1. Operating lease treatment under ASC 842 vs. ASC 840: What changed?

2. Operating lease vs. finance lease identification under ASC 842

- Transference of title/ownership to the lessee

- Purchase option

- Lease term for major part of the remaining economic life of the asset

- Present value represents “substantially all” of the fair value of the asset

- Asset specialization

3. Is lease capitalization required for all operating leases under 842?

4. Operating lease accounting example and journal entries

- Details on the example lease agreement

- Step 1: Determine the lease term under ASC 840

- Step 2: Determine the total lease payments under GAAP

- Step 3: Prepare the straight-line amortization schedule under ASC 840

- Step 4: On the ASC 842 effective date, determine the total payments remaining

- Step 5: Calculate the operating lease liability

- Step 6: Calculate the right-of-use asset (with journal entry)

Operating lease treatment under ASC 842 vs. ASC 840: What changed?

Under ASC 840, operating leases were considered off-balance sheet transactions. The rent expense associated with the arrangements was recognized in the income statement, but nothing was recorded on the balance sheet. This made it difficult to understand the total amount of commitments a company had. It could also make comparisons between companies difficult, depending on their different approaches to leased vs. capital assets.

To increase transparency, the FASB issued ASC 842, Leases. One of the main provisions of this new standard is that all leases must be recognized on a company’s balance sheet. For operating leases, ASC 842 requires recognition of a right-of-use asset and a corresponding lease liability upon lease commencement.

With the changes introduced under ASC 842, all leases are now presented on both the balance sheet and income statement whether they are operating or finance (capital) leases. The updated financial statement presentation requires issuers to show the operating ROU asset and operating lease liability separately from the finance (capital) ROU asset and lease liability both on the face of the financials and in the notes disclosures.

However, the effect of operating leases on the income statement is not changing. Companies will continue to recognize a straight-line expense for the lease payments made over the lease term as an operating expense on the statement of profit and loss.

Operating lease vs. finance lease identification under ASC 842

Operating vs. finance lease classification under ASC 842 is relatively similar to the operating lease vs. capital lease criteria under ASC 840, but certain “bright lines” for classification have been removed, consistent with the more “principles-based” approach of ASC 842. For a lease to be classified as a finance lease, it must meet one of the five criteria listed below. If the lease does not fall under any of these criteria, it is classified as an operating lease:

1. Transference of title/ownership to the lessee

Ownership of the underlying asset is transferred to the lessee by the end of the lease term.

2. Purchase option

The lease arrangement grants the lessee an option to purchase the asset, which is reasonably certain to be exercised. It is important to note, the purchase option must be reasonably certain to be exercised for this criteria to met.

3. Lease term for major part of the remaining economic life of the asset

The lease term spans a major part of the remaining economic life of the underlying asset.

Note: The FASB provided additional clarification that “major part” can be consistent with the 75% threshold used under ASC 840. Companies are allowed to determine how they will define the “major part” threshold. In practice, though, a large portion of organizations tend to lean towards using the 75% threshold previously seen in ASC 840.

4. Present value represents “substantially all” of the fair value of the asset

The present value of the sum of the remaining lease payments equals or exceeds substantially all of the underlying asset’s fair value. If applicable, any residual value guarantee by the lessee not already included in lease payments is also included in the present value calculation.

Note: The FASB provided some additional clarification that “substantially all” can be consistent with the 90% threshold used under ASC 840. Here also, companies are allowed to determine their own “substantially all” threshold, but in practice the majority of entities are continuing to use 90%.

5. Asset specialization

The underlying asset is of such a specialized nature that it is expected to have no alternative use to the lessor at the end of the lease term.

Is lease capitalization required for all operating leases under 842?

An entity can establish an accounting policy to exclude operating leases with a lease term of 12 months or less at lease commencement (provided they also do not have a purchase option that is reasonably certain of exercise) from capitalization on the balance sheet. Further, while ASC 842 does not have an exclusion for low-value assets, some companies have established a capitalization threshold. Similar to a capitalization threshold for fixed assets, the company has determined that leases below this value are not material to the company and therefore, are not recognized on the balance sheet.

Operating lease accounting example and journal entries

The following is a full example of how to transition an operating lease initially recorded under ASC 840 to ASC 842 accounting treatment.

Details on the example lease agreement:

First, assume a tenant signs a lease document with the following terms:

Lease term

The lease begins on April 1, 2016 (commencement date) and continues for 120 full calendar months. The tenant is granted access to the premises 60 days prior to the commencement date to install equipment and furnishings (the “early access period”). Such access is subject to all the terms and conditions of this lease, except that the commencement date and the payment of rent shall not be triggered thereby.

Tenant improvement allowance

The tenant received a tenant improvement allowance, or TIA, of $1.2 million from the landlord as an incentive to sign the lease. The landlord paid the contractor directly for the construction of the improvements, which were constructed prior to the early access period.

Moving expenses

The tenant also received a reimbursement of $30,000 for moving expenses from the landlord.

Base rent

Per the lease document, the first rent payment is due three full calendar months after the tenant begins operating at the leased location. Base rent is $205,000/month paid in arrears; with annual 3% increases on the anniversary of rent commencement.

Assumptions

Assume the lease is classified as an operating lease and the fair value of the building is $300 million. Assume the tenant opened for business at the location on June 1, 2016. Assume the tenant is a private company with a calendar year-end and transitioned to ASC 842 on January 1, 2022. Assume the discount rate implicit in the lease is unknown and the tenant’s incremental borrowing rate is 6% on September 1, 2016, and 9% on January 1, 2022.

Here are the steps to take to correctly transition the above lease from ASC 840 to ASC 842 accounting:

Step 1: Determine the lease term under ASC 840

The lease term stated in the contract is 120 months. The document also grants the tenant an early access period, subject to all the terms and conditions in the lease. Assuming the early access period started on February 1, 2016 – 60 days before the April 1 commencement date – then under ASC 840 the lease is accounted for beginning on that date, and the lease term is 122 months: from February 1, 2016, through March 31, 2026.

Note: To understand the difference between the commencement date, execution date, possession dates, etc, read this article on when a lease starts.

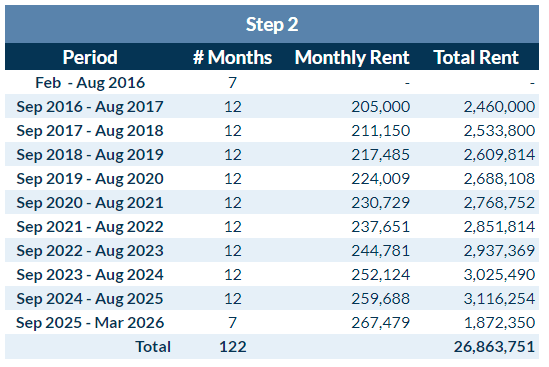

Step 2: Determine the total lease payments under GAAP

The tenant will begin paying rent on September 1, 2016 (3 months from the date the tenant opened for business). The total lease payments are $26,863,751, as illustrated in the payment schedule below.

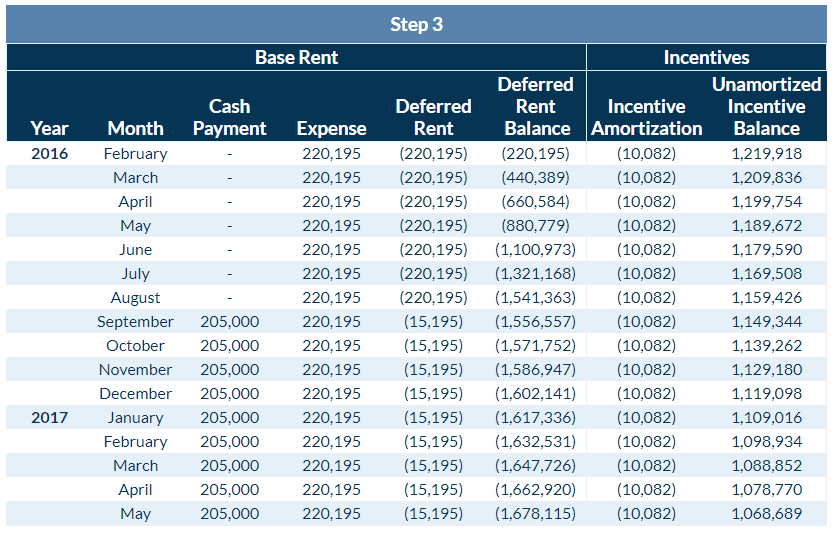

Step 3: Prepare the straight-line amortization schedule under ASC 840

Under ASC 840, the lease term is 122 months (from step 1) and total rent is $26,863,751 (from step 2). Straight-line monthly rent expense calculated from base rent is therefore $220,195 ($26,863,751 divided by 122 months).

The tenant must also account for the total incentive of $1,230,000 ($1.2 million of tenant improvement allowances + $30,000 of moving expenses). Under ASC 840, the incentives are amortized over the lease term on a straight-line basis as well, resulting in a monthly credit to rent expense of $10,082 ($1,230,000 / 122 months). As a result of the incentive adjustment, periodic rent expense on the income statement is $210,113 ($220,195 – $10,082).

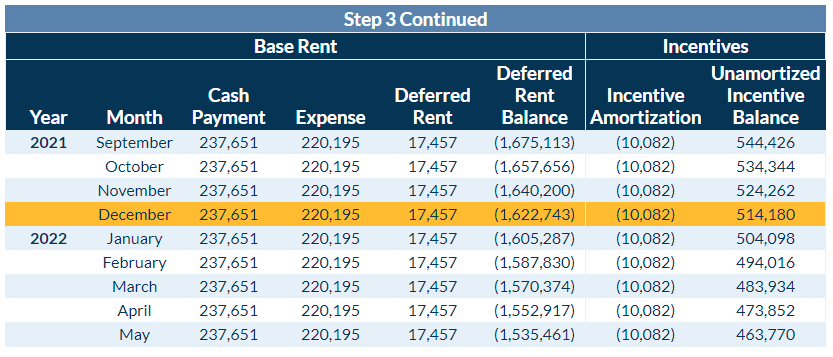

Below is the first 16 months’ straight-line amortization schedule under ASC 840, showing amortization of both rent and the incentives.

How is the rent-free period shown on the amortization schedule

The rent-free period is shown on the amortization table as seven months of no payment with the periodic straight-line expense accruing as deferred rent. Below is a summary of the columns in the amortization table impacted by the free rent:

- Cash Payment: This is the exact amount paid out each month.

- Expense: This is the periodic rent expense calculated from the total payment amount divided evenly over the number of months in the lease term, also known as straight-line rent expense.

- Deferred Rent: This is the difference between the expense incurred and the cash paid. In the first seven months, the company has free rent so the deferred rent amount is the total of the expense for the month.

- Deferred Rent Balance: This is the cumulative difference between the expense incurred and the cash paid. When the expense is greater than the payment the balance increases and when the expense is less than the payment the balance decreases until it is $0 at the end of the lease term.

Step 4: On the ASC 842 effective date, determine the total payments remaining

For calendar-year private companies, the effective date of ASC 842 was January 1, 2022. The transition entry is recorded from either the start of the earliest comparative period presented or if companies utilize the practical expedient and do not present comparative financial statements, the transition date.

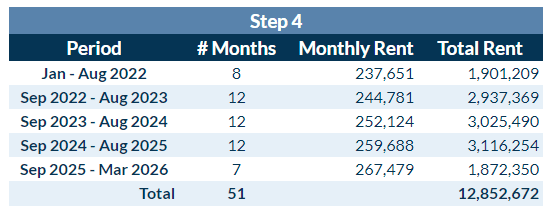

Most private companies will elect to use the practical expedient to not present comparative financial statements, so our example will as well. Therefore, the transition date for this company is January 1, 2022. The total remaining payments from January 1, 2022, through March 31, 2026, are $12,852,672, shown in the updated payment schedule below.

Step 5: Calculate the operating lease liability

Since the company elected to not present comparative financials, they must calculate the present value of the remaining lease payments as of their transition date. ASC 842 requires private entities to use the rate inherent in the lease, unless that rate is not readily determinable. If the implicit rate is not determinable, the tenant has the option to use their incremental borrowing rate or a risk-free rate.

In this example, the tenant uses their January 2022 incremental borrowing rate of 9%, and payments are made at the end of the month. Using these facts and LeaseQuery’s present value calculator tool, the present value of the remaining lease payments is $10,604,260. This is the lease liability as of January 1, 2022.

Note: The present value amount above ($10,604,260) is a simplified calculation based on Excel. The number you get should be lower than this, if you were using more accurate interest calculations, like those available in some lease accounting software solutions. Keep this in mind as you’re viewing demonstrations of lease accounting software from your choice of vendors.

Step 6: Calculate the right-of-use asset (with journal entry)

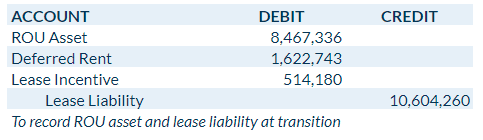

Per ASC 842, the ROU asset is the liability calculated in step 5 above, adjusted by deferred or prepaid rent and lease incentives. In this example, it is the liability of $10,604,260 plus the deferred rent balance as of December 2021, plus the unamortized incentive balance as of December 2021.

Below is a portion of the table from step 3 for the September 2021 through March 2022 periods to show how we arrive at the deferred rent balance and unamortized incentive balance as of December 31, 2021:

The formula for the ROU asset is the lease liability of $10,604,260 less $1,622,743 (accumulated deferred rent balance as of December 2021) less $514,180 (unamortized incentives as of December 2021). This gives us a total ROU asset of $8,467,336. The journal entry to record the lease liability and ROU asset at transition clears the outstanding deferred rent and lease incentive amounts to the ROU asset and would look like this:

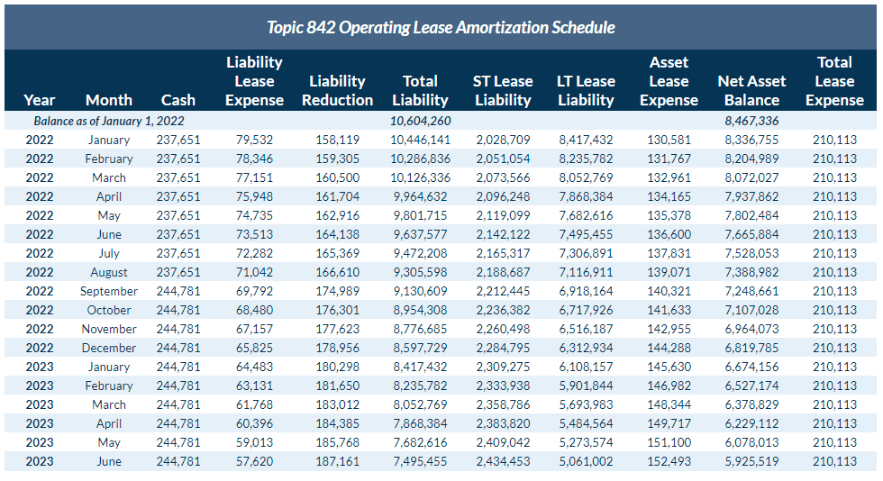

After recording the ROU asset and lease liability as of transition, the tenant would prepare an amortization table under ASC 842 to assist with the calculation of the periodic entries moving forward. Below is the amortization schedule for the lease in the example as of the transition date for a private company.

This concludes the example of how to transition an operating lease from ASC 840 to ASC 842.

Ultimate Lease Accounting Guide

For more examples of operating leases, finance leases, and more under ASC 842, download LeaseQuery’s Ultimate Lease Accounting Guide today.