To the ASC 842

Finish Line and Beyond

A Survey of How Private Companies Are

Preparing for the Lease Accounting Transition

It’s Not a Sprint to the Finish Line – But Companies Should Be Off to the Races

The road to ASC 842 compliance has been a long and winding one for the accounting industry—especially for private companies who have had many pauses and delays throughout their lease accounting compliance journey, as well as a COVID-19 curveball thrown at them in the middle. But even with the compliance deadline finally in sight, this last leg of the 842 marathon may have more twists and turns than ever.

The lease accounting landscape today is defined by contrast: high expectations contrasted against slow execution; knowledge about the length, difficulty, and nuances of the compliance process contrasted against slow adoption—with too many organizations not putting their knowledge into action in a timely manner.

From Wall Street to Main Street, private companies are facing a fast-approaching transition date for compliance under ASC 842. However, that does not mean now is the time to sprint toward the finish line. Rather, it’s a time to continue pacing yourself to ensure accurate, confident, and timely completion.

For those companies who find themselves either lagging behind the pack, or stuck at the start line, the focus should remain firmly on the future, with new innovations, services, and engaging new challenges waiting just around the corner.

During the fall of 2021, we surveyed more than 270 respondents from private companies, government entities, and non-profit organizations, about their biggest priorities—and roadblocks—as the FASB ASC 842 lease accounting deadline approaches.

Total Survey Respondents by Sector

Industry Spotlight

This survey included participants from a variety of industries, all of whom

faced more than their fair share of challenges during the pandemic.

Financial Institutions

14.2%

Healthcare

9.5%

Restaurants

2.1%

Energy

4.5%

Retail

5.9%

Manufacturing

15.1%

Other

27.3%

Non-profit

4.8%

Government

10.7%

Consultant

5.9%

Survey Says…

Although 88% of respondents believe their organization is on track to meet the January 2022 transition deadline … more than 40% have not yet started the process or are in the early stages of assessing their implementation plan.

In contrast, the experience of public companies (who were required to transition to ASC 842 as of January 2019) shows the lease accounting transition was both more complicated and time-consuming than anticipated.

At this critical time, we must answer these questions:

Where are private companies in their transition process?

What are the major challenges, roadblocks, and external pressures slowing the transition down?

What do companies need to clear those last few hurdles? (the staffing, knowledge, and software questions)

And, most importantly, what do companies’ priorities say about the post-transition future impact?

Expectations vs. Reality

It’s a fact that FASB ASC 842 represents the first major change to lease accounting regulations in decades. Public companies who completed their ASC 842 marathon in 2019 have warned that the implementation journey was more challenging than expected, and the balance sheet disruption caused by the increase of lease liabilities along with the addition of right-of-use (ROU) assets is proof.

We’ve learned that transitioning is a long and intense journey. And—just like marathon training can’t

happen overnight—an organizations’ race to compliance is best tackled as a slow and steady one, too.

Where are companies in their lease accounting transition process?

Private companies need to ensure they hit all the stops along their road to transition. Following each step will help organizations feel more confident throughout their ASC 842 compliance journey. The time invested in the process will pay off with efficiencies in the overall day-to-day workload.

Late to the start? Here is the go-to transition checklist that can help you find your way.

A Difficult Road Ahead

For those private companies who have started their ASC 842 transition, most say it has been difficult to some degree.

Prior to the announcement of the new lease accounting standard, most companies had a higher materiality threshold when considering leases as many recorded disclosures in the footnotes and/or the expense recognition on the balance sheet was the same for operating leases whether they were identified or not. However, as companies adopt the new process, that sentiment is changing drastically. While transitioning was always a monumental task, in correlation with the new significant changes to the face of financials, private companies have added a list of new concerns to their plate as the deadline nears.

Our survey uncovered these top three concerns that may impact lease accounting compliance:

COVID-19 pandemic

lease modifications

Staffing and

talent challenges

Going it alone

The COVID-19 Pandemic

While a general deprioritization of the lease accounting transition process was the case for 37% of the companies we spoke with, others shared insights into the specific COVID-19 repercussions that most commonly held them back from reaching the compliance finish line:

22%

Remote Work Challenges

25%

Staffing Challenges

Deployed to other priorities

12%

Deployed to other priorities

6%

Changes to Lease Portfolio

Staffing and Talent Challenges

Talent acquisition and retention is an undeniable pain point for companies at the moment, regardless of industry, size, or structure. From the Great Resignation to employee burnout and everything in between, it can feel like there just isn’t enough staff to get everything done. This is especially true as compliance deadlines approach, resulting in the need for changes in processes in an organization. Companies are preparing for their processes to be reimagined, redesigned, and redeployed.

25%

Short of the ability to add more hours to the day, companies have been doing their best to increase

staff to address recent lease accounting challenges. In planning for the lease accounting transition…

26%

of companies report that they either added—or are currently trying to add—someone to their team to manage the lease accounting transition process.

50%

added 1-2 permanent staff members to their teams during the lease accounting transition process; a further 5% of companies added between 6-9 employees to their permanent teams in preparation for the transition.

45%

of respondents added 1-2 temporary consultant staff members to their teams as part of the lease accounting transition process.

Accounting work can be tedious, especially during busy or stressful times – such as a complicated accounting compliance transition. This is even more reason for companies to choose the right software partner to help with the lift, as well as to ensure their staff is engaged, consulted, and considered as new systems are put in place.

New automation tools built purposefully for lease accounting can increase teams’ efficiency while allowing them to upskill and focus on challenging, more engaging work that reaches beyond recording journal entries or sifting through piles of contracts to uncover lease information.

A smooth and successful transition to ASC 842 could aid in retaining or recruiting employees. The processes being put in place now to streamline lease accounting and financial reporting will have a huge effect on your department’s morale and the future health of your company – which is all the more reason to ensure you get it right.

Going It Alone

Although 74% of survey respondents indicated they did not feel the need to add someone to their team to help the lease accounting transition, nearly 16% ended up adding to their team and another 10% are actively searching for the right person(s).

Ultimately, deciding to add new team members to help cross the ASC 842 finish line may come down to the way companies use technology or lease accounting partners.

The graph above demonstrates those still in the early stages of transition shouldn’t wear rose-colored glasses when reviewing the data from others’ success stories. Instead, organizations need to focus on having the right partners and software on their side, as both play major roles in the required time and success of your transition.

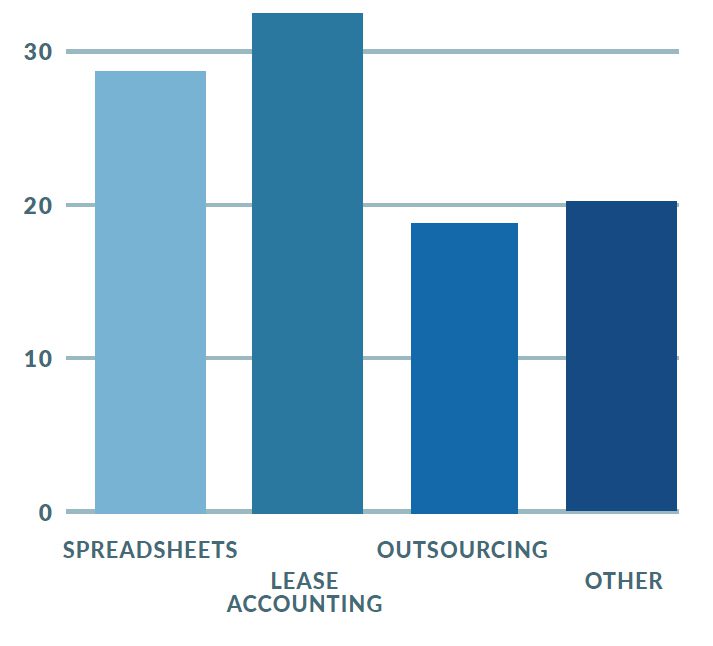

What type of technology are companies using for their transition?

Questions to ask your transition team

If using Excel or other spreadsheets for transition, have you started thinking about…

- The security of your data?

- How you will consolidate your lease information into the required disclosures?

- What controls can be put in place to protect yourself from manual error?

If you’re planning to use software, have you...

- Identified the “must-have” vs. “nice-to-have” functionalities?

- Gotten approval from management?

- Chosen one yet?

If you’ve chosen a lease accounting solution, have you...

- Identified your lease portfolio?

- Named the solution administrator?

- Determined and which practical expedients you will apply?

- Completed your implementation yet?

What type of technology are companies using for their transition?

Questions to ask your transition team

Businesses are spending less time on the adoption date, since transition entries, as well as the necessary amortization schedules and disclosures, are instantly available at the moment of transition. Finally, organizations using a trusted partner and lease accounting solution before the transition to ASC 842 are seeing the added benefit of ensuring compliance with legacy accounting standards, combined with a simplified year-end disclosure process.

The transition will affect more areas of the business than some may expect, compounded by a lack of budget or staff. This makes prioritizing money and manpower at this stage extremely important, especially for companies that have not yet started.

Managing Your Businesses’ Most Valuable

Resources: Time, Visibility and Strategy

Where is time being spent most during the transition process thus far?

Most transition guides and advice warn that identifying your leases and gathering your lease information will be the most time-consuming step to adopting ASC 842. We proved this with our Accountant’s Journey toward Lease Accounting Adoption Survey, which polled more than 200 accounting professionals who told us the transition took longer than expected – and now, we can expect to see it again. If you have not started your transition, gathering your lease information now will set you up for transition success in the future.

After the race is won

The new lease accounting standards are in place to ensure an appropriate level of transparency and consistency across all types of organizations’ financial statements. Although the transition may fuel questions and anxiety around its complexities, it’s time businesses look beyond the finish line and embrace the actual benefits realized throughout the compliance journey.

Uncovering savings through contract analysis: As businesses face increased liquidity issues and look ahead to more strategic investments, many are starting to look for opportunities. Being able to analyze copious amounts of lease data gives accountants more insight into their lease portfolio than ever before (i.e. lease vs. buy analysis), facilitating more accurate budgets and forecasts for the future.

What are the top three benefits reported by those who have completed their transition?

66%

Better visibility into lease portfolio

27%

Ongoing efficiencies created through lease software

7%

Uncovering savings through contract analysis

To the Finish Line and Beyond

With the final deadline for the lease accounting transition approaching, companies are starting to shift their focus on day two challenges, and more importantly, what’s next for their businesses. Our survey responses illustrate where decision-makers’ heads are and what they’re keen to prioritize once the books are balanced and the dust has settled.

Don’t procrastinate – Start (or accelerate) the process now, to begin reaping the rewards of a post-transition future

Businesses everywhere are thinking about and looking forward to a post-transition future. Don’t risk leaving money on the table or closing yourself off from key business insights and visibility that will help you prioritize, plan, and protect your business’ future.

Get your team together, implement the right technology solution and start unlocking:

Better understanding of your business today

Negotiating power for what you want to change or transform

Enhanced transparency and liquidity you need to invest in tomorrow

Outside of lease accounting, what are accounting departments’ top priorities?

To help map out your transition journey, including the insights

you can uncover along the way, view our lease accounting transition guide.