- Fixed asset examples

- Current assets vs. long term assets

- Tangible vs. intangible assets

- Right-of-use assets vs. fixed assets

- Operating vs. non-operating assets

- Capitalization policy and materiality

- Total fixed assets vs. net fixed assets

2. Fixed asset accounting and journal entries

3. Fixed asset depreciation methods

- Straight-line method

- Double-declining balance method

- Units of production method

- Sum of remaining years’ digits method

4. Financial statement treatment of fixed assets

5. Fixed asset analysis: Financial ratios and calculations

7. Summary

Fixed assets are one of the main pillars of business. Many organizations would not exist or generate revenue without their property, plant, and equipment. To understand accounting and financial reporting, begin with a broad-level knowledge of fixed assets.

What are fixed assets?

In accounting, a fixed asset, also known as a capital asset or tangible asset, is a tangible long-lived piece of property or equipment a company plans to use over time to help generate income. ASC 360, Property, Plant, and Equipment is the US GAAP accounting standard regarding fixed assets (ASC 360).

Fixed asset examples

Fixed assets are purchased for long-term business use. These items are also referred to as property, plant, and equipment, or PP&E. Examples include:

- Land and buildings

- Equipment

- Furniture and fixtures

- Heavy machinery

- Hardware and, in some cases, software

- Tools

- Vehicles

- Leasehold improvements

Current assets vs. long term assets

Current assets refer to company-owned items that will be converted into cash within the year. This includes items such as inventory and accounts receivable. Long-term assets are the remaining items that can’t be replaced with cash within one year. This includes things like the buildings and vehicles the company owns.

Tangible vs. intangible assets

Intangible assets are not included in fixed assets. These assets are not physically touchable but they still add value to the balance sheet. Examples of intangible assets include goodwill, research and development, licensing and rights, and intellectual property such as patents, copyrights, trademarks, logos, and brands.

Right-of-use assets vs. fixed assets

The new lease accounting standards introduced a new type of asset, distinct from fixed assets: the right-of-use asset, or ROU asset. The ROU asset is the balance sheet representation of a lessee’s right to use the underlying leased asset for the duration of the lease term.

Finance lease ROU assets, previously known as capital lease assets, are treated somewhat similarly to fixed assets in that the ROU asset related to a finance lease is typically depreciated using the straight-line method. The treatment of operating lease ROU assets, however, is quite different from fixed assets and the related ROU asset is amortized using a different method.

Operating vs. non-operating assets

Operating assets are those used in the daily functioning of a business and its generation of revenue, such as cash or machinery and equipment. Non-operating assets do not directly relate to operations but still contribute to revenue generation. Examples include investments or the land and building where an organization’s headquarters is located.

Capitalization policy and materiality

Many organizations implement a policy for tangible asset expenditures which sets a materiality threshold over which purchases will be capitalized. This can be for a single asset purchase or a group of similar assets purchased around the same time. Capitalizing relatively insignificant purchases does not improve the readability of financial statements and may end up costing an entity more than the asset’s value. However, to avoid large expenses hitting the income statement all at one time and to follow the matching principle of accounting by depreciating the cost of equipment or property over its useful life, a capitalization policy should be established.

Organizations must exercise judgment to determine a reasonable dollar threshold based on factors such as the size of their entity and type of operations. For example, a smaller organization may have a lower threshold than a large organization, or a non-for-profit organization may want a lower threshold in order to give maximum visibility into use of funds. Many organizations have a $5,000 capitalization threshold for property, plant, and equipment, but professional judgment must be exercised on a case-by-case basis.

Many organizations choose to present capitalized assets in various asset groups. It is common to segregate fixed assets on the balance sheet by asset class, such as buildings or equipment, as separate lines on the balance sheet. This better shows the composition of an organization’s fixed assets and gives readers of financial statements more visibility into how fixed assets are being used. For example, a manufacturing company will probably have significant amounts of machinery and equipment as those are key to the primary business operations in that industry. Depending on the nature of an entity’s business, it may make sense to group items that share common characteristics or purposes.

Total fixed assets vs. net fixed assets

Net fixed assets are the metric measuring the value of an entity’s fixed assets. This aggregation of the book value or purchase price of all an organization’s fixed assets along with their related accumulated depreciation is used to ascertain the amount an entity’s fixed assets are worth at a given time. In other words, it’s the total carrying value of all equipment, buildings, vehicles, machinery, and other fixed assets.

Fixed asset accounting and journal entries

Fixed asset accounting refers to the action of recording an entity’s financial transactions for its capital assets. For organizations reporting under US GAAP, ASC 360 is the appropriate accounting standard to follow. For most organizations, fixed assets are a significant investment and must be accounted for properly.

The majority of fixed assets are purchased outright, but entities sometimes borrow funds to purchase fixed assets or pay to use a piece of property or equipment over a period of time. These types of transactions are typically set up as leases. Lease accounting is separate from fixed asset accounting and is covered under US GAAP by ASC 842, Leases.

What is the fixed asset lifecycle?

The lifecycle of a fixed asset is the timeframe from the initial purchase of the fixed asset through the disposal of the asset, whether due to the sale of the asset or due to the asset reaching the end of its useful life.

Organizations need a process to ensure these transactions are being identified as they occur, analyzed to apply the appropriate accounting treatment, reviewed for any necessary judgments or assumptions, recorded through journal entries on a timely basis, and ultimately reported in the financial statements accurately. This involves communication between multiple departments.

Real estate or procurement teams should notify accounting when fixed assets are purchased. Management and accounting personnel that oversee financial reporting should set expectations for capitalization policies, determining an asset’s useful life, and the appropriate method of depreciation. Operations teams must notify accounting of any material changes to the asset such as damages or planned improvements.

A fixed asset’s lifecycle includes various stages during its useful life:

- The initial acquisition of the asset

- Depreciation as it is used

- Periodic revaluation and/or potential impairment

- The disposal of the asset.

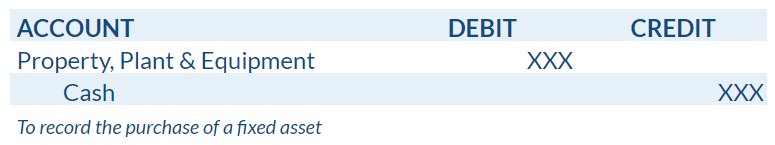

Acquisition

When an asset is purchased, all costs related to acquiring the asset, including costs to ship or put an asset in place will be capitalized. As the name indicates, a fixed asset is an asset, presented in the general ledger as a debit. The basic entry to record a fixed asset is a debit to the fixed asset class category, such as property, plant, or equipment, and a credit to cash. The credit to cash may be replaced with a credit to accounts payable, short-term accrual, or other liability, depending on how the asset is procured. For simplicity, we will use cash in our examples. A sample entry to record a fixed asset purchase would be as follows:

Depreciation

Since fixed assets are used for a longer period of time, they are likely to devalue with use. Depreciation is the practice of accounting for an asset’s decrease in value as it is used. The more a resource is depleted over time, the less value it possesses.

Three factors to consider when calculating a fixed asset’s depreciation are:

- Useful life: The time period during which the asset will be productive

- Salvage value: The amount an asset is expected to sell for at the end of its useful life

- Depreciation method: The prescribed manner used to calculate the decrease in value of an asset

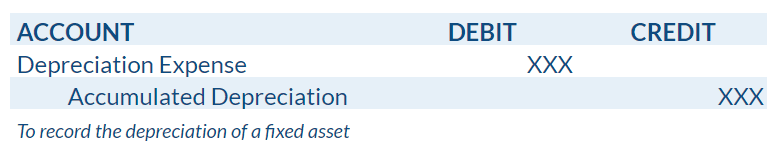

Various methods may be elected by organizations to depreciate fixed assets. This article will explain the most common methods below. Regardless of method applied, the journal entry for depreciation will include a debit to depreciation expense and credit to accumulated depreciation to be used in the calculation of net fixed assets.

Depreciation expense is the periodic recognition of expense related to the asset’s decrease in value over time. The timing of this expense depends on the method of depreciation being used. An organization should select a method that is representative of the asset’s use or purpose. For example, machinery and equipment may be depreciated using the units of production method as it is directly related to how the asset is being used and its gradual decline in value. The journal entry to record depreciation expense is:

Accumulated depreciation is a contra asset account representing the aggregate of depreciation expensed as of a specific date. The purpose of presenting accumulated depreciation is to show the net value of fixed assets. Typically financial statements present the gross fixed asset balance capitalized initially, with the accumulated depreciation to date to show the net fixed assets value at a point in time.

Revaluations and impairment

Under US GAAP, fixed assets are accounted for using the historical cost method. The historical cost method requires assets to be measured at the cost paid when the asset is acquired as opposed to another measure of valuation such as the fair market value. However, fixed assets should be valued at the lower of cost or market value when significant changes in market value occur. ASC 360 requires annual impairment analysis for all long-lived assets to test for significant changes in an asset’s fair market value and if the costs related to the asset are recoverable.

Impairment testing may also take place if a triggering event occurs. Triggering events are indicators an asset may have deteriorated such as

- Significant adverse effects related to the use of an asset or its physical condition such as equipment damages or vehicle wrecks.

- Unexpected changes in the costs that will be incurred to construct or improve the asset

- material changes in value due to legal factors or a sudden shift in the business climate that could affect the valuation of an asset.

- A significant decrease in the market value of an asset potentially making an asset obsolete.

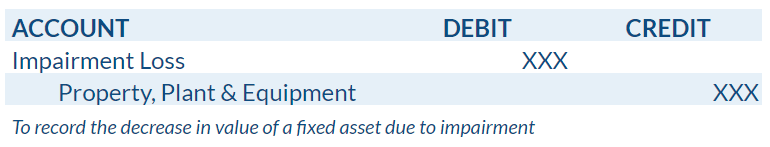

Damages may be visible if one were to inspect the asset, but an impairment related to market changes may not be visible. Regardless, an impairment should be recorded once a triggering event becomes known, not at the time of routine impairment testing. The asset value will be reduced with a credit and a loss will be recognized for the reduction of value.

Under IAS, fixed assets can be accounted for in one of two different ways:

- The historical cost method – only recording depreciation and never adjusting the carrying value or

- The revaluation method – adjusting the carrying value upward or downward based on fair value, with the difference being booked to a revaluation reserve.

Disposals

Organizations dispose of a fixed asset at the end of its useful life or when appropriate, if, for example, the asset is no longer being used. The journal entry to record a disposal includes removing the book value of the fixed asset and its related accumulated amortization from the general ledger (and subledger).

Organizations may also dispose of a fixed asset by selling it. Depending on the condition and expected salvage value of the asset, it may be sold for more or less than its carrying value. The journal entry to record the sale of a fixed asset includes removing the book value of the fixed asset and its related accumulated amortization from the general ledger (and subledger), recording the cash (or cash equivalency) received, and then recognizing any gain or loss, if appropriate.

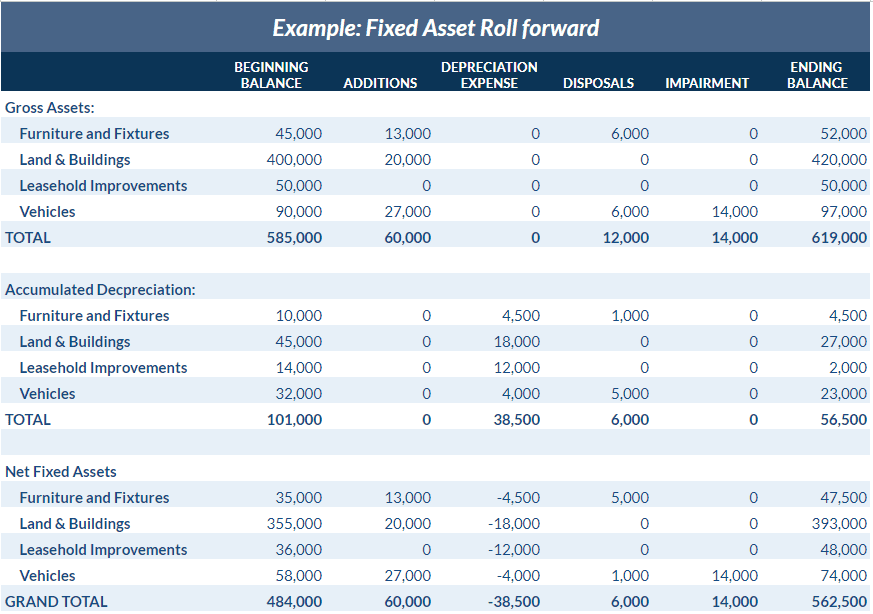

Fixed asset roll forward example

The fixed asset roll forward is a common report for analyzing and reviewing fixed assets. The report is a schedule showing the beginning balance, purchases and/or additions, disposals, depreciation, and ending balance of fixed assets for a certain time period. It may be generated by asset class category or other subsections such as a location, department, or subsidiary. A fixed asset roll forward is typically created quarterly and/or annually. This schedule is frequently requested from auditors for use in their workpapers and audit testing.

Transfers

Transfers may occur during the lifecycle of a fixed asset for various reasons. An asset may be transferred from a construction-in-progress account to a completed fixed asset account when fully constructed. A fixed asset may be transferred between subsidiaries, business segments, locations, or departments of an entity. In the case of asset grouping, one or multiple assets included in an asset group may be transferred.

Methods of fixed asset depreciation

As stated above, various methods may be used to calculate calculate depreciation for fixed assets. It depends on the nature of an organization’s business which method best reflects actual use and the decrease in value of their fixed assets. When determining the useful life of an asset, an organization should consider the frequency and nature of the asset’s use in operations, the condition of the asset at acquisition, its history, and service patterns.

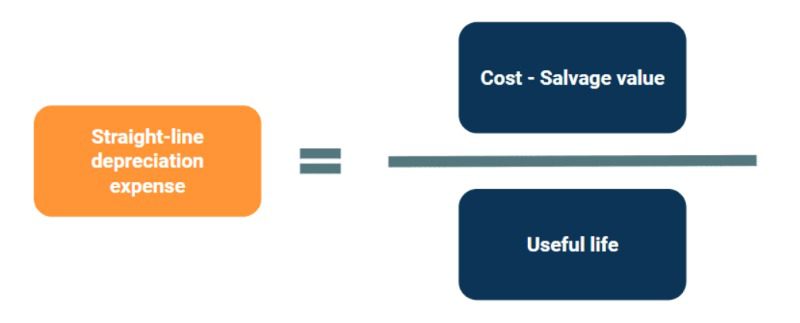

Straight-line method

The straight-line method of depreciation is the most common and simple method as it recognizes expense evenly throughout the useful life of the asset. Straight-line depreciation is computed as follows:

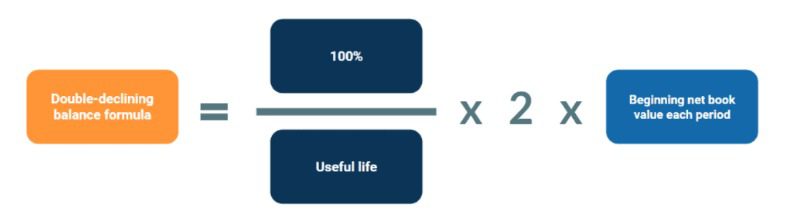

Double-declining balance method

The double declining balance method of depreciation assumes the asset is used more at the beginning of its useful life and less towards the end by depreciating at a much higher rate in the first years after acquisition and lower towards the end of its useful life. This method depreciates assets twice as fast as the straight-line method.

Double declining balance is calculated as follows:

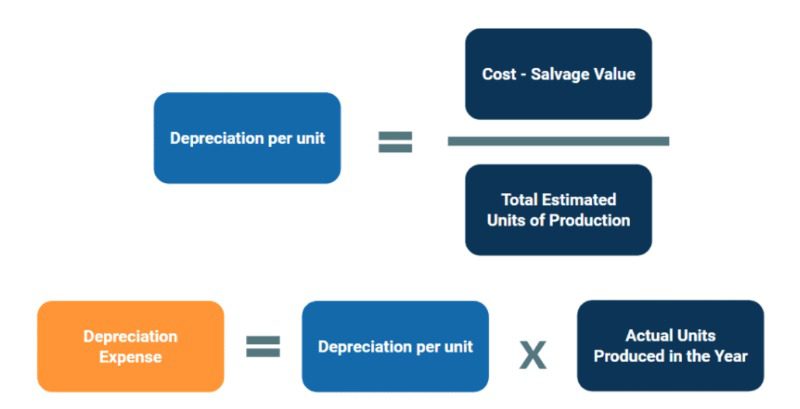

Units of production method

The units of the production method of depreciation are based on the number of actual units produced by the asset in a period. This method makes sense for an asset that depreciates from usage rather than time.

Depreciation using the units of production method is calculated as follows:

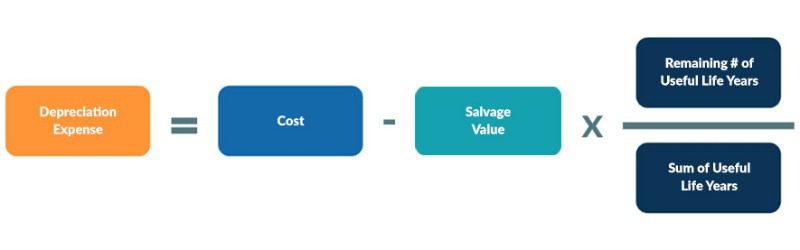

Sum of remaining years’ digits method

This method of depreciation is another accelerated depreciation method. It involves adding together each year in an asset’s useful life and then using that sum to calculate a percentage representing the remaining useful life of the asset. The percentage is then multiplied by the asset’s depreciable base, cost less salvage value, to arrive at the depreciation to be recognized each period.

Here is a step-by-step example to illustrate the calculation of the sum of the years’ digits depreciation expense for an asset with the following assumptions:

- Cost to acquire $20,000

- Useful life 5 years

- Salvage value $4,000

Step 1: Calculate the depreciable base

The depreciable base is the cost minus the salvage value of the asset. The asset’s cost is $20,000 and the salvage value is $4,000 which calculates to a depreciable base of $16,000.

Step 2: Calculate the sum of the years’ digits

The asset has a useful life of 5 years. The sum of the years’ digits would be years 1+2+3+4+5, which is a sum of 15.

Step 3: Divide the remaining years in the asset’s useful life by the sum of the years’ digits

In year 1, the remaining useful life is 5 years. 5 years divided by the sum of the years’ digits of 15 calculates to 33.33% which will be used to calculate depreciation expense.

Step 4: Multiply the annual rate of depreciation calculated in Step 3 by the depreciable base calculated in Step 1.

The depreciable base in the example is $16,000 which is multiplied by 33.33% to arrive at a depreciation expense of $5,333 for year 1.

Financial statement treatment of fixed assets

Fixed assets on the balance sheet

Organizations may present fixed assets in a number of different ways on the balance sheet. As discussed above, fixed assets may be segregated by asset class. Conversely, they could also be presented as the gross value of total fixed assets along with the accumulated depreciation recognized to date, aggregated to their net value. Entities may even keep it simple and present only one line item for fixed assets equal to the net value of fixed assets at a point in time. The presentation of fixed assets should be the most appropriate representation of how the fixed assets are used at an organization and the nature of the organization’s business.

Fixed assets on the income statement

Depreciation expense is recorded on the income statement to represent the decrease in value of fixed assets for the period. In some cases, a gain or loss may be recognized due to the disposal, transfer or impairment of fixed assets.

Fixed asset analysis: Financial ratios and calculations

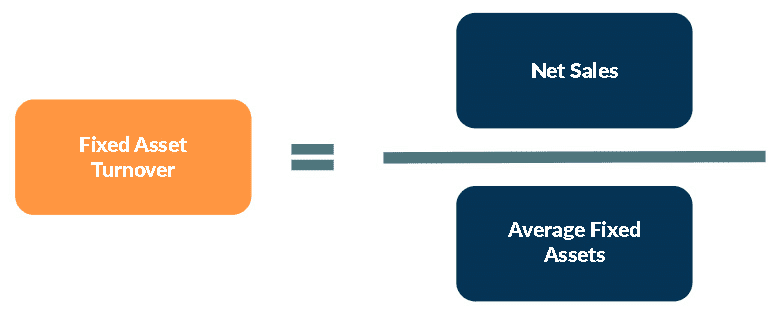

Fixed asset turnover ratio

The fixed asset turnover ratio determines a company’s efficiency in generating sales from existing fixed assets. A higher ratio means fixed assets are being used more adequately than a lower ratio. The fixed asset turnover ratio is best analyzed alongside profitability as it does not represent anything related to the company’s ability to generate profits or cash flows.

The formula to determine fixed asset turnover is:

Within the timeframe being analyzed, the components of the formula are defined as

- Net sales equal gross sales less returns and allowances

- Average fixed assets equal the net fixed asset beginning and ending balances divided by two.

The value of a “good” asset turnover ratio depends on the industry or type of organization considered. For example, in the retail industry, a good asset turnover ratio could be around 2.5, whereas a company in another sector may be aiming for a turnover ratio in the range of 0.25 – 0.5. Generally, the higher the turnover, the greater the productivity.

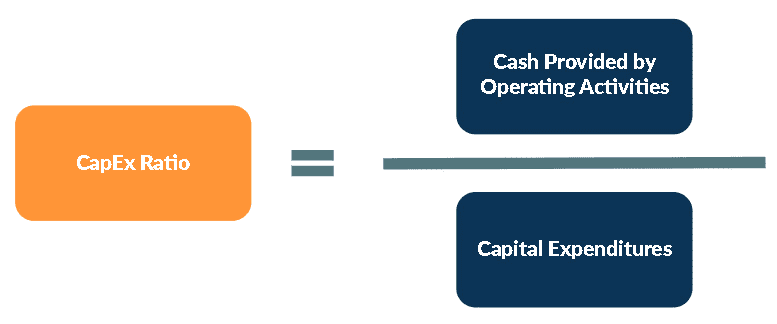

CapEx ratio

The capital expenditures (“CapEx“) ratio is calculated by dividing the cash provided by operating activities by the capital expenditures. This ratio demonstrates a company’s ability to generate cash from operations to cover capital expenditures. Similar to the fixed asset turnover ratio, the CapEx ratio focuses on cash flows rather than using an accrual-based metric, revenue. A ratio greater than one means the organization generated enough operating cash to cover capital purchases.

Many readers of financial statements are interested in cash flows relative to expenditures. Lending institutions and creditors would like to see that an organization is using the money they borrowed effectively and has the ability to repay debts. Investors would like to see the money they invested is being used to generate sufficient cash to receive a return on their investment. This ratio could also be helpful internally for budgeting and investment strategy.

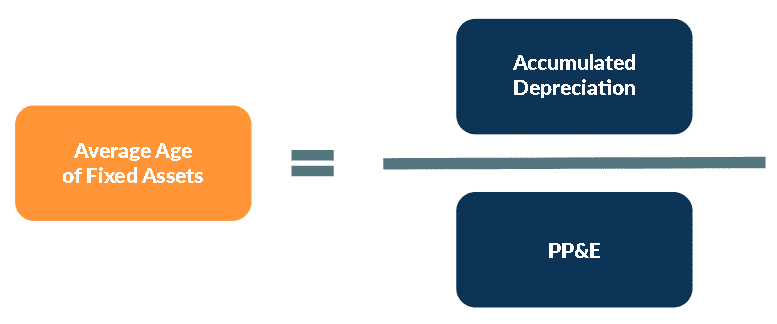

Average age of fixed assets

The average age of fixed assets, commonly referred to as the average age of PP&E is calculated by dividing accumulated depreciation by the gross balance of fixed assets. This ratio gives visibility into how old an organization’s fixed assets are. An older average age may indicate the organization will require reinvestment in fixed assets in the near future. This financial ratio can be helpful internally when budgeting and forecasting. It could potentially be useful for readers of financial statements in predicting if an organization will need to make a large capital outlay in the near future.

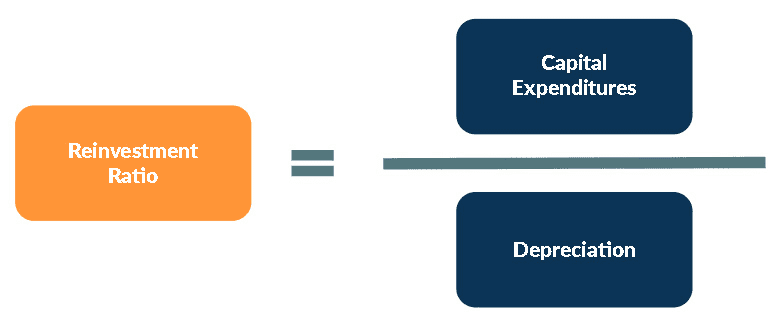

Reinvestment ratio

The reinvestment ratio is calculated by dividing capital expenditures by depreciation. This ratio tells how much an organization is investing in fixed assets and if they are replacing depreciated assets. An organization with significant fixed assets or operations tied to fixed assets should expect a ratio greater than one. The cost of new fixed assets will likely increase due to normal inflation, while depreciation is calculated using historical costs. If the ratio is at or below one, an organization is probably not investing in fixed assets. This could be helpful to look at internally to gauge if fixed assets need to be replaced or if they are currently being replaced on an expected timely basis. It can tell readers of financial statements if a large purchase of fixed assets may be coming in the near future or if fixed assets are being managed well.

Fixed asset software

As fixed assets are a significant investment for many entities and an organization typically has several fixed assets, using fixed asset software is common. If an organization utilizes an ERP, it may use the fixed asset module available from the ERP instead of third-party fixed asset software.

Detailed records of an organization’s fixed assets must be kept for financial reporting and taxation purposes. Fixed asset software allows an organization to track detailed information for each piece of property, plant, or equipment, including:

- Purchase price/book value

- Purchase date

- Useful life

- Physical location

- Asset class category

- Depreciation method

- Accumulated depreciation

- Net book value/carrying value

In addition to tracking line item details, fixed asset software allows a company to view summarized data about all their fixed assets or in separate categories such as asset class, department, subsidiary, or physical location. Reports such as the fixed asset roll forward discussed above can be generated quickly with software, making analysis and research less of a cumbersome task.

Summary

Fixed assets are the property, plant, and equipment used by an organization in its operations and generation of revenue. For many organizations, fixed assets are a significant investment and may be presented in several different ways in their financial statements depending on the nature of their business and what interests the readers of their financial statements. Due to the complexity and importance of fixed asset accounting, it’s common for entities to invest in fixed asset software to save time and improve accuracy.