It is important to evaluate the type of change that is occurring to properly account for the lease liability and right-of-use (ROU) asset. Types of modifications include:

- Additional rights

- Extension or reduction of the lease term

- Full or partial termination of the arrangement

- Changes in consideration

If the change grants additional rights of use not included in the original lease and the lease payments increase proportionate to the standalone price of the additional right of use, then the lessee would account for a brand new lease arrangement with a new lease liability and ROU asset recorded. However, if both requirements are not met, then as of the effective date of the modification, the lessee must reassess the classification of the lease (using an updated discount rate) and modify the existing lease agreement. This modification is done by assessing how the lease liability and ROU asset will be remeasured based on the type of change.

In this blog, we will address the accounting for a partial termination of a lease under ASC 842 and IFRS 16.

**Please note in April 2020, the FASB provided a lessee with accounting elections to account for concessions made in the COVID-19 pandemic environment. If a lessee chooses to utilize this election, these changes are made outside the modification guidance. For more information regarding the impact of COVID-19 on lease modification accounting, please take a look at the following article.

Additionally, in May 2020, the IASB published an amendment to IFRS 16 providing a practical expedient for lessees to account for rent concessions granted in response to COVID-19 as changes to the lease that are outside of the modification guidance in IFRS 16.

Is it a termination?

If the new terms of the agreement reduce the rights to the underlying asset(s), then it is referred to as a partial or full termination. For example, if a lessee is leasing 9,000 square feet of an office building and then four years into the lease term signs an agreement with the landlord to only lease 6,000 square feet, the amended agreement would result in a partial termination of the existing lease arrangement. Now consider the same office building, but instead, the lessee decides to downsize and no longer needs any of the building space. This would result in a full termination.

How to account for a termination

Accounting for a full termination is relatively easy. Simply derecognize the lease liability and ROU asset and recognize any differences in gain or loss. However, when accounting for a partial termination, both the lease liability and ROU asset must be remeasured as of the modification date. Remeasuring the lease liability is straightforward as it is consistent regardless of the type of modification, but remeasuring the leased asset of a partially terminated lease can be challenging. The lessee decreases the carrying amount of the lease asset in proportion to the partial termination of the lease.

Reassessing classification

Under ASC 842, a lease is classified as either finance or operating based on five criteria:

- Transfer of ownership

- Option to purchase

- The lease term is for the major part of the remaining economic life

- The present value of lease payments equals or exceeds substantially all of the fair value of the asset

- No alternative use to the lessor at the end of the lease term

If any of the criteria described above are met, then the lease is classified as a finance lease. For more information on lease classification, please refer to this article.

Upon determining there is a partial termination, the lease classification needs to be reassessed. This means that the same lease classification test that was performed at lease commencement is performed again, but with the updated lease terms. This article provides a full example of when a modification changes a lease classification from operating to finance.

Under IFRS 16, all lessee leases are classified as finance leases, which will not require lessees to perform any analysis of the five criteria outlined above.

Remeasuring the lease liability

Next, the lessee should remeasure the lease liability based on the revised lease payments in the modified contract using the discount rate as of the effective date of the partial termination. The effective date of the partial termination modification is the date in which both lessor and lessee agree to the modified terms.

Remeasuring the right-of-use asset

Determining the value of the ROU asset after a lease is partially terminated is a bit trickier, since the lease asset is reduced on a basis proportionate to the partial termination of the lease. Under ASC 842, the reduction to the ROU asset can either be interpreted as the proportionate change in the lease liability OR the proportionate change in the remaining ROU asset. Under either approach, the difference between the reduction in the liability and proportionate change in the ROU asset will be recognized as a gain or loss (ASC 842-10-25-13). ASC 842 offers Example 18 – Modification That Decreases the Scope of a Lease to demonstrate these two approaches to lease modification for partial terminations.

While there are two acceptable approaches to measure the ROU asset under ASC 842, IFRS 16 only has one option – to reduce the ROU asset by the proportionate change in the remaining ROU asset. Example 17 – Modification That Decreases the Scope of the Lease within IFRS 16 illustrates the approach to account for for partial terminations. As above, the difference between the reduction in the liability and proportionate change in the ROU asset will be recognized as a gain or loss (IFRS 16.46).

Partial termination accounting with example

To illustrate the two methods for remeasuring the ROU asset of a partially terminated lease, let’s walk through an example of an operating lease partial termination.

Assume a private company, Company L, enters into an operating lease agreement commencing on January 1, 2020 – the date the company plans to early adopt the new lease accounting standard. The agreement states that Company L will lease five floors of a building for office space at $6,000,000 per year increasing by 3% over a period of 10 years. Company L has determined it will use its incremental borrowing rate on January 1, 2020, to value this arrangement.

See Incremental Borrowing Rate for IFRS 16, ASC 842, and GASB 87 for further information on the selection of the discount rate for use in your lease arrangement.

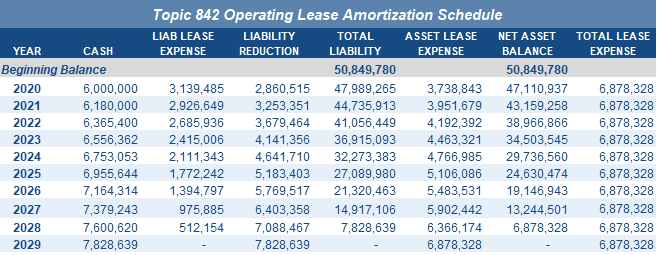

The IBR is 7%, which results in the calculation of the beginning lease liability and ROU asset upon commencement (January 1, 2020) of $50,849,780. The following amortization schedule presents the lease liability and lease asset throughout the full lease term:

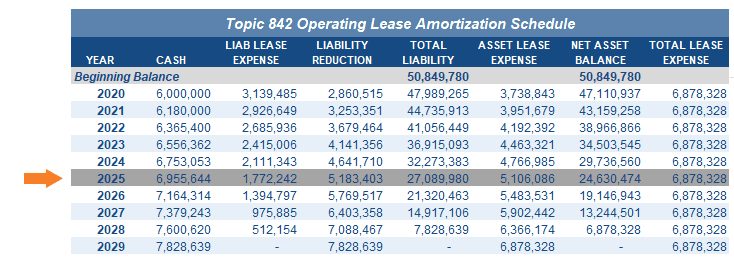

Now let’s assume in January of 2026, the lessee and lessor amend the original terms of the lease to only include 3 floors of the office space. According to the original terms of the lease, the balance of the lease liability and ROU asset at the end of 2025 are $27,089,980 and $24,630,474, respectively.

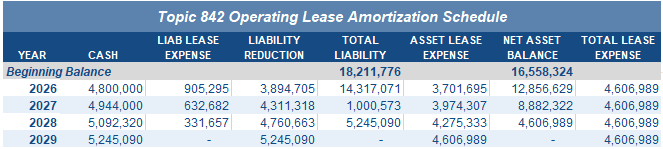

As a result of the renegotiated terms, Company L will now pay $4,800,000 annually starting January 1, 2026, and increase each year thereafter by 3%. We’ll assume that the lessor did not charge a termination fee associated with this change. First, the lessee re-evaluated their lease classification based on the updated lease terms, with the result that the lease will maintain its classification as an operating lease.

Due to the partial termination, the company will now use its incremental borrowing rate on January 1, 2026, 6.75%, so the present value of the remaining lease payments is $18,211,776. This will result in a $8,878,204 ($27,089,980 – $18,211,776) decrease in the lease liability. The modified lease liability calculation will remain consistent in both of the approaches below. However, the value of the ROU asset will change based on the approach selected.

The value of the ROU asset at the date of modification is determined based on either of the following:

- The proportionate change in the lease liability

- The proportionate change in the remaining ROU asset

We will demonstrate how to calculate both methods.

Approach 1: proportionate change in the lease liability

To value the lease asset using the proportionate change in the lease liability, start by dividing the difference between the previous balance of the lease liability and the new lease liability (i.e. the $8,878,204 calculated above) by the balance of the lease liability prior to modification. In this example, the lessee would calculate:

The carrying amount of the asset prior to the modification ($24,630,474 as presented in the amortization table above) is then reduced by the percentage change in the lease liability. To calculate the change in this example:

Then the new ROU asset is calculated by subtracting the ROU asset before modification by the adjustment necessary to the ROU asset calculated above:

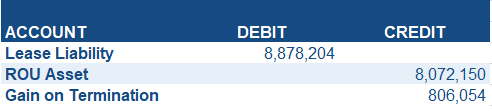

The difference between the reduction of the lease liability ($8,878,204) and the reduction of the ROU asset ($8,072,150) is a gain:

Company L would make the following journal entry for the modification if applying the proportionate change to the lease liability:

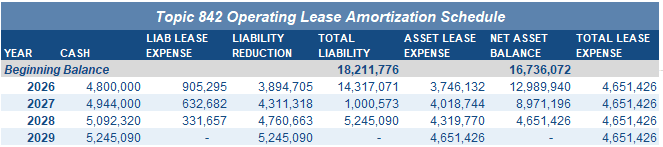

Below is the updated amortization schedule reflecting the remeasurements resulting from applying the proportionate change in the lease liability:

Note: The proportionate change in lease liability approach is only acceptable under ASC 842. IFRS 16 entities should use Approach 2 discussed below.

Approach 2: proportionate change in the remaining ROU asset

To remeasure the lease asset using the proportionate change in the remaining ROU asset, the lessee must assess the remaining ROU asset in comparison to the original terms of the lease agreement.

In this example, the original terms of the agreement state that the lessee will lease five floors. This is later amended to stipulate only three leased floors. This can be taken at face value whereby the lessee would simply calculate the change in the number of floors they have access to or the lessee can determine the square footage of each floor and then calculate the change.

For the sake of keeping it simple, we’ll assume that each floor has equivalent square footage, so the lessee will take the difference in the number of leased floors as a result of the modification (5-3) over the original leased floors (5) and calculate the proportionate change.

The carrying amount of the lease asset before modification ($24,630,474) is then reduced by the percentage change in the remaining ROU asset.

While the modified lease liability value was calculated above, in this approach, the pre-modification lease liability value is used to calculate if there is a gain/loss on partial termination. The carrying amount of the lease liability before modification ($27,089,980) is reduced by the percentage change in the remaining ROU asset.

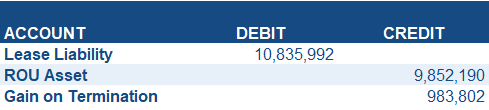

The difference between the proportionate reduction of the lease liability ($10,835,992) and the proportionate reduction of the ROU asset ($9,852,190) is recognized as a gain on termination.

To better understand the change in the modified lease liability and ROU asset, we have split the journal entry into two steps. The first step is to record the reductions in the ROU asset and lease liability as calculated using the proportionate change in the ROU asset. Please see below for the initial entry:

The lessee would next calculate the remaining liability as the lease liability before modification ($27,089,980) less the proportionate lease liability reduction ($10,835,992), resulting in a remaining liability of $16,253,988.

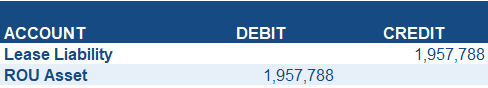

Under this approach, the lessee will then need to recognize the difference between the remaining liability calculated ($16,253,988) and the modified liability value (calculated at the beginning of this example as $18,211,776).

This difference is also recorded as an adjustment to the ROU asset. This change is a combination of the change in the payment terms of the modified arrangement combined with the impact of the updated discount rate. To record the adjustment to the lease liability and ROU asset after the remeasurement of the lease liability, the lessee would make the following entry as a result of the updated lease terms:

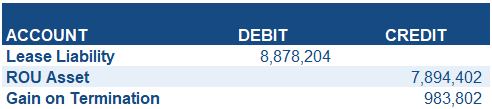

As mentioned above, we split the journal entry for this approach into two steps (above) for clarity. To calculate the new ROU asset after modification, the lease asset before modification ($24,630,474) would be decreased by the proportionate adjustment to the ROU asset ($9,852,190) and then increased as a result of the updated lease terms ($1,957,788).

The consolidated entry that Company L would make to record a partial termination based on the proportionate change in the remaining lease asset:

An updated amortization schedule reflecting the modification of the agreement and partial termination by using the proportionate change in the ROU asset approach is presented below:

Please note: The steps to remeasure the lease liability and lease asset based on the proportionate change in the remaining ROU asset described in the second approach above will be the same under IFRS 16.

As IFRS 16 requires all lessee leases to be classified as finance leases, the calculations would be applied to the lease liability and ROU asset of a finance lease, not an operating lease as shown above.

Which partial terminations approach do I choose?

Benefits exist for both approaches. As we have noted above the impact to the lease liability ($8,878,204) is consistent regardless of the approach selected. In this example, the decrease in the ROU asset is larger if the proportionate change in the lease liability (Approach 1) is selected. Selecting the first approach is easier to calculate as it’s based on the change in the liability that will be calculated from the updated lease terms.

There may be instances however, where it is more appropriate to use the proportionate change in the remaining ROU asset (Approach 2). For example, if there is a large penalty to terminate the lease or a large upfront payment, calculating the adjustment by using the proportionate change in the lease liability method (Approach 1) would result in an increase of the ROU asset.

Selecting the second approach may prove to be a little more challenging as it requires additional calculations, but because it is based on the change of the ROU asset, in these types of situations, it does not result in a disproportionate adjustment of the ROU asset. As an accounting policy election, companies should apply the modification approach consistently to all similar lease terminations.

IFRS 16 requires the use of the second approach when accounting for a partial termination. If your organization follows the authoritative guidance set by both the IASB and FASB, it may be easier to account for partial terminations consistently by applying the proportionate change in the remaining ROU asset approach.

Summary

This article presents information on terminations, specifically partial terminations. It also provides a step-by-step guide on how to remeasure both the lease liability and lease asset under ASC 842 and IFRS 16 when the rights of the original lease are partially terminated. For more information regarding terminations, please refer to the following article.

Related articles

For more information regarding modifications, please review the following articles.