1. What is a practical expedient?

2. Accounting transition methods

3. Transition practical expedients

- The package of practical expedients

- No reassessment of lease classification

- No re-evaluation of embedded leases

- No reassessment of initial direct costs

- Initial direct costs

- Hindsight

- Land easements

4. Recognition practical expedients

6. Summary

Implementing a new standard is a difficult and time-consuming project for any organization. The journey starts with evaluating the current processes and understanding the new guidance, to then establishing the bridge for how existing and future agreements will be managed. Due to the strenuous efforts often increasing the costs of implementation, the accounting boards provide support for accomplishing compliance with options to ease adoption. This article will address common practical expedients and other accounting relief options for those reporting under ASC 842 and those already reporting under IFRS 16.

What is a practical expedient?

A practical expedient is a relief effort provided by standard setters in an effort to help preparers more easily apply accounting guidance.

As it pertains to lease accounting, both the FASB and IASB have issued practical options to ease the adoption of the new standards. Companies can elect these relief efforts either lease by lease, by class of asset, or as an accounting policy election depending on the type of practical expedient. Identifying the appropriate practical expedients for your company will save time, but if it is not interpreted properly, companies run the risk of errors in lease accounting.

Let’s take a deep dive into these relief efforts by first walking through the transition method options available under both ASC 842 and IFRS 16.

Accounting transition methods

Transition method for ASC 842

ASC 842 requires companies to transition using a modified retrospective method. This means that a cumulative-effect adjustment is made on the initial date of adoption for existing leases. Companies can choose from two options for the initial date of application:

- Effective Method – Apply the new standard as of the effective date, where the comparative periods are presented under ASC 840

- Comparative Method – Apply the new standard as of the earliest comparative period presented

Below represents a table of the effective date and comparative periods for both public and private companies:

As an example, if a private company elects not to restate comparative periods, then all lessee leases would have a lease liability and right of use (ROU) asset established as of January 2022, and the comparative periods would be unchanged.

As an example, if a private company elects not to restate comparative periods, then all lessee leases would have a lease liability and right of use (ROU) asset established as of January 2022, and the comparative periods would be unchanged.

Transition methods for IFRS 16

Whereas ASC 842 allows only one way to transition, IFRS 16 offered two ways to transition to new lease accounting guidance. International companies could elect to transition using a modified retrospective approach or a retrospective approach. This election must be applied consistently to the entire lease portfolio.

The modified retrospective approach recognizes the impact of the new standard as of the initial date of application, January 2019, and prior periods are not restated. This means all lessee leases measure a lease liability and ROU asset at the initial date of application with a corresponding adjustment in equity.

Moreover, in electing the modified retrospective method, companies could choose to measure the ROU asset for existing operating leases in two different ways.

- Retrospectively – as if IFRS 16 had always been applied, but using a discount rate as of the initial date of application

- Modified – equivalent to the lease liability measured as of the initial date of application, including specific adjustments

Both options could be selected on a lease-by-lease basis.

The retrospective approach recognizes the impact of the new standard as if it had always been applied. In other words, all lessee leases are measured according to historical information (i.e., lease term, lease payments, options, etc.) and an adjustment in equity recorded as of the beginning of the earliest period presented. This approach also resulted in the restatement of previous years’ financials. It is important to note that if the retrospective approach was selected, the only practical expedient option available, as discussed below, was to grandfather the lease definition under IFRS 16.

Whether you have reporting requirements under ASC 842, IFRS 16, or both, electing the transition method is important for the outcome of the new liability and asset balances, profit trends, and the overall cost and timeline of implementation.

Check out our ASC 842 and IFRS 16 Transition Guide:

Transition practical expedients

Each of the subsequent practical expedients directly relate to a company’s ability to easily transition existing leases to the new lease accounting standard. While some of these practical expedients can be selected individually, a few must be selected together as a package under US GAAP.

The package of practical expedients

The following three practical expedients must be elected all at once for transition and cannot be elected individually. Under ASC 842 this group of expedients is referred to as “the package of practical expedients”.

No reassessment of lease classification

Entities can opt not to reassess the lease classification of existing or expired leases under ASC 842, and simply maintain its original classification. Under the new guidance, the “bright-line” criteria (75% of the lease term and 90% or greater of PV of lease payments) in the lease classification test are removed. Additionally, there is a fifth test for specialized use at the end of the lease term. However, if a lease was classified as a capital lease under 840, it remains a capital lease, albeit with a name change to finance lease. If a lease was classified as an operating lease under the old standards, it is still an operating lease. The caveat being errors under ASC 840 are not exempt. In other words, if an error in classification occurred under ASC 840 it would also be treated as an error under ASC 842.

No re-evaluation of embedded leases

Entities can elect not to reevaluate whether expired or existing leases contain a lease per the definition of ASC 842. Ultimately, if the accounting for leases embedded in service and outsourcing contracts were appropriately considered under the old standard, then you don’t need to re-evaluate those contracts. Similar to the practical expedient above, this assumes no errors were made in previous evaluations.

While IFRS 16 did not offer a package of practical expedients, companies did have the option not to reassess lease for existing or expired leases. Similarly, under US GAAP, companies could elect to grandfather or maintain the classification according to IAS 17 so that additional costs were not incurred to reassess leases. As mentioned earlier, if the retrospective transition method was elected, this is the only practical expedient that was available for transition.

No reassessment of initial direct costs

Entities can opt not to reassess previously capitalized initial direct costs as there are slight differences in how initial direct costs are defined under ASC 840 and ASC 842. Under 840, a portion of your internal expenses could be allocated to initial direct costs. For instance, a percentage of the salaries could be allocated for internal real estate or legal staff. Under 842, initial direct costs are defined as costs that would not have been incurred if the lease had not been signed – typically external costs, such as broker fees or external legal fees. This expedient allows the organization to not reassess those costs.

Pros and cons of electing the package of practical expedients

The package of practical expedients is commonly elected by companies as it greatly reduces the amount of time spent re-evaluating leases for transition. Furthermore not electing the package will require companies to:

- Re-evaluate each lease under the lease classification criteria of ASC 842

- Re-evaluate existing or expired leases (i.e. for embedded leases or other omitted lease agreements

- Reassess initial direct costs, which may lead to an equity adjustment

On the other hand, not electing the package of practical expedients might be advantageous if a specific lease classification is preferred. For instance, finance lease classification can impact EBITDA and, as a result of the updated classification criteria under ASC 842, a company might choose to reassess lease classification rather than elect the practical expedient if doing so yields a preferred outcome.

Initial direct costs

As it pertains to IFRS 16, if a company made a policy election to transition according to the modified retrospective approach and chose to measure the ROU asset retrospectively, the company could have elected a practical expedient to exclude initial direct costs from the measurement of the beginning ROU asset balance.

Pros and cons of electing the initial direct cost expedient

Companies that elected this expedient were not required to determine historical information related to initial direct costs. As explained above, the ROU asset is measured as if IFRS 16 had always been applied. Therefore, companies may or may not be privy to the historical data for their initial direct costs. Electing this expedient established a ROU asset with a lower value at the initial date of application, resulting in decreased depreciation expense for these leases.

Hindsight

Electing to use the hindsight practical expedient allows lessees and lessors to make assumptions regarding the lease term and value of the ROU asset at commencement by leveraging current information. In essence, lessees and lessors may not be aware of the likelihood of extension or reduction of lease terms at commencement, but can apply judgment based on the information available now through the effective date of the new standard. Use of the hindsight practical expedient is applicable under both ASC 842 and IFRS 16. However, it isn’t commonly elected due to the work the application process requires. If elected, lessees and lessors must apply the practical expedient to the entire portfolio on a lease-by-lease basis.

Pros and cons of electing the hindsight practical expedient

The advantage of electing the hindsight practical expedient is that it provides companies with a clearer expectation of beginning lease liability and ROU asset balances. However, the time required to assess every lease is not often thought of as relief to the implementation of the new standard.

Land easements

A land easement represents the right to use another entity’s land for a specific purpose as outlined in the agreement. Specifically, under US GAAP, companies can elect not to reassess existing or expired land easements under the definition of a lease under ASC 842. Instead, the accounting can be maintained under its current policy. The caveat being it does not apply to land easements classified as leases under ASC 840. It is also important to note that this practical expedient is only applicable to land easements existing before the adoption date of ASC 842, and any modifications to existing leases and/or new land easements entered into after the effective date must follow the guidelines as described by ASC 842. IFRS 16 does not explicitly provide a practical expedient for land easements.

Pros and cons of electing the land easement practical expedient

This expedient is extremely beneficial for those in the utility and oil and gas industry, where a utility pole may be anchored on someone’s land or a gas line that runs through multiple properties. As such, the FASB issued an update so these companies can elect an expedient to minimize the workload of assessing intricate contracts.

Recognition practical expedients

Short term lease exemption

Slight differences exist in how short-term leases are defined under both standards. Under US GAAP, a short-term lease is defined as a lease with a term of 12 months or less as of the commencement date, without a purchase option, the lessee is likely to exercise. Under IFRS, a short-term lease is defined as a lease term of 12 months or less as of the commencement date that does not include a purchase option, regardless of the likelihood of the option being exercised. Uniquely, IFRS 16 also considered leases ending within 12 months of the adoption date to be short-term.

Based on the applicable definition, the short-term lease exemption under both standards means companies do not have to capitalize those leases and record them on the balance sheet. Short-term leases can continue to be expensed in the period incurred such as operating leases under ASC 840 and IAS 17. Companies can choose to elect this exemption by class of asset.

Pros and cons of electing the short-term lease practical expedient

Electing this practical expedient will save time. However, companies will still need to disclose short-term lease costs in the financial statements. Note: This excludes leases with a term of one month or less. Please refer to ASC 842 Disclosure Requirements to evaluate these lease costs and other disclosure balances.

Materiality threshold

ASC 842 does not specifically address setting a materiality threshold to exclude leases, but companies are applying judgment to establish thresholds similar to their capitalization thresholds. On the other hand, the Basis for Conclusion to IFRS 16 (BC100) addresses how companies can define “low value” assets and offers a specific value for consideration. If the fair value of the asset is less than $5,000 when new, then the lease does not have to comply with the new standard. Companies can decide if the threshold applies individually or in the aggregate. As an example, if a company leases golf carts that are worth $4,900, this practical expedient may be applied for each golf cart or a master lease agreement.

Pros and cons of electing the low-value lease exemption

The advantage of electing this practical expedient under IFRS 16 is that these leases can continue off-balance-sheet financing meaning no lease liability and lease asset will be measured for these leases. Depending on how they impact certain financial ratios (recall that under IFRS all leases are finance leases, which results in an uptick in EBITDA, but also increases debt ratios), exclusion can be either an advantage or disadvantage. Similar to the recognition exemption for short-term leases, companies will be required to disclose the expense for low-value leases.

Other practical expedients

Combining lease and non-lease components

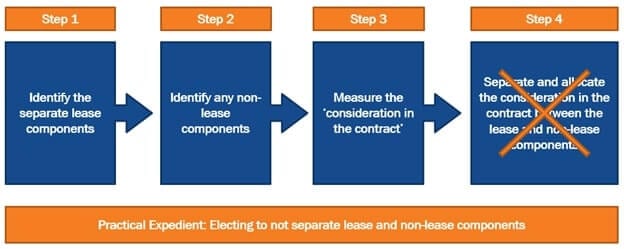

The practical expedient to combine lease and non-lease components is commonly misconstrued. Per the standard, components are activities that transfer goods and services, and the total contract consideration should be allocated to each separate lease and non-lease component. This expedient allows lessees and lessors to account for each lease and non-lease component as a single lease component, meaning lessees and lessors do not have to separate and allocate the consideration between lease and non-lease components.

Essentially, by electing this practical expedient companies don’t have to perform the analysis to determine the methodology of allocation.

Essentially, by electing this practical expedient companies don’t have to perform the analysis to determine the methodology of allocation.

Pros and cons of electing not to separate lease and non-lease component practical expedient

Electing this expedient will save time, whether applied by class of asset (e.g. electing to apply to real estate leases, but not computer leases) or to the entire portfolio. On the other hand, it will produce a higher lease liability balance.

If not elected, lessees and lessors should expect to:

- Determine lease and non-lease components

- Evaluate the fair value of the lease and non-lease components

- Develop an allocation methodology for the fixed consideration and document the method for your auditors

- Repeat this process individually for each lease where the practical expedient was not applied.

Discount rates

Evaluating the appropriate discount rate is challenging for all companies. The economics of any lease agreement is best represented by the rate implicit in the lease. This is the rate the lessor charges the lessee and the rate that results in the most accurate valuation of expected lease payments. Therefore, when assessing the rate lessees and lessors should first apply the stated or implicit rate in the lease. Unfortunately, this can be difficult to determine for most lessees as lessors may not be willing to provide all the required information to determine the implicit rate. As such, both the FASB and IASB have provided companies with easier ways to determine the rate in order to calculate the present value of lease payments.

Applying discount rates under ASC 842

If the implicit rate is not readily available, then lessees can apply the rate which it would pay to borrow funds under a collateralized loan for similar payments across a similar term as the lease, otherwise known as the incremental borrowing rate. The standard does not specify whether lessees should make assumptions based on the remaining lease payments and lease term or the total payments and total lease term, so this decision will require judgment. Whichever approach is selected should be applied consistently to all existing operating leases and any new leases going forward.

As it pertains to the application of the borrowing rate, companies can choose to apply rates on a lease-by-lease or portfolio basis. Applying rates on a portfolio level provides additional ease as it involves grouping leases with similar characteristics (i.e. lease term, location, etc.) and therefore reduces the effort of determining discount rates for each individual lease.

Applying discount rates for private companies under ASC 842

In addition to the ability to apply the incremental borrowing rate, private companies specifically can elect a practical expedient to use their risk-free interest rate. The risk-free rate is the rate investors expect to earn from risk-free investments over a period of time, such as a government treasury bill. If elected, this alternative must be applied to the entire lease portfolio.

Applying discount rates under IFRS 16

Like US GAAP, companies reporting under IFRS 16 can elect a practical expedient to apply the incremental borrowing rate to leases if the implicit rate cannot be determined. The incremental borrowing rate under IFRS 16 is defined similarly as described above. It is stated to be the rate borrowers would expect to pay for an asset of similar value over a similar term. When it pertains to leases denominated in foreign currency, companies should seek to use the rate at which funding is obtained.

Pros and cons of electing to apply alternative discount rates

These alternatives rate options minimize the legwork required to evaluate the implicit rate, and for private companies, further reduces the time to determine the incremental borrowing rate. Nevertheless, private companies should consider the impact of applying an often lower, risk-free rate which produces a higher lease liability balance.

COVID-19 lease concessions

In addition to relief efforts for transition and application, more recently, the FASB and IASB issued practical expedients and an amendment, respectively, to address the impact of COVID-19 on lease concessions. The guidance under both is very similar; however, IFRS 16 does not offer relief guidance for lessors. If applied, the relief accounting is only available to COVID-19 related lease concessions resulting in the total consideration of the contract being substantially the same or less than the total consideration in the original contract. With that said, short-pays that are not agreed upon are not eligible.

Pros and cons of electing COVID-19 lease concession practical expedient

The existing modification frameworks within ASC 842 and IFRS 16 require the remeasurement of the lease liability and ROU asset using a discount rate as of the effective date when significant changes occur. Due to the economic environment caused in part by the global pandemic, borrowing rates are comparably lower than in previous years. Remeasuring a lease liability at a lower discount rate causes a higher lease liability and ROU asset balance. Applying the practical expedient or amendment allows for less complex lease modifications and calculations, and prevents an increase to lease liabilities and lease assets as a result of discount rate adjustments. Of course, the impact of electing and applying the relief effort will vary from company to company.

Summary

Ultimately, making the decision to elect or not elect these practical expedients will vary for each organization based on reporting requirements, types of leases, and other accounting policy elections. It’s important to weigh the pros and cons of transition methods, recognition practical expedients, transition practical expedients, and other expedients meant to make the process of adopting a new standard less cumbersome. Keeping in mind any election made will dictate the cost, work, and effort put in on the front end, whether applied lease by lease or by class of asset.