The COVID-19 Lease Impact Report

HOW COMPANIES ARE NAVIGATING LEASE ACCOUNTING’S NEW NORMAL

Building business agility in 2021

2020 made history on many levels and marked a turning point for companies across every industry. While the global pandemic and economic downturn affected each company differently, the common denominator is disruption.

Whether customer demand stalled or surged, businesses were forced to take a close look at their overall strategy and make critical adjustments. The business case for health and safety above all else was clear. After the immediate crisis response, companies settled into a new reality. They shifted from reactive response to proactive moves, with new priorities in focus.

Our survey of more than 400 accounting and finance executives found that after pulling through unprecedented disruption, companies are heading into 2021 with a newfound appreciation for agility and sustainability.

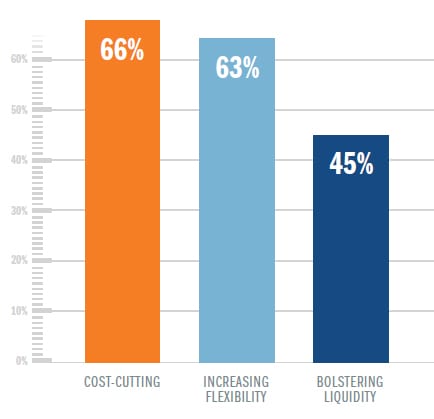

Cost optimization, flexibility and liquidity are the key goals guiding business decisions and will have a significant impact on companies’ real estate and leasing strategy in the next year.

DESCRIBE HOW THE PANDEMIC & ECONOMIC ENVIRONMENT HAS SHIFTED YOUR ACCOUNTING & FINANCE DEPARTMENT’S PRIORITIES FOR 2021?

In This Report

Top Priority is Cutting Costs

With two-thirds of accounting and finance executives reporting that cutting costs is a bigger priority for their company to stay in business in 2020, the key challenge will be where and how to trim budgets. Reassessing real estate and lease portfolios appear to be top targets for cost savings following the rise of the remote workforce, shifts in demand, and declines in traditional brick-and-mortar commerce.

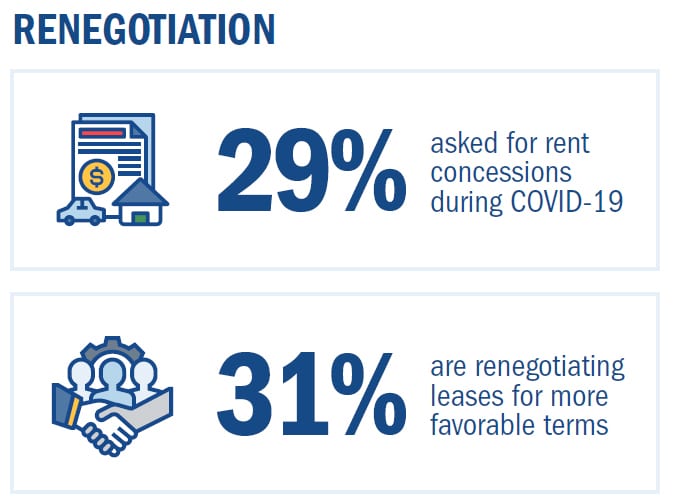

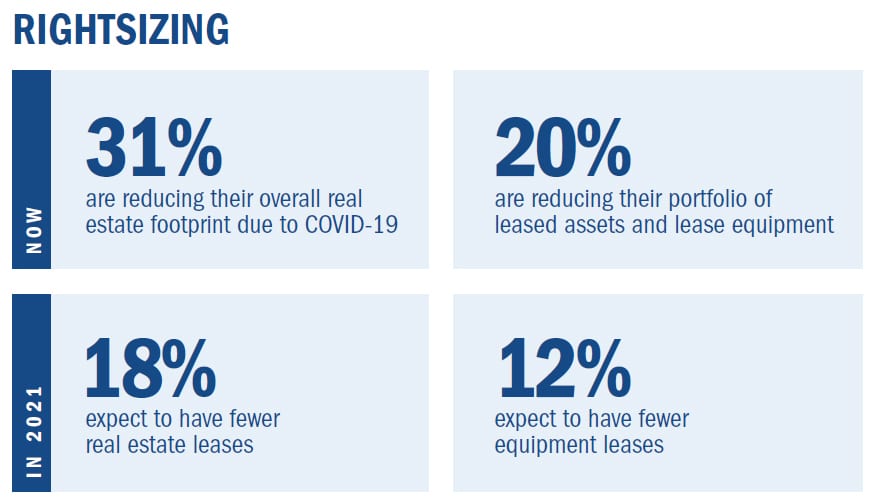

Companies point to two key real estate and leasing strategies: renegotiation and rightsizing.

Requesting rent concessions is a common strategy across most industries, but particularly for those most acutely impacted by mandated shutdowns. A whopping 92% of restaurants and 54% of retailers say they asked for rent concessions as a direct result of the pandemic.

Among companies reducing lease counts, cutting costs is the most cited driver for their decision (21%). Looking ahead, the outlook for the real estate market is mixed and depends on competing trends.

For example, retail and restaurant occupancy may remain low or decline further, while manufacturing, industrial and healthcare space needs could increase to meet production and service demands.

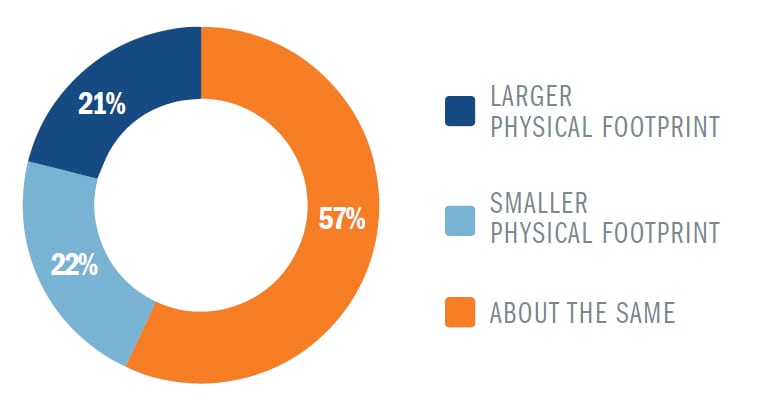

When considering 2021 expectations, 21% of companies say they expect their physical footprint to be larger and 22% expect it will be smaller. Footprint decreases may be partially offset by increases in 2021, but it’s unlikely that real estate will return to pre-COVID 2019 levels. According to Moody’s analytics, the ofce vacancy rate could reach nearly 20% in 2021.

For companies who will seek to optimize their footprint and renegotiate contract terms, the high vacancy rate may be benecial in achieving cost reductions with landlords and lessors.

2021 FOOTPRINT PROSPECTS

Significant Focus on Finding Flexibility

Agility went from corporate buzzword to essential objective in a year when closures forced businesses and their employees to rapidly learn how to seamlessly work in a remote environment. It also made companies realize that predictions, projections and expectations can become irrelevant overnight. From the course of the pandemic, to the economic impact, to potential changes on the regulatory front, there is still more uncertainty and volatility ahead.

As a result, businesses are less focused on their crystal ball and more focused on building flexibility into their strategy and operations so that they can respond and adapt to expected change.

While 10% of companies who plan to downsize their lease portfolio next year said that a remote workforce is driving their change in needs, forecasting challenges are also leading companies to take a closer look at their existing contract terms.

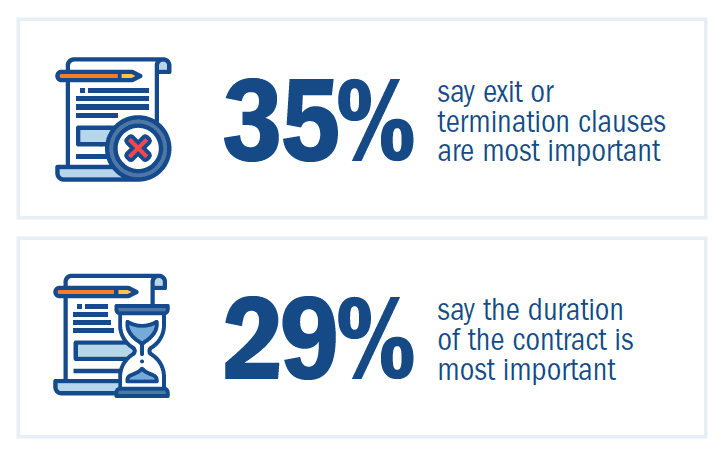

OUTSIDE OF RATES, WHAT IS THE MOST IMPORTANT

FACTOR TO YOUR BUSINESS WHEN RENEGOTIATING

LEASE TERMS FOR 2021?

When asked what was most important as they were negotiating lease terms for 2021, companies pointed to two key factors: exit clauses and contract duration. Finance leaders want to build more flexibility into their contracts and focus on the short-term, so that if they need to make changes, they can do so with fewer financial penalties.

Companies are also mindful of the FASB’s major accounting rule change, ASC 842, which requires recording most lease obligations on the balance sheet. The rule is currently in effect for public companies, while for private companies the standard is effective for fiscal years beginning after December 15, 2021.

LeaseQuery’s Lease Liabilities Index Report found that the new lease accounting requirements resulted in average balance sheet liabilities to increase by 15x. Whether public or private, being—or appearing—overleveraged could be a major ag to stakeholders or investors in a challenging economic climate, making it all the more important that companies understand their full lease portfolio and build in flexibility where possible.

Aim to Bolster Liquidity

The end goal of cutting costs and building in more flexibility is to have greater access to liquidity, which was make or break for companies in 2020 and will continue to be a huge focus for 2021.

During times of robust economic growth, companies may be focused on reinvesting cash for growth, but now the wiser strategy appears to be adding to the rainy-day fund. Almost half of companies say bolstering liquidity is a bigger priority now. Historically, it was common for companies to only have a couple of months’ worth of funding for operations readily available, and the crisis made clear that long-term stability may require more. Companies across every industry have been looking to add to cash reserves through any available path, including government relief programs, bank loans and investors.

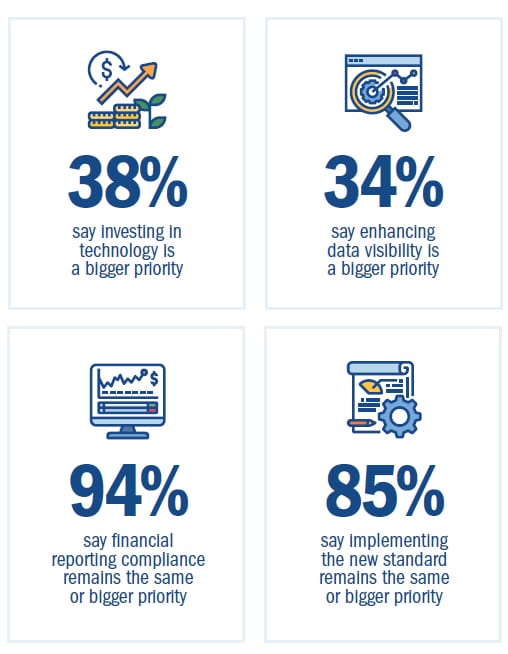

Access to capital and a continued economic recovery will be essential to ensuring adequate liquidity in the next year, but so will transparency and accuracy of financial data. Making key business decisions—from real estate to staffing to investment—requires real-time insight into financials, and companies are rightfully focused on making sure they have the infrastructure, technology and processes in place to achieve that.

Accurate and on-time financial reporting will also be key to recovery, particularly for companies who are seeking additional capital or need to properly account for government relief funds to avoid repayment. When the crisis hit, the accounting and finance department’s priorities understandably shifted, but shareholders, stakeholders and regulators still expect compliance with rules and reporting deadlines. Increased scrutiny over financial results and reporting will likely be a major challenge for companies in the coming year.

HOW HAS THE PANDEMIC & ECONOMIC ENVIRONMENT SHIFTED YOUR ACCOUNTING & FINANCE DEPARTMENT’S PRIORITIES FOR 2021?

Start Unlocking Eye-Opening Insights

Even with liquidity and flexibility as the aspiration, companies are not downplaying the importance of implementing the new lease accounting standard. It can take companies a year or more to understand the new rules and bring together the right professionals, process and technology to prepare for compliance.

The silver lining of all that effort is increased visibility into a company’s entire lease portfolio, which will be even more critical in a year when companies will make adjustments to their real estate and equipment leases to respond to changing market conditions. Companies have uncovered cash savings and beneficial contract terms they were not taking advantage of—just in the initial steps of gathering and documenting all leases.

The drivers of action are both carrot and stick. The deadline is unlikely to shift again, and the faster businesses comply, the sooner they can benefit from the insight.

In a time of continued volatility and emerging risk, it’s all the more valuable to optimize what companies can control.

Companies should continue their path to recovery and growth by rening their lease strategy and readying for compliance as soon as possible.

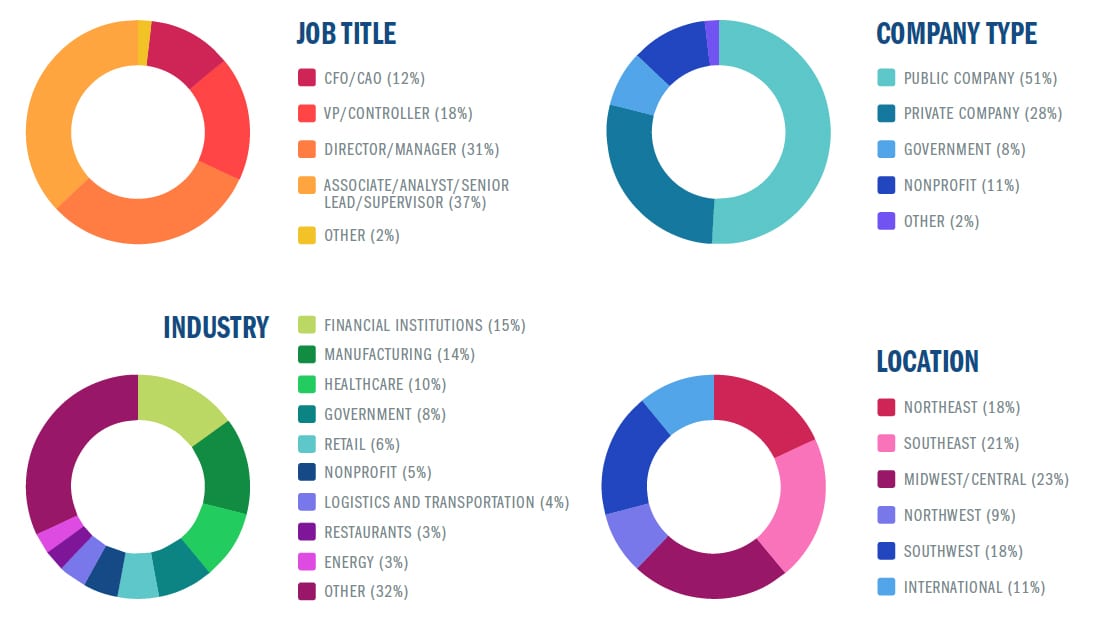

Survey Respondents

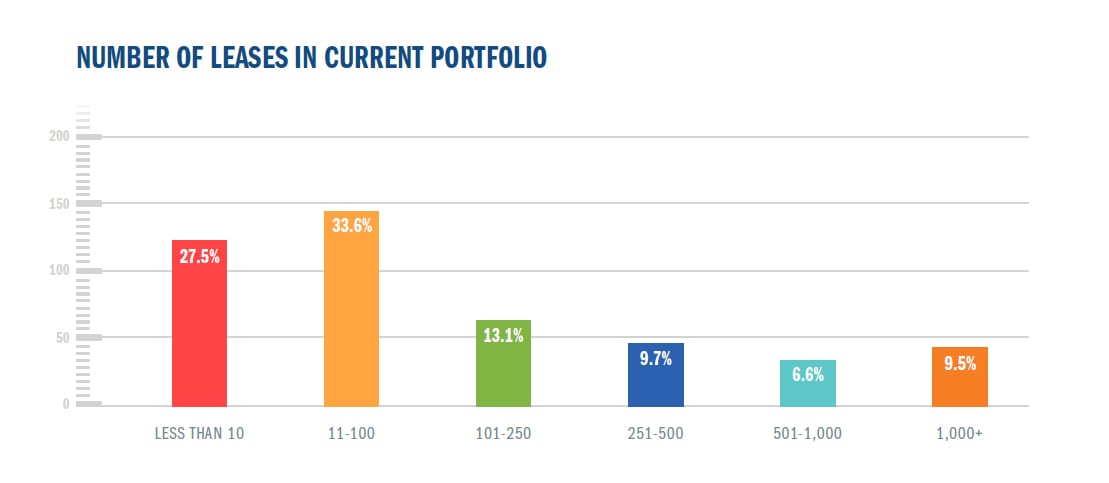

LeaseQuery’s Lease Portfolio Survey polled 443 accounting and finance executives across industries in October 2020.

Resources

ARTICLE

Potential Impairments of Leases Assets and Right-of-Use Asset

ARTICLE

Accounting for Lease Concessions under IFRS 16 as a Result of the COVID-19 Pandemic

WEBINAR VIDEO

Accounting for COVID-19 Lease Concessions