What is a capital/finance lease?

A capital lease, now referred to as a finance lease under ASC 842, is a lease with the characteristics of an owned asset. Under US GAAP, a lessee records the leased asset for a finance lease as if they purchased it with funding provided by the lessor.

As a refresher, an operating lease functions much like a rental agreement; the lessee pays to use the asset but doesn’t enjoy any of the economic benefits nor incur any of the risks of ownership.

Finance lease vs. capital lease

Why will capital leases now be referred to as finance leases? This is one of the changes to lease accounting under the new lease accounting standards and the reasoning behind it is simple. The existing nomenclature of “capital lease” is no longer specific to one lease type because the majority of leases will now be capitalized (except those with a term of 12 months or less at commencement). Hence, the new term, “finance lease,” is used under ASC 842.

Capital lease criteria under ASC 840

The capital lease criteria under ASC 840 consisted of four tests to determine whether a lease was a capital lease or an operating lease. This assessment was performed when the lease was signed. The tests included the following:

- 1st test – Does the title/ownership transfer to the lessee at the end of the lease term?

- 2nd test – Is there a bargain purchase option?

- 3rd test – Is the lease term 75% or more of the remaining economic life of the asset?

- 4th test – Does the present value of the sum of the lease payments exceed 90% or more of the fair value of the underlying asset?

ASC 842 provides a practical expedient that, upon transition, allows a company to retain the lease classifications for leases that commenced pre-transition. However, the FASB has indicated that companies electing this practical expedient must ensure that the accounting under ASC 840 was appropriate, as this expedient was not intended to allow accounting errors from previous years to carry forward uncorrected.

Finance lease criteria under ASC 842

The way finance leases are treated for lessees has not changed much. Finance lease obligations are still recorded on the balance sheet and classified as a liability. The most significant change is there are now five tests that determine lease classification instead of four. Another distinction from the old standards is that the lease classification test is now performed at lease commencement instead of when a lease is signed.

ASC 842-10-25-2 provides the lease classification criteria for lessees:

“A lessee shall classify a lease as a finance lease and a lessor shall classify a lease as a sales-type lease when the lease meets any of the following criteria at lease commencement:

- The lease transfers ownership of the underlying asset to the lessee by the end of the lease term.

- The lease grants the lessee an option to purchase the underlying asset that the lessee is reasonably certain to exercise.

- The lease term is for the major part of the remaining economic life of the underlying asset. However, if the commencement date falls at or near the end of the economic life of the underlying asset, this criterion shall not be used for purposes of classifying the lease.

- The present value of the sum of the lease payments and any residual value guaranteed by the lessee not already reflected in the lease payments in accordance with paragraph 842-10-30-5(f) equals or exceeds substantially all of the fair value of the underlying asset.

- The underlying asset is of such a specialized nature it is expected to have no alternative use to the lessor at the end of the lease term.”

Now, let’s walk through each test and understand some of the distinctions between ASC 840 and ASC 842.

- 1st test – Does the title/ownership of the underlying asset transfer to the lessee at the end of the lease term?

This test is consistent under ASC 840 and ASC 842.

- 2nd test – Does a purchase option exist and is the lessee reasonably certain to exercise the option?

In contrast to ASC 840, under ASC 842, the existence of a purchase option does not automatically classify a lease arrangement as a finance lease. Instead, the criteria is focused on the lessee’s determination (using economic factors) of its likelihood to exercise a purchase option within the agreement. This is inclusive of all purchase options, not just those considered a bargain.

- 3rd test – Is the lease term commensurate with the major part of the remaining economic life of the asset?

- 4th test – Does the present value of the sum of the lease payments equal or exceed substantially all of the fair value of the underlying asset?

The specific thresholds or “bright lines” for the third and fourth tests have been removed under ASC 842. “Major part” and “substantially all” are not defined under ASC 842. However, ASC 842-10-55-2 provides guidance that the 75% threshold represents a “major part” of remaining economic life of the underlying asset and the 90% threshold represents “substantially all” of the fair value of the underlying asset.

It’s important for your company to establish its own thresholds for these tests, document them in an internal accounting policy, and follow them consistently. In our experience, most LeaseQuery clients have chosen to keep the existing thresholds of 75% and 90%, respectively, for continuity purposes.

- New 5th test – Is the asset so specialized in nature it provides no alternative use to the lessor once the lease is complete?

The fifth test was added in ASC 842. However, typically, we notice if a lease triggers the fifth test, it’s likely that it also triggered the third or fourth test. This is because, for example, a shrewd landlord factors in the future use of the asset when establishing the lease payments, and as such, typically the fourth test would be triggered.

“Strong-form” vs. “weak-form” finance leases

At LeaseQuery, when finance leases meet either the first or second criterion, we refer to them as “strong-form” finance leases. We refer to those meeting only the third, fourth, or fifth criterion as “weak-form” finance leases. This is an important distinction because there is one major difference between these two types. For finance leases that transfer ownership at the end of the lease term or for those that contain a lease purchase option, I.e. strong-form finance leases, the underlying assets are amortized over the asset’s useful life, as if the asset were owned. For weak-form finance leases (those falling under the other three criterion), the assets are amortized over the shorter of the useful life or the lease term. The difference is subtle, but it has accounting implications.

Finance lease accounting example

In this section, we’ll explain finance lease accounting under ASC 842 using an example.

Assume a company (lessee) signs a lease for a forklift with the following information:

- Fair value: $16,000

- Lease term: 3 years

- Base rent: $450 month paid in advance

- Useful life of the forklift: 5 years

- Purchase option: At the end of the lease term, the company can purchase the forklift for $1,000, which is the estimated fair value at the end of the lease.

- Discount rate: A bank would charge the lessee 4% for a $16,200 loan over 3 years

- The company has no plans to purchase the forklift

Determining finance lease vs. operating lease under ASC 842

To determine if the lease is a finance lease or an operating lease, the company performs the finance versus operating lease analysis using the five criteria laid out under Topic 842. If the lease meets any of the following five criteria, then it is a finance lease.

Criteria 1: Does the title of the underlying asset transfer to the lessee at the end of the lease term?

Title of the underlying asset does not transfer to the lessee at lease end, so the first test for finance lease accounting is not met.

Criteria 2: Does the lease contain a purchase option the lessee is reasonably certain to exercise?

The lessee does not plan to exercise the purchase option, so the second test for finance lease accounting is not met.

Criteria 3: Is the lease term greater than or equal to the major part of the remaining useful life of the asset? (Note: This company has maintained the greater than or equal to 75% threshold for this test).

The lease term is 3 years while the remaining useful life of the forklift is 5 years. 3 years is less than 75% of 5 years ( 3.75 years), so the third test for finance lease accounting is not met.

Criteria 4: Is the present value of the sum of the lease payments substantially all of the fair value of the leased asset? (Note: This company has maintained the greater than or equal to 90% threshold for this test).

See below where we discuss the analysis of this fourth test.

Criteria 5: Is the underlying asset of such a specialized nature it is expected to have no alternative use to the lessor at the end of the lease term?

The fifth test is not applicable to this lease.

To perform the fourth test, the lessee calculates the present value of the remaining lease payments. In this example, take the present value of the monthly payments of $450 over 3 years at 4%.

Download our free present value calculator to perform the calculation. Using this tool, we calculate a present value of $15,293 which is greater than 90% of the fair value of the asset (90% of $16,000 is $14,400). This lessee has chosen to utilize the 90% threshold to represent “substantially all” of the fair value of the asset. As a result, this lease is classified as a finance lease per the fourth test.

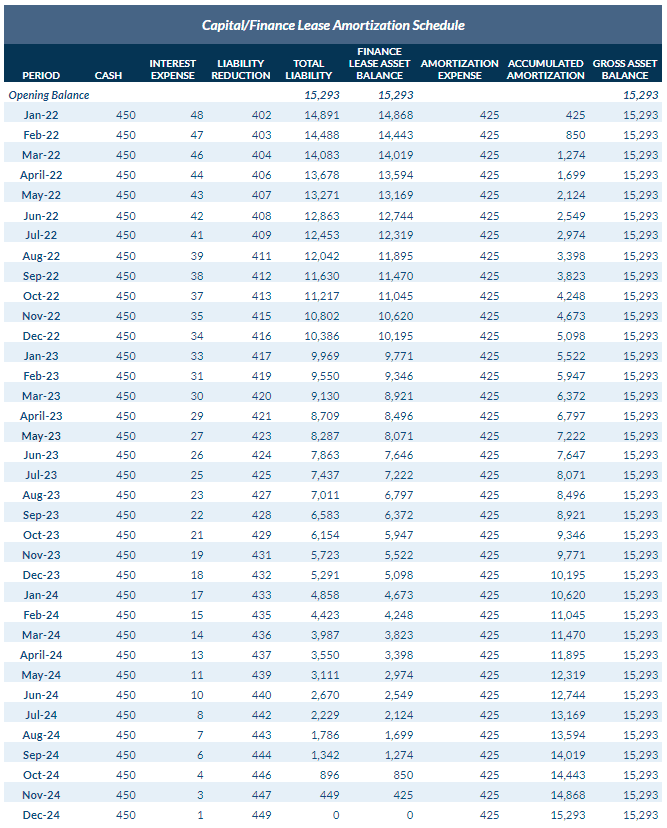

The following is the lease amortization schedule, prepared with the effective interest method, used to record the journal entries under finance lease accounting (rounded to the nearest whole dollar):

How to record a finance lease and journal entries

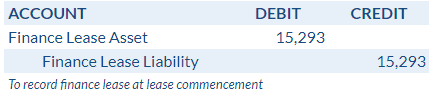

We now have all the information we need to record the initial journal entry. As documented above, the present value of the minimum lease payments is $15,293, so the initial journal entry to record the finance lease at lease commencement is:

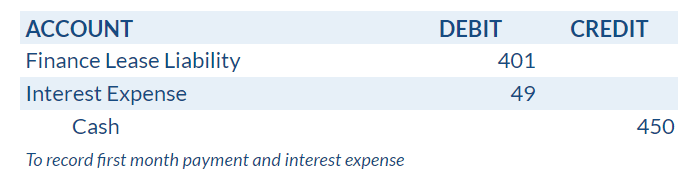

In the first month, two entries are recorded: one to record the payment of the lease and a second to record amortization expense. The periodic cash payment is split between the following:

- interest expense on the finance lease liability

- the finance lease liability reduction

These numbers are easily obtained from the amortization schedule above.

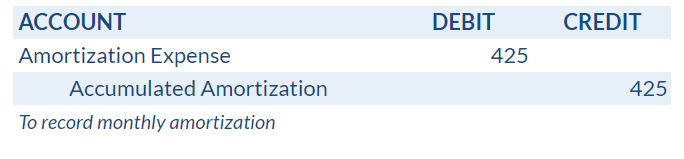

Because this is a “weak-form” finance lease, it’s amortized over the lease term of 3 years (36 months). The following journal entry represents the entry for amortization expense, which will not change throughout the lease:

Journal entries in subsequent months will be similar to the first month’s entries. The payment will be allocated between lease liability and interest expense and amortization expense will be recognized.