This article discusses what rent expense is and how the new lease accounting standard, ASC 842, affects the presentation of rent expense in the financial statements. It also explains the appropriate recognition of rent expense, including an example demonstrating rent expense measurement, at the end of the article.

What is rent expense?

Rent expense is an expense account representing the cost incurred by an organization for the right to use or occupy a specified asset that they do not own. For many companies, rent is a significant expense incurred to support their business. Sometimes rent expense can be incurred for buildings, warehouses, or offices occupied by the organization. Other times organizations rent different types of vehicles or equipment – such as office or maintenance equipment – because they require more flexibility than ownership offers.

How has accounting for rent payments changed under ASC 842?

Under ASC 840, accounting for rent was simple for operating leases. At a high level, the lessee, or tenant, would have recorded a debit to rent expense and a credit to cash to represent the expense for the usage of the asset underlying the lease agreement incurred during the period and payment for that expense in the same period.

However, recent updates have complicated lease accounting. Organizations now have to record both an asset and a liability for their operating leases. Under ASC 842, organizations record a lease liability equal to the present value of the remaining lease payments and a right-of-use asset equal to the lease liability with certain adjustments.

Lease payments decrease the lease liability. A lease expense, equivalent to the straight-line rent expense recognized under ASC 840 for operating leases, is recognized for time value discount of the lease liability and amortization of the ROU asset for operating leases. Called lease expense under ASC 842, this aggregated expense is recorded in the operating section of the income statement.

How is rent expense measured?

Under current US GAAP, the FASB states that when rents are not constant, the lease expense should be recognized on a straight-line basis throughout the life of the lease. This method of rent expense recognition is applicable under both ASC 840 and ASC 842 for leases classified as operating leases.

The new lease accounting standard addresses the recognition of a single lease expense over the term of the lease for operating leases in ASC 842-20-25-6:

“A single lease cost, calculated so that the remaining cost of the lease is allocated over the remaining lease term on a straight-line basis unless another systematic and rational basis is more representative of the pattern in which benefit is expected to be derived from the right to use the underlying asset.”

Under both ASC 840 and ASC 842, the formula to calculate the straight-line expense is as follows: Total net lease payments divided by the total number of periods in the lease.

For an in-depth discussion of operating lease accounting under ASC 842 and a full example with deferred rent expense and journal entries, read our blog, Operating Lease Accounting under the New Standard, ASC 842: Full Example and Explanation.

Other considerations in the rent expense measurement

Additional items within the lease agreement that need to be factored into the straight-line lease expense calculation may include the following:

- Lease incentives – An incentive is an instance in which the lessor motivates the lessee to sign the lease by offering beneficial terms. A common example of a lease incentive is a tenant improvement allowance. If the lease incentive has not been paid at the lease commencement date, the anticipated cash inflows from the incentive are netted against the cash outflows for the lease payments and factored into the straight-line rent expense calculation. For a more in-depth explanation of lease incentive accounting please refer to this article, Lease Incentive Accounting under ASC 842.

- Rent abatements or rent-free periods – These are instances where the lessee is not required to pay rent for a set period or recurring periods of the lease, as stated within the lease agreement. These periods of free rent or rent abatement are factored into the total net lease payments, as well as the straight-line rent expense calculation.

- Rent escalations – Rent escalations are very common in lease agreements. These are instances where the contract stipulates an increase in base rent payments, typically either a percentage or a dollar amount, over the life of the lease. This will impact the calculation of straight-line rent expense as these increases will need to be factored into the calculation. The example below demonstrates how to calculate the straight-line rent expense for a lease agreement with rent escalations.

Differences in timing of cash flows in rent payments

Prepaid rent, deferred rent, and accrued rent

In practice, lease payments are not typically made straight-line, even if they are recognized in that manner. Under ASC 840, the difference in timing of actual cash payments and the recognition of expense on a straight-line basis was typically recognized on the balance sheet in the form of prepaid rent, deferred rent, or accrued rent.

Prepaid rent

When cash payments in a period were greater than the expense recognized, prepaid rent would be capitalized on the balance sheet with a debit balance. This was considered a prepayment, which is an asset, due to rent payments being greater than rent expense incurred. For an extensive explanation of prepaid rent and other rent accounting topics, see our blog, Prepaid Rent and Other Rent Accounting for ASC 842 Explained (Base, Accrued, Contingent, and Deferred).

Deferred rent

The inverse of prepaid rent is deferred rent. When cash payments in a period were less than the expense incurred, deferred rent would be recognized on the balance sheet as a credit balance. This was considered a deferral, which is a liability, as expense for rent was incurred, but that amount was not totally paid yet. For further explanation of deferred rent, see our blog, Deferred Rent Accounting and Tax Impact under ASC 842 and 840 Explained.

Accrued rent

Accrued rent is another liability account under ASC 840 that is derived from a difference in the timing of cash payment and expense recognition. If cash payments are not made at the same time as expense is recognized, the obligation to pay the amounts that have been expensed would be accrued. For a full explanation with journal entries, read our blog, “Accrued Rent Accounting under ASC 842 Explained.”

Under ASC 842, none of these accounts will be presented on the balance sheet anymore. At transition, the cumulative balance in each of those accounts will be removed from the books and the ROU asset will be correspondingly adjusted. Since prepaid rent has a natural debit balance, it will need to be eliminated from the balance sheet with a credit and offset by a debit to the ROU asset, increasing the net asset balance. Deferred rent and accrued rent, being liabilities, will need to be debited in order to be derecognized, and the ROU asset will be respectively credited, decreasing the net asset balance. After the transition, the differences in the timing of cash flows and expense recognition will continue to be reflected in adjustments to the ROU asset balance.

How is rent expense presented in the financial statements?

Rent expense on the income statement

Rent expense appears on the income statement. Not every organization will have an identical presentation, but rent expense is now widely referred to as lease expense on the income statement. As stated previously, the rent payments for operating leases under ASC 840 were expensed and therefore considered off-balance-sheet transactions. This would be beneficial for lessees as organizations did not have to report a liability on the balance sheet for the obligation. However, not reporting the obligation on the balance sheet may make the organization’s overall commitments appear drastically lower, depending on the significance of that entity’s operating lease portfolio.

The total liability balance (short-term and long-term liability balances) is often used by stakeholders in evaluating whether to invest or lend to an organization. Potential investors or lenders use those balances in financial ratios that often greatly contribute to decision-making. As a result of transitioning to ASC 842, organizations will see an increase in overall liability and asset balances, which may significantly impact the balance sheet and financial ratios used by various stakeholders. Organization’s lease activity will become more transparent, which is the ultimate goal of the FASB’s issuance of the new lease accounting standard.

Rent expense on the balance sheet

As was the case under ASC 840, rent expense is not reported on the balance sheet. It is still only reported on the income statement and calculated on a straight-line basis.

Example: Straight-line rent expense calculation

Consider the following scenario:

A retailer enters into a 10-year warehouse lease with initial rent payments of $10,000 a month and a 2% annual rent escalation. The lease commences on January 1, 2022, and ends on December 31, 2031. Let’s assume this is an operating lease, and the retailer transitioned to ASC 842 on January 1, 2022.

How do you calculate the straight-line rent expense for the scenario above? In order to arrive at the correct answer under US GAAP, we need to sum the total net lease payments and then divide those payments by the total number of periods in the lease term.

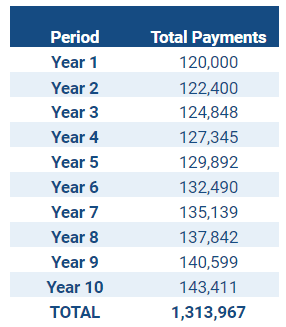

Step 1: Calculate the total payments

The aggregate payments required under the lease total is $1,313,967.

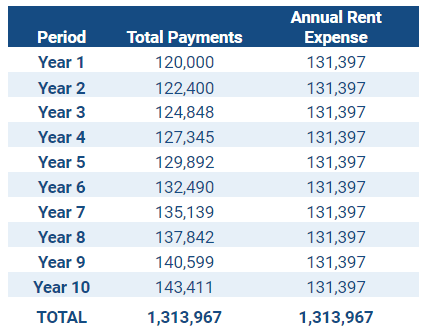

Step 2: Calculate the rent expense by dividing the total payments by the lease term

The annual rent expense is $131,397 ($1,313,967 divided by 10 years), and the monthly rent expense is $10,950 ($1,313,967 divided by a lease term of 120 months).

In this example, we calculated a straight-line rent expense of $131,397 per year. We can see from Step 2, the annual payments begin at $120,000 and increase each year to reflect the 2% rent escalation but the expense is consistently recognized on a straight-line basis over the lease term.

In this example, we calculated a straight-line rent expense of $131,397 per year. We can see from Step 2, the annual payments begin at $120,000 and increase each year to reflect the 2% rent escalation but the expense is consistently recognized on a straight-line basis over the lease term.

Under ASC 840, the difference between the actual cash payment and the expense recognized each period for an operating lease is accounted for in a deferred/prepaid rent account. Under ASC 842, this difference is no longer accounted for in a separate balance sheet account. The new accounting standard incorporates the difference between the cash payments and the expense recognized for an operating lease in the ROU asset each month.

Summary

ASC 842 will have little to no impact on the income statement for rent expense. It is calculated and presented in significantly the same way, but it may now be called lease expense. Rent expense is calculated on a straight-line basis. Lease agreements may include rent abatements, and/or escalations. However, the general theory of calculating the straight-line rent expense for a particular contract will remain constant: sum the total net lease payments and divide by the total number of periods in the lease.

Future payments for rent-related to operating leases were previously off-balance sheet transactions. This was beneficial to lessees in that the obligation for those payments did not drive up the liability balance. However, ASC 842 aims to increase transparency for stakeholders by including a lease liability and corresponding ROU asset on the balance sheet for operating leases. Rent expense will still not be on the balance sheet.

Under ASC 840, differences in payments and expense recognition, stemming from things like rent holidays, prepayments, or escalations, would be recognized on the balance sheet in the form of Prepaid Rent, Deferred Rent, and/or Accrued Rent. Under ASC 842, those balances are no longer on the balance sheet but are reflected as adjustments to the ROU asset balance.