Lease Management

Software with LeaseQuery

Track your leased assets, from buildings to equipment, efficiently and accurately.

It can be difficult to sort important dates, documents, and data using a simple spreadsheet. Software can streamline your lease administration processes and improve your reporting and forecasting capabilities.

What is lease management?

Lease management involves routing a contract to relevant departments, creating a lease abstract, preparing the asset for use, and acquiring it. Software automates those tasks and makes information more accessible.

Beneficial Features of LeaseQuery for Lease Management

Critical Alerts

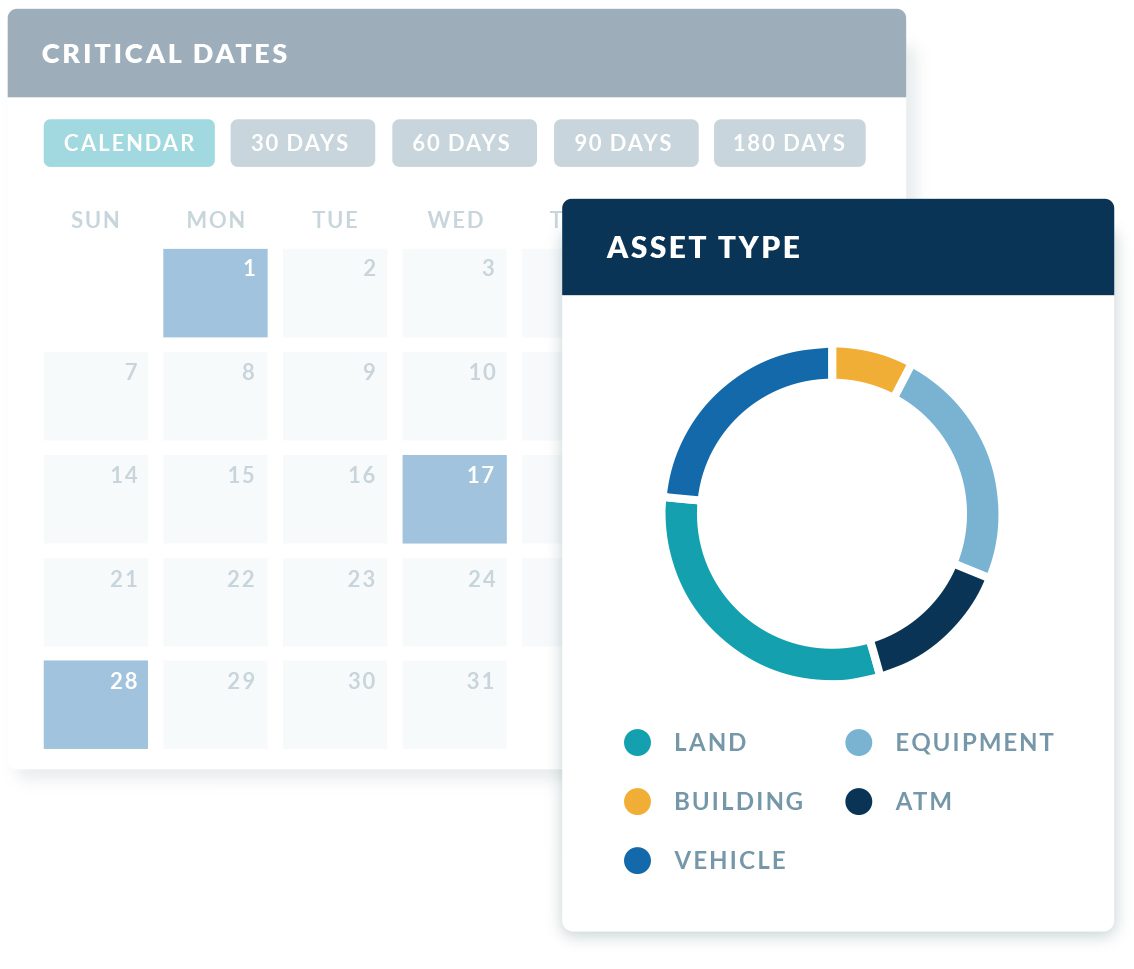

Avoid late fees and overpayments with alerts for critical dates like renewals, payment due dates, rent abatements, and more.

Cloud Based Lease Database

Add accessibility and security miles above Excel – a searchable, central database in the cloud means you and your team can easily access and share information about your leases at any time.

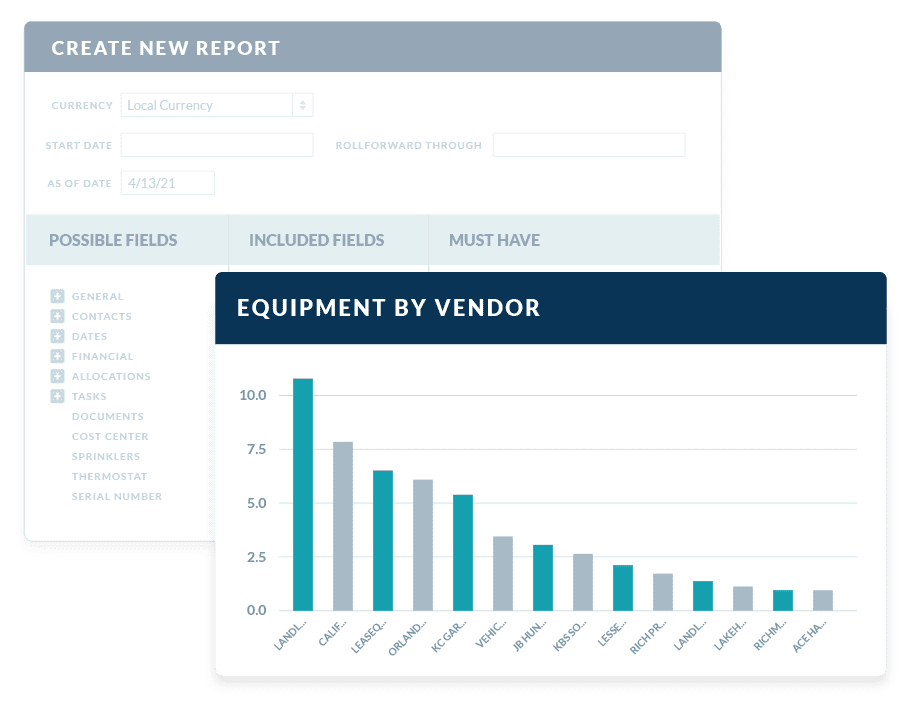

Reporting Studio

Easily develop budget plans with quick access to reports on lease information like location, square footage, storage information, etc.

Automated Lease Abstraction

Automatic instant lease abstracts created for every lease you enter – our tool ensures you receive a custom, professionally designed PDF with all of your important lease details.

Who needs software for lease tracking?

Lease managers receive all kinds of requests throughout the day. If you maintain your documents in files on a local server, sorting through that data can be time-consuming. Companies with more than ten leases should consider a software to save time and reduce errors.

Centralize lease documents

The more leases you have, the harder it is to keep up with all the data for each one. A lease software that enables you to upload and store your lease information, as well as perform a quick search to find the information you need, is key.

Track any asset

Even if your business typically leases one type of asset, it’s a good idea to get an asset-agnostic system that can grow with you as your needs change. With flexible lease management software, you don’t have to panic and reevaluate if you switch your business model.

Prevent mistakes with critical date alerts

Missing important dates can cause major business interruptions. A lease management system provides you with automated alerts before those dates arrive to save time, money, and stress.

Improve your reporting

Using software built specifically for leases gives you access to reporting features that make it easy to retrieve lease data. The best lease management software will allow you to generate reports based on square footage, geography, type of lease, or any attribute you choose for accurate reporting.

Streamline communication across departments

With the shift to remote work, completing collaborative tasks can be complicated. Having a cloud-based system to access lease data isn’t just a convenience; it’s a necessity. Lease management software allows stakeholders across the organization to self-serve when they need documents and reports.

“We are able to instantly pull up all of the details on any given lease with only a couple of clicks. From basic information like location, size, and important dates – to amortization charts and financial accounting data – the search feature makes it simple to use and gives you immediate results.”

Missy Whitehill

Operations Manager, Scotland Wright