The new lease accounting standard for governmental organizations, GASB Statement No. 87, goes into effect for all reporting periods that begin subsequent to December 15, 2021. In 2019, GASB released an implementation guide to provide additional clarification on GASB 87. For a definition of a lease under GASB 87 and a discussion on the changes between Legacy GASB Lease Guidance and GASB 87, see our previous GASB 87 blog.

One of the key highlights is that under GASB 87, all lease arrangements are classified as finance leases. Additionally, the standard represents an overhaul for the lessor in accounting for lease agreements, requiring the lessor to recognize a Lease Receivable, as well as a Deferred Inflow of Resources, measured in a similar manner to the lessee approach for recognizing a lease liability. Read Lease Accounting Explained: New Standards, Lessee vs. Lessor, Changes, Calculations, & More from LeaseQuery for further information on lessor accounting guidance for GASB 87.

In this detailed example, we will walk through the full accrual basis accounting for the transition from accounting for an operating lease by both the straight-line and lease contract method under the Legacy GASB standards to the transition to GASB 87, which results in a finance lease classification.

If your organization’s leases are recorded with governmental funds, a conversion entry will be necessary at year-end to convert from the modified accrual accounting basis to the full accrual basis necessary to compile government-wide financials.

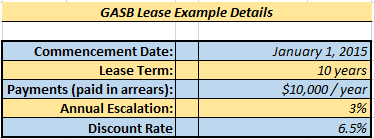

GASB Lease Example Details:

For this example, we will use a calendar-year transition date to GASB 87 of January 1, 2020. The Board has determined the impracticality of governmental bodies transitioning retrospectively to the new standard. The standard notes that applying GASB 87 retroactively to presented comparative periods is only required if practicable; thus, the adjustments to the Statement of Financial Position should be based on the transition date or any restated comparative periods. Our expectation, considering the complexity of adopting the standard as of transition, is that the vast majority of governmental entities will not restate prior periods, similar to the transition under US GAAP ASC Topic 842, Leases, whereby many public companies have elected the practical expedient whereby they have not presented comparative financial information. If governmental organizations deem impracticality in restating prior periods, the entity must disclose, within the notes to the financials, the reason for not presenting comparative periods.

Example 1: Transition from Straight-line Method

Step 1: Calculate the initial lease liability

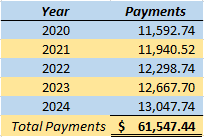

The lease liability is calculated as the present value of future lease payments as of the transition date. See below for the remaining lease payment schedule as of the transition date of 1/1/2020. All payments noted below are paid in arrears.

The discount rate determined, per GASB 87, should be the interest rate implicit within the lease. If that interest rate is not readily determined by the lessee, which occurs in most scenarios, the lessee should use the estimated incremental borrowing rate. Utilizing the estimated incremental borrowing rate, of 6.5%, as the annual discount rate, the present value is calculated as $50,687.11.

Step 2: Calculate the initial lease asset value

The lease asset value is initially calculated in the same manner as the lease liability; however, in addition to the present value of future lease payments, the asset value would include prepaid lease payments, less any lease incentives received from the lessor prior to the commencement of the lease term.

Based on this information, the lease asset will initially begin at the same value as the lease liability: $50,687.11; however, one more step is required to complete the initial calculation of the leased asset.

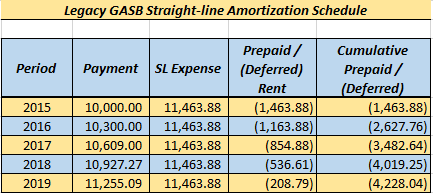

Step 3: Assess any Statement of Financial Position items under the current GASB standard

For this example, we will assume the lessee accounted for this operating lease, prior to transition, using the straight-line expense method. As of 12/31/2019, the lessee has a cumulative deferred rent balance of $4,228.04. In calculating the lease account to be recognized, the initial leased asset value (which is consistent with the lease liability) is decreased by the total amount of the cumulative deferred rent at transition.

In summary, the leased asset balance will begin at the following balance:

$50,687.11 – 4,228.04 = $46,459.07

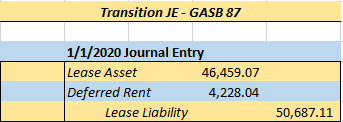

Step 4: Record the opening Journal Entry under GASB 87

The initial journal entry under GASB 87 will establish the asset and liability on the Statement of Financial Position, as well as remove the cumulative deferred rent balance that resided on the Statement of Financial Position under Legacy GASB. See below for the applicable entry, in this instance, as of 1/1/2020.

Step 5: Record a subsequent journal entry

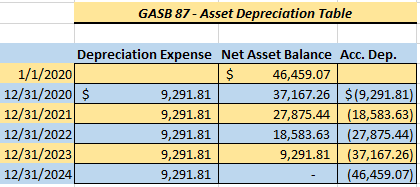

The leased asset should be amortized, reported as an outflow of resources, in a “systematic and rational manner” over the lesser of the lease term or useful life. The Board notes that this amortization expense would represent an outflow synonymous to depreciation expense; thus, we will refer to the Finance Leased Asset amortization expense as depreciation expense. The expectation is that governmental organizations will use a straight-line expense method to calculate the depreciation expense over the remaining lease term, unless, in an unlikely scenario, the useful life of the asset is a shorter period than the lease term. See below for a straight-line depreciation table.

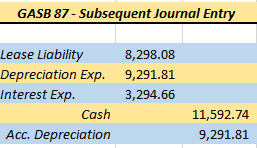

The other remaining aspect of the profit/loss portion of the entry is the interest expense calculation. The lessee will amortize the discount on the lease liability—the difference between the gross cash outflow and the amortization of the liability is calculated as interest expense. This expense is calculated similarly as interest expense has always been calculated for a capital lease—utilizing an interest rate to determine the expense, based on the ending liability balance of the prior period. (Note: While LeaseQuery software calculates interest using a daily rate, for simplicity in this blog we have used a simplified annual calculation).

Based on an opening liability balance of $50,687.11 at 1/1/2020, interest expense is calculated as $3,294.66 for the current annual period.

The difference between the gross cash payment and the interest expense calculation equals the reduction in the liability for the period.

![]()

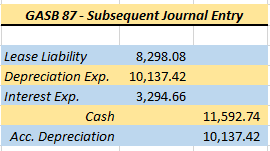

Thus, the journal entry to post at the end of the 2020 annual period is as follows:

Example 2: Transition from Lease Contract Method

GASB 13 allows the lessee the option to account for operating leases utilizing the Lease Contract Method (effectively cash basis of accounting) if the payment schedule portrays a ‘systematic and rational’ manner. Therefore, we will provide an additional example transitioning from this approach. See below for a link to our blog post on accounting for operating leases under GASB 13.

GASB 13 – A Comprehensive Example

Step 1: Calculate the initial lease liability

This step is synonymous with example #1, as the lease liability only considers future lease payments. The initial lease liability balance is $50,687.11.

Step 2: Calculate the initial lease asset value

Since the cash payment each period mirrors the expense, the lease asset calculation, thus, mirrors the calculation of the lease liability. The initial lease asset value is $50,687.11.

Step 3: Assess any Statement of Financial Position items under the current GASB standard

As noted above within the Contract Method amortization schedule, no prepaid or deferred rent balance exists as of the transition date, as the expense matches the cash payment each period. Thus, no action is necessary during this step.

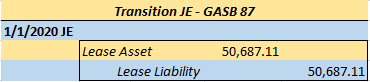

Step 4: Record the opening journal entry under GASB 87

The initial journal entry under GASB 87 will establish the lease asset and lease liability on the balance sheet. As the opening asset and liability balance agree when transitioning from the Lease Contract method, these two items will be the only two inputs to the opening journal entry.

Step 5: Record a subsequent journal entry

The accounting method will now mirror the accounting displayed under Example #1. Based on an opening asset value of $50,687.11, the calculated annual depreciation using the straight-line method for each year would be $10,137.42.

Interest expense will be calculated in the exact same manner, as well. As the beginning liability balance at transition for Example #1 is the same as Example #2, the calculation is identical.

Thus, the journal entry to post at the end of the 2020 annual period is as follows:

At last, we have booked initial and subsequent journal entries transitioning from both the Straight-line method and the Lease Contract method.