1. What is an operating lease?

2. What is a capital lease / finance lease?

3. Capital/finance lease vs. operating lease criteria

- Transfer of title/ownership to the lessee

- Exercising a purchase option

- Lease term

- Present value

- Alternative use

4. Finance lease vs. operating lease accounting treatment

5. Impact on the business

6. Frequently asked questions

- Do we have to capitalize every lease?

- Are all leases now finance leases?

- Are out-of-scope leases still required to be disclosed in the footnotes?

7. Summary

Leases have two classifications under US GAAP. A capital lease, now known as a finance lease, resembles a financed purchase; the lease term spans most of the asset’s useful life. An operating lease resembles a rental agreement in that the asset is used for a set time with useful life remaining at lease end.

Lease classification is determined by five criteria laid out under ASC 842, the new lease accounting standard, and dictates appropriate lessee and lessor accounting. This new standard now requires US GAAP entities to record both types of leases on the balance sheet.

What is an operating lease?

From an accounting perspective, leases are considered operating under ASC 842 if none of the five criteria for finance leases are met.

From a business perspective, operating leases allow lessees to treat leased assets like normal fixed assets in the context of operating a business, but only for a period of time as they are ultimately returned to the lessor with some useful life left. The lessee is renting the asset to manage the normal operation of their business.

What is a finance lease / capital lease?

From an accounting perspective, leases are considered finance under ASC 842 if at least one of the five criteria discussed below are met.

From a business perspective, capital leases are agreements which behave like a financed purchase such that a company can spread the acquisition cost of an asset over a period of time. The lessee is paying for the use of an asset which spends the majority of its useful life serving the operations of the lessee’s business.

Under current US GAAP (ASC 842), public and nonpublic entities follow a two-model approach for the classification of lessee leases as either finance or operating. Lessors must classify leases as sales-type, direct financing, or operating. Lease classification determines how and when expense and income are recognized, and what type of assets and liabilities are recorded.

For lessees governed by ASC 842, leases are deemed either finance or operating based on the criteria outlined below.

Capital/finance lease vs. operating lease criteria

ASC 840 designated two types of leases: operating and capital.

ASC 842 still designates two types of leases: operating and finance. One of the changes implemented with ASC 842 is the renaming of capital leases to finance leases. While this is mostly a nomenclature change to provide more clarity to the different types of lease commitments, key differences in how a lease is classified under ASC 840 vs. ASC 842 do exist.

Previously, only four criteria were used to determine if a lease was a capital lease for the lessee. Now, there are five criteria to consider for finance leases (ASC 842-10-25-2):

- Transfer of title/ownership to the lessee

- A purchase option the lessee is reasonably certain to exercise

- Lease term is over a major part of the economic life of the asset

- Present value equals or exceeds substantially all of the fair value of the asset

- Asset specialization: Would it provide any value to the lessor after the lease term?

If a lease does not meet any of the five criteria, it is an operating lease. Let’s take a closer look at the differences in criteria below.

1. Transfer of title/ownership to the lessee

Criteria: Transfer of ownership occurs by the end of the lease term. This is commonly seen in equipment or vehicle leases where at the conclusion of the lease term, the lessor relinquishes the title to the asset and ownership of the asset transfers to the lessee.

This criterion is the same from ASC 840 to ASC 842. If title transfers to the lessee, then the lease is classified as finance.

2. Exercising a purchase option

Criteria: The lease agreement contains a provision where the lessee has the option to purchase the asset, which the lessee is reasonably certain to exercise. This is slightly different from previous guidance where the presence of a bargain purchase option would indicate a capital lease. A bargain purchase option under ASC 840 was defined as a purchase price significantly lower than the expected fair value of the asset or penalties realized due to the asset’s specialized use.

To determine whether the option is reasonably certain to be exercised, the lessee should review the following factors:

1. Contract-based

- Evaluate pricing for purchase option

- Evaluate the duration of the lease term and other options

2. Asset-based

- Determine the cost of returning the asset to the lessor

- Consider relocation

- Evaluate significant leasehold improvements, etc.

3. Market-based

- Determine the market price for comparable assets

- Consider laws and regulations

4. Entity-based

- Determine the significance of the asset to the lessee’s operations

- Define tax consequences

- Evaluate the financial impact of purchasing the asset, etc.

Of course, judgment is required when assessing whether an option is reasonably certain to be elected. For additional guidance, please refer to ASC 842-10-55-26. If this purchase option exists and the lessee is reasonably certain to exercise it, then the lease is classified as finance.

3. Lease term

Criteria: The lease term represents the major part of the asset’s economic life. Companies must now make judgmental assessments that can often vary by class of asset. This is one of the stark differences between the old and new lease standards. ASC 840 defined a specific threshold of 75% or more of the asset’s remaining economic life. The “bright line” or specific threshold for this test is removed under ASC 842.

ASC 842 does not indicate a specific percentage, instead using the terminology “major part,” which requires more judgment. “Major part” is not a defined threshold under ASC 842; however, ASC 842-10-55-2 states an organization can continue to use the 75% threshold to define a “major part” of the remaining economic life of the underlying asset.

In addition, if a lease commences “at or near the end” of the asset’s economic life, the lease term criterion is not used and the lease classification conclusion is based only on analysis of the other four factors. The ASC 842 guidance does not establish a “bright line” for determining when this exception should be used, but suggests scoping out this criterion for leases commencing in the last 25% of an asset’s life is a reasonable approach.

For most situations, if the lease term exceeds 75% of the remaining economic life of an asset and the asset still has at least 25% of its original useful life left, then the lease is considered a finance lease.

4. Present value

Criteria: The present value of lease payments over the lease term, calculated at lease commencement, equals or exceeds substantially all of the fair value of the asset. Similarly, as indicated above for the economic life criterion, ASC 842 removes the bright line of this test. “Substantially all” is also not defined under ASC 842. However, this phrase is used throughout other guidance where a 90% threshold is implied. Furthermore, ASC 842-10-55-2 explains how companies can continue to use the 90% threshold from ASC 840 to define substantially all of the fair value of the underlying asset.

When assessing lease payments under ASC 842, unlike ASC 840, if a portion of property taxes or insurance is considered a lease payment, then it should also be included for the purposes of the classification test. ASC 840 excludes fixed executory costs. For most situations, if the present value of the lease payments to be made over the lease term exceeds 90% of the fair value of the asset, then the lease is considered a finance lease.

It’s important to determine your organization’s internal policy for each threshold of the classification criteria, document it, and follow it consistently. In our experience, most companies choose to keep the thresholds of 75% and 90% from ASC 840 for continuity purposes, as deviating from these standard amounts will cause additional work and documentation to substantiate.

5. Alternative use

Criteria: The asset is so specialized in nature it provides no alternative use to the lessor after the lease term.

While the first four criteria were present under ASC 840, this fifth criteria is new under ASC 842. Some real-world examples of leases which may trigger the new specialized use test could be:

- Extensive bodywork (welding work, etc.) on a piece of equipment specific to the lessee’s business and cannot be easily undone.

- A storage tank leased from a fuel provider that is buried on the lessee’s property. Removing the tank would require excavation.

Though we mentioned a lease must meet a minimum of one of these five criteria to be considered a finance lease, we have often found if a lease triggers the fifth test, it has also triggered one of the other four tests. This is because most landlords likely factor in the future use for the asset when establishing the lease payments. As such, the fourth test would be triggered too.

With the example of equipment specifically designed or remodeled to fit the business need of the lessee, these contracts will typically be considered finance leases already because the lessor still needs them to be profitable. The lessor likely structured the contract so the lessee will use the specialized equipment for the majority of its useful life or the lease payments equal substantially all of its fair value.

If the asset is of such specialized nature it offers no alternative use after the lease term ends, then the lease is classified as finance.

Capital/finance lease vs. operating lease accounting treatment

Both finance and operating leases represent cash payments made for the use of an asset. However, because of the distinction between the two types of leases, it is worth mentioning the differences in the mechanics of the accounting for each.

The cash payments made for each lease must have a corresponding expense. This expense represents the lease cost and may differ slightly from the cash payment made each period.

Operating lease accounting

Operating lease payments under ASC 840 were often recorded to rent expense as simply a debit to expense and a credit to cash. Operating lease accounting under ASC 842 is more complex. To summarize, a right-of-use asset and a lease liability must be established at lease commencement (or transition to ASC 842), and then reduced over the remaining lease term in addition to recording the cash payment and lease expense.

The total lease expense booked under ASC 842 for operating leases is comprised of an asset lease expense and a liability lease expense and is equal to the total amount of required cash payments allocated evenly over the lease term. The liability lease expense represents the interest accrued on the lease liability each period and the asset lease expense represents the amortization of the lease asset.

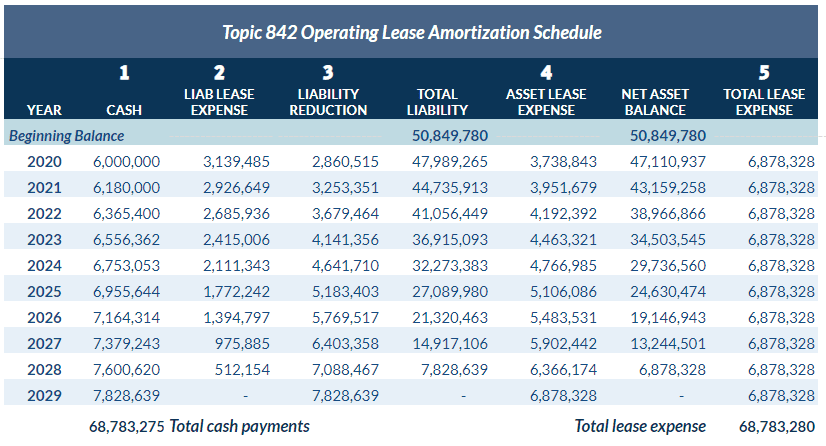

The lease liability is reduced by the periodic cash payment, less any interest accrued on the lease liability balance. The lease asset is reduced by the periodic lease asset expense. Below is an example of an operating lease amortization schedule showing:

(1) Cash payments

(2) Liability lease expense

(3) Liability reduction

(4) Asset lease expense, and

(5) Total lease expense under ASC 842:

Capital/finance lease accounting

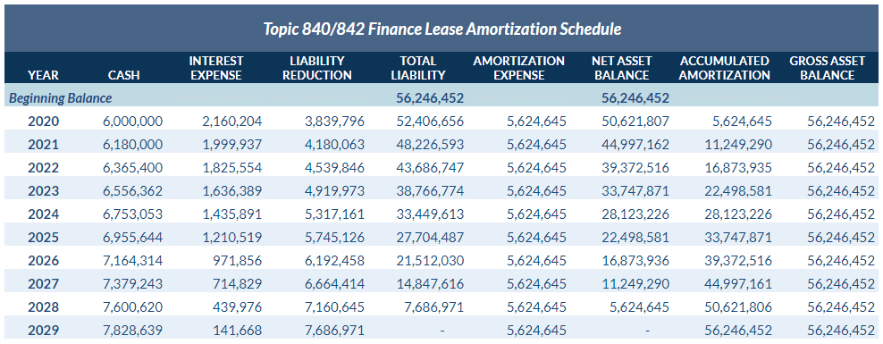

Accounting for finance leases under ASC 842 is much the same as capital lease accounting under ASC 840. Similar to operating leases, a right-of-use asset and lease liability must be established at lease commencement (or transition to ASC 842), and then reduced over the remaining lease term.

The finance lease liability is treated as capital lease liabilities were – the lease payments are split between the interest expense incurred on the lease liability and a lease liability reduction amount. The right-of-use asset is reduced by amortization expense like capital lease assets were reduced by depreciation expense. Below is an example of a finance lease amortization schedule under ASC 842:

Download our Ultimate Lease Accounting Guide for detailed examples of finance and operating lease accounting

Are you looking for more detail on finance and operating lease accounting under ASC 842? Our Ultimate Lease Accounting Guide includes 44 pages of comprehensive examples, disclosures, and more.

Impact on the business

So, what is the business impact of ASC 842? Previously, operating leases were considered off-balance-sheet transactions. Now, ASC 842 requires operating leases to be recognized on the balance sheet as both an asset and a corresponding liability. These new presentation requirements provide better representation of lessees’ obligations to investors, creditors, and other financial statement users.

First we will look at the balance sheet. Since both capital/finance and now operating leases require reporting a liability and asset, the total assets and liabilities recognized on the balance sheet are increased. The asset and liability balances associated with each lease type should be presented in separate line items resulting in an operating right-of-use-assets line item and a finance right-of-use-assets line item.

No impact to debt occurs when transitioning to ASC 842. However, companies should consider how the new operating lease assets and liabilities could potentially impact their financial ratios.

Let’s also consider the income statement. The classification of a lease helps determine how the lessee recognizes expense. No change to expense is recognized when transitioning from ASC 840 to ASC 842; therefore, the income statement remains consistent. Operating leases will continue to recognize rent expense and capital/finance leases will recognize both interest expense and amortization expense.

Effectively, no impact to the income statement also means no impact to EBITDA. However, situations may occur where leases classified as operating under ASC 840 may be considered finance leases under ASC 842 as a result of the additional classification criteria, and vice versa. Please note the package of practical expedients to evaluate the relief efforts at transition.

Frequently asked questions

Do we have to capitalize every lease?

All leases are subject to ASC 842. However, some fact patterns can create scope exceptions for operating leases, allowing the lessee to skip capitalizing an asset and liability onto the balance sheet – effectively keeping operating lease accounting consistent with ASC 840 for these few scenarios.

The first exception is for short-term leases. Leases with a total term, including renewal options reasonably certain to be exercised, of 12 months or less are exempt from capitalization. Note that under ASC 842 this measurement is taken from lease commencement to lease end, not your transition date to lease end.

The second exception is for leases which are deemed immaterial to financial statement users. ASC 842 does not establish a materiality exception or threshold, but materiality exemptions are allowed overall by US GAAP. If an entity has a materiality threshold for fixed assets, a similar methodology may be applied to leases as well.

One consideration, however, is that the materiality threshold for leases under ASC 842 must be applied to whole asset groups, not individual leases. For example, if a company determines it has immaterial copier leases, it must aggregate all its copier leases and analyze the total amount of copier leases for materiality to stakeholders .

The materiality threshold for leases is a subjective determination which must ultimately be approved by your auditors.

Are all leases now finance leases?

No – the distinction between operating and finance (previously capital) leases remains under ASC 842.

If leases are out of scope due to short-term criteria or materiality, are they still required to be disclosed in the footnotes?

Short-term lease cost, or the cash paid for leases under 12 months in total (which will match the expense), is part of the overall required disclosures for “total lease cost”. Leases which are deemed immaterial have no disclosure requirement.

Summary

The classification of an operating lease versus a finance lease under the new guidance is determined by evaluating whether any of the finance lease criteria are present. If a lease agreement contains at least one of the five criteria, it should be classified as a finance lease.

A significant aspect of the new standard is that both operating leases and finance leases must be recorded on a company’s balance sheet, whereas only capital leases were previously recorded on the balance sheet.

Understanding how a lease is classified, the key differences from ASC 840 to ASC 842, and its impact to the business will equip your company for success under the new lease accounting standard.