private companies prepare for the final push to adoption of ASC 842, understanding the potential impact to the balance sheet for your industry is important.

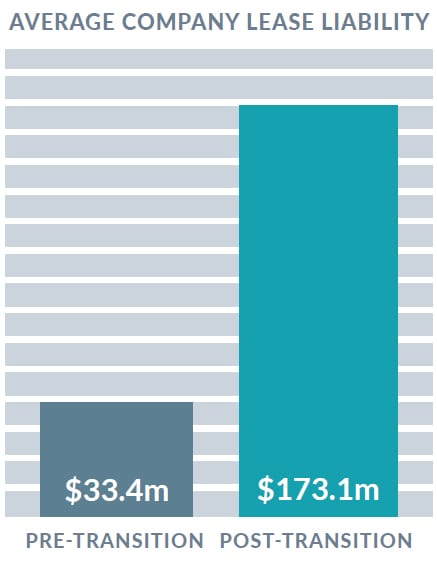

In 2020, large companies that were early adopters of the lease accounting standard saw a 1,475% increase in average lease liabilities. Now, with more middle-market and smaller private company businesses completing their transition, the before and after impacts felt by the average company are solidifying.

According to the 2021 update of LeaseQuery’s Lease Liabilities Index Report, an expanded analysis from approximately 400 to more than 950 companies’ balance sheets pre- and post-transition, average balance sheet lease liabilities increases are now at 419%.

Public vs. Private Picture

Public companies settle into their new normal

While the impact of the initial transition to the new lease accounting rules was extraordinary, public companies are now settling into their new reporting normal and working their way through lingering technical complexities.

As mentioned, many public companies recently completed the filing of their second annual reports under the new lease accounting rules – and got to do so during a comparatively calmer period than companies who are facing the transition now (while also contending with the impacts of the COVID-19 pandemic and sweeping changes in consumer behavior, investor sentiment, and a global economic downturn).

However, that’s not to say they had an easy time of it; public companies’ average liabilities went from $59M to $239M.

Private companies prepare for financial snapshot overhaul

Many private companies, on the other hand, have not yet completed their transition to the new standards–and may be surprised about just how much they’ll have to overhaul their financial snapshot. Among private companies in compliance, average liabilities increased from $8.6M to $116M, a stark change in an already complex financial year.

Looking ahead, there is a wide array of variation in where private companies are in their transition journey. Many are behind or stalled despite warnings from public companies over the last two years that organizations should begin their implementation as soon as possible and expect both a longer timeline and more obstacles than anticipated.

In addition to pandemic reprioritization, a major driver of this variation—and the confusion surrounding it—is the multiple deadline extensions for non-public entities. Some companies that were already well on their way to completing their transition did not stop, while others took advantage of the extensions. Now, it must be full steam ahead for all, and these average liability increases provide a glimpse of what’s to come.

Private Companies Get the SECrets of Common Transition Troubles

LeaseQuery recently assessed SEC comment letters on lease accounting disclosures from public companies’ 2019 and 2020 filings across a range of industries, uncovering insight into some challenges private companies may encounter when on the other side of implementation – and how to avoid them.

Common themes in SEC comments that private companies should use as a playbook include:

Provide clarity through transparent disclosures regarding COVID-19 concessions and changes

Get descriptive when documenting discount rates

Keep records of contract terms and ensure variable rent payments are appropriately accounted for and disclosed

Accurately record ROU assets or risk non-compliance

With fluctuating lease portfolios and business needs, coupled with the challenges of complying with the new standard, it is imperative companies centralize their lease data, understand every facet of their lease portfolios, and secure the technology and resources to identify and solve any barriers to compliance.

The Tested 10

A Spotlight on the Key Industries Affected

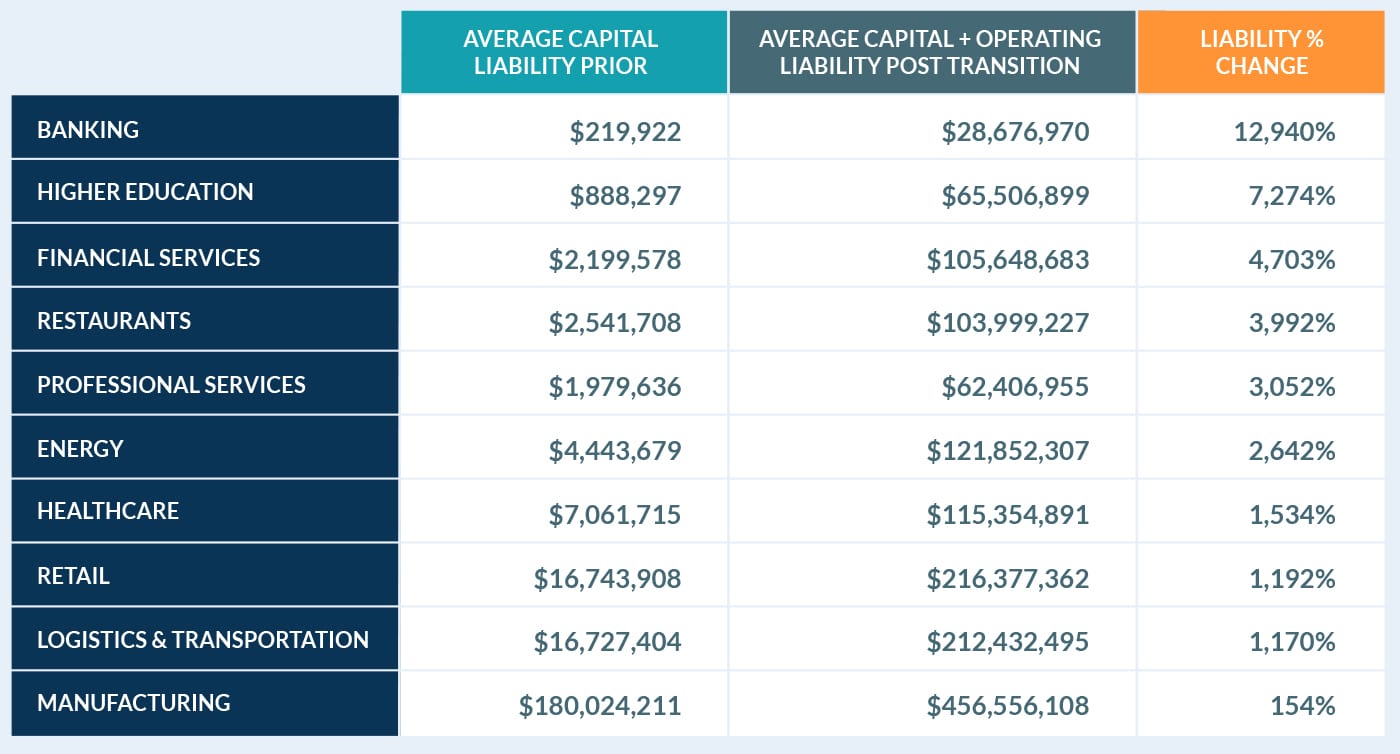

Because one of the first steps of the new lease accounting rules requires documentation and categorization of the lease portfolio, many industries that manage a large portfolio of equipment and property leases are running into challenges.

Public companies and early adopters went through their transition during a period of relative calm. Those who transitioned in 2020 or will finish implementation this year have the added challenge of managing this reporting change at the same time they work through the fallout of the pandemic, including resets to business strategy, long-term changes to customer behavior, and shifting employee expectations.

Below, we spotlight the impacts on the 10 key industries most affected by both lease accounting and economic change: banking, higher education, financial services, restaurants, professional services, energy, healthcare, retail, logistics & transportation, and manufacturing.

Banking

As many companies spent much of 2020 seeking extra cash, the demand for banking significantly increased. Capitalizing on services like the Paycheck Protection Program (PPP) and various other CARES Act programs became a lifeblood to large and small businesses across the country.

Financial institutions also found themselves reassessing their own physical footprint needs as the online banking trend increased during the heat of the pandemic. To further limit in-person interaction during the last year, the need for new leased equipment like ATMs and drive-up teller systems may add a number of new leases to the balance sheet.

Overall, the banking industry has contended with evolving regulations for years. Lease accounting implementation is approaching for private organizations and the adoption of Current Expected Credit Loss (CECL) is up next in 2023. Accounting compliance will continue to be a challenge for the industry.

Higher Education

In the height of pandemic uncertainty, education had to make the shift to virtual learning overnight. Although colleges and universities throughout the country have been offering online courses for years, virtual school soon became the only option to support social distancing. As much of the higher education industry begins to open back up for in-person learning, the question remains – will higher education ever return to exactly what it was before?

While virtual learning becomes more appealing, especially to students working full-time jobs, balancing family life, etc., the demand for classroom space may decrease as the need for equipment leases like computers, headsets, and other technology to improve the virtual learning experience will increase.

Higher education institutions are now facing liquidity challenges as students lower the dollars spent on on-campus housing and other services. Institutions are also evolving the way they offer “experiences” like sports, social events, and various other extracurriculars. Finally, many larger institutions are finding with so many departments and separate schools in place, their leases are likely decentralized. As this industry prepares for transition, tracking all these changes is critical to ensuring each lease makes its way to the balance sheet.

Financial Services

Financial services encompass hedge funds, private equity (PE) firms, investment organizations, retirement companies, and many more. This industry is no stranger to scrutiny—watched by analysts, economists, and investors as a forerunner of the economy and how the flow of capital is faring.

The dynamics between PE firms and current or target portfolio companies are heavily impacted by the new lease accounting standards. Investors are largely metric-driven, and financial metrics using balance sheet elements will be grossly affected by the increases. And because lease obligations have typically been the largest off-balance sheet liability, lessees will be looking for the financial effect of recording them accurately, while PE firms may make strategic changes to their investment analysis approaches moving forward.

Overall, though the new rules won’t necessarily change how the financial service sector makes loan or leasing decisions, they still have a major impact on how those decisions are appearing on the balance sheet. Just as before, the underlying fundamentals of the industry still remain unchanged, making communication with key stakeholders critical to ensure stability.

Restaurants

Unfortunately, restaurants were one of the industries hit hardest by the pandemic. Mass restaurant closures were seen across the country—100,000+ according to the National Restaurant Association. However, as businesses begin to slowly reopen, the industry is still expecting consolidation in various areas. The good news is consolidation doesn’t necessarily mean another round of closures. Instead, restaurants are finding imaginative ways to operate including the rise of ghost kitchens (kitchen-only restaurants to support delivery and take-out), new equipment to ensure certain health and safety protocols are met, new options for delivery services, and more.

As equipment leasing trends and reimagined kitchen spaces are on the rise in this new era of restaurant operation, so are the leases added to the balance sheet. And while health and safety compliance measures with state and local rules will remain a top priority for restaurants to operate under their new normal, balance sheet accuracy is critical. Having a better understanding of their lease portfolios significantly helps lessees during the renegotiation process. The lease accounting rule change, paired with updated COVID-19 protocols, may be an even heavier prompt for operators to reconsider lease vs. buy decisions moving forward.

Professional Services

With the pandemic changing the market for 2021 and beyond, businesses have a higher demand for professional services – from ESG (environmental, social governance) consulting to digital transformation services. These types of services are in place to give companies the resources and guidance necessary to continue adapting and rethink their future.

As businesses realize how much of professional services can be done remotely, the outlook for the future of leasing workplace category extremes like campus-style offices or WeWork-esque rentals is on the rise. While there’s no doubt more professionals will continue to work remotely, the professional service industry must also consider the impact on their space requirements as the necessity for business travel changes. As this industry moves forward, the types of leases may change or even increase, making lease centralization and visibility even more essential.

Energy

With travel bans in full force and commutes coming to a halt during much of 2020, oil prices plunged and supply surged during the spring and summer months. However, infrastructure needs remain even in times of volatile demand. And with a slow return back to business and travel, in addition to expected investment in infrastructure at federal and state levels, the oil and gas and energy industries have begun to see a resurgence in demand and growth during the latter half of 2020 and will continue throughout 2021.

Compliance challenges, however, will remain as the industry contends with volatility abroad, the push toward renewables, and digitization—all of which are changing demand and decision making. Potential new challenges for the energy sector’s balance sheets will include things like easements and taking new, money-saving contracts like solar farms into account. Many of these new contracts will likely include more embedded leases, confirming the importance of balance sheet scrutiny. Overall, as energy industry businesses continue to alter their long-term strategy for a greener world in the wake of a pandemic and an economic crisis, lease arrangements will continue to be a major focus.

Retail

Retailers face the one-two punch of the combined heavy impacts from the new lease accounting rules and industry upheaval due to the COVID-19 pandemic and resulting consumer changes.

With stores just beginning to reopen or return to normal hours after mandated shutdowns, requesting rent concessions is a common strategy. In fact, in LeaseQuery’s COVID-19 Impact Report, 54% of retailers say they asked for rent concessions as a direct result of the pandemic. And, as the acceleration of e-commerce and new convenience models like curbside pickup continue, both lease renegotiation and rightsizing are in full force.

The retail industry has also seen a major shift in space needs, particularly for the new (and here to stay) BOPIS (buy online, pick up in-store) trend. However, not all retail categories struggled last year; Grocery chains, home improvement stores, and athleisure brands all worked double-time as the pandemic waged, and may be looking for new store space in 2021 and beyond.

Looking ahead, 2021 will be yet another critical year for retail and their lease accounting transition process as the industry seeks to optimize its leasing and location strategy in combination with accommodating evolving demands.

Healthcare

Healthcare workers’ heroism was front and center in 2020 as the industry’s professionals of every level stood on the front line of the COVID-19 crisis. While the industry prioritized fighting the peak of the pandemic, it’s no surprise lease accounting was likely put on the backburner in 2020. However, as the focus begins to slowly go back to reimagining operations, many hospitals are facing challenges managing how to account for the surge in demand they saw in the height of the pandemic, while other healthcare facilities like dental offices and smaller specialty physician practices are trying to find relief from the steep decline they faced. All are working to understand and adapt to evolving patient care needs and preferences.

In 2021, the healthcare industry should consider the rise of telehealth and the increased focus on in-home and community care. This may decrease the amount of office space being leased while increasing the need for costly equipment for quality telehealth experiences and concierge-level in-home care.

With significant evolution in facilities, medical equipment, and technology, the industry continues to be highly impacted by the lease accounting rule change. As many healthcare systems small and large face a liquidity crisis, getting compliant could help hospitals and healthcare organizations find cost savings or better reassess their leasing and real estate needs in this new normal.

Logistics and Transportation

2020 saw many supply chains tested—or even halted completely—under the weight of unexpected demand increases and new quarantine protocols. From trucking and railways to last-mile delivery, the pandemic fundamentally changed not only how companies and consumers view logistics but highlighted how much was taken for granted throughout the complex process of getting goods into customers’ hands and homes.

Still, the challenges of mid-2020 became successes in early 2021, as transportation and logistics were again in the spotlight, this time for their herculean effort around safe, global vaccine distribution. In the coming years, consumer expectations for near real-time delivery, coupled with an increased focus on infrastructure investment at the federal level, position the industry for major growth, but also major challenges in demand to solve for.

Whether it’s negotiating for more warehouse space, adding trucks to the fleet, or accessing more containers for shipments, there are complex lease terms and balance sheet impacts in the day-to-day operations of this industry, and even more so in times of peak demand.

Manufacturing

Starting with the largest base by far, a 154% liabilities increase for manufacturing is actually quite significant. Over the last decade, the manufacturing industry has found itself in the midst of technological evolution, leveraging the Internet of Things (IoT) and other connected solutions to improve both output and efficiency. However, the uncertainties of the last year have changed the way the manufacturers view the value of supply chain security and even redundancy.

While investment in digital transformation continues to change how and where manufacturing is done, the new goal for manufacturers is to de-risk the supply chain. This comes after many lessons have been learned from unexpected rises or declines in demand. Moving forward, manufacturers are likely to negotiate new terms for both warehouse and production space leases, in addition to equipment, and may be looking to bring processes closer to the customer.

The Post-Transition Promise Land

It is clear with every day of delay companies risk leaving dollars on the table or critical business insights hidden across the organization.

While the first steps remain a thorough understanding of the new standards and building a comprehensive inventory of your leases, companies need to consider the expected end game now. Communicating these significant changes to stakeholders—including internal leadership teams, board members, investors—is a must as your transition plan comes to fruition.

About the Lease Liabilities Index

LeaseQuery’s Lease Liabilities Index is an annual analysis of more than 950 public, private, and nonprofit organizations’ financial statements as they implement the new lease accounting standards. The index is designed as a benchmarking resource to help companies assess and communicate changes to their stakeholders.

About LeaseQuery

LeaseQuery helps more than 10,000 accountants and finance professionals eliminate lease accounting errors through its accountant-approved lease accounting software. It is the first lease accounting software built by accountants for accountants. By providing specialized consulting services in addition to its software solution, LeaseQuery facilitates compliance with the most comprehensive regulatory reform in 40 years for businesses across all sectors.