This article is part of a series of articles covering equity method accounting in accordance with ASC 323 Investments – Equity Method and Joint Ventures (ASC 323). This series will cover broader, less complex equity method investment transactions and progress to more specific and complicated scenarios, following a format of introducing the concepts and then providing a realistic example with calculations and journal entries to illustrate.

In this article, the focus will be on how to account for losses on investments. For a refresher on the principles of equity method accounting, please see this article: The Equity Method of Accounting for Investments and Joint Ventures under ASC 323.

Equity method

The equity method of accounting applies when an organization invests in a company and exercises significant influence, but does not control the company. Equity investments in a separate entity can be held in the form of common stock of a corporation or a capital investment in partnership, joint venture, or limited liability company. In order for the equity method of accounting to apply to the investment, the organization must have the ability to influence the operating and financial decisions of the investee.

Per ASC 323, the equity method of accounting is applicable to the following types of investments:

- Common stock

- In-substance common stock

- Capital investment

- Undivided interest

Loss from equity method investments

The investor measures the initial value of an equity method investment at cost, recording the investment as an asset offset by the consideration exchanged. The value of the investment is increased by the investor’s proportionate share of the investee’s current period net income. On the other hand, the investment is decreased by the investor’s portion of the investee’s current period net loss, distributions, and dividends. The investment asset continues to be increased/decreased until the investment is disposed of or the investee’s portion of accumulated losses exceeds the investment balance.

When an investment balance is reduced to zero due to incurred losses over time, the investor generally pauses recognizing future losses to avoid recording a “negative” investment. In some instances, such as the expectation of the investee’s imminent return to profitability or when the investor is committed to financially supporting the investee during this time, losses may continue to be recognized. For example, one instance in which the investee would likely have an immediate return to profitability is if the investee incurred a significant non-recurring loss (i.e., a legal pension settlement). One example of when the investor is providing continuing financial support is if the investor guarantees the investee’s debt.

If the investor pauses recognition of losses in the financial statements due to an investment balance that has been reduced to zero, the investor must continue to track cumulative losses and their impact to the investment balance outside of the general ledger. The investor can only begin recording equity income again when their share of earnings reverses the total accumulated losses they previously incurred. As such, it is important for an investor to properly track their share of income and loss even when they aren’t recording journal entries in their general ledger.

The scenario outlined below illustrates the calculations and journal entries necessary to correctly account for these transactions.

Example of accounting for equity method losses in excess of the investment

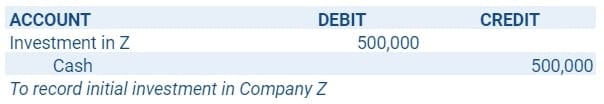

Initially, Company A purchases stock in Company Z equating to a 25% ownership in Company Z for a purchase price of $500,000. Company A’s 25% ownership provides them significant influence over the operational and financial decisions of Company Z. Therefore, Company A records their investment in Company Z using the equity method of accounting.

Initial measurement

Company A records the initial value of their equity method investment at cost as a debit to an investment account and a credit for the cash payment. The investment is recorded in the period the transaction is made with the following journal entry:

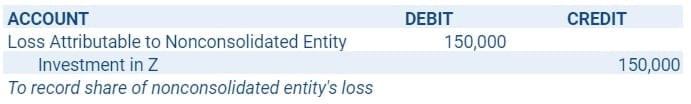

Subsequent measurement

In the first two years of operation, Company Z incurred losses in each year of $600,000. As a result of Company A’s 25% ownership in Company Z, they must recognize $150,000 ($600,000 x 25% = $150,000) of loss in each year:

Year 1

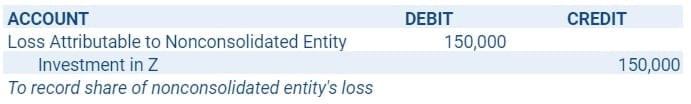

Year 2

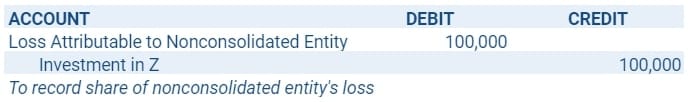

Year 3

Company Z continues to operate at a loss and in the third year of operation and recognizes a loss of $400,000. Company A records $100,000 ($400,000 x 25% = $100,000) for their portion of the loss. The entry on Company A’s books is as follows:

Year 4

In year four of operation, Company Z recognizes a loss of $500,000. Company A’s share of the loss is $125,000 ($500,000 x 25% = $125,000). However, after the losses recorded for years one through three, Company’s A net investment balance has decreased below $125,000 as illustrated in the following table:

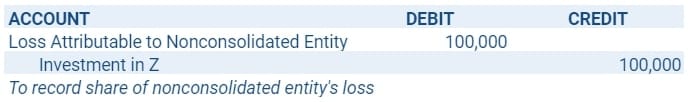

At the end of year three, the remaining investment balance in Company Z is $100,000, and the proportionate share of Company A’s loss for year four is $125,000. Additionally, the criteria for the losses to continue to be recognized have not been met (i.e., immediate return to profitability, or the investor’s commitment to financially support the investee during this time). Therefore, the amount of loss Company A is able to recognize in their financial statements for year four is limited to $100,000. The investment balance is reduced to zero as a result of the losses incurred in years one through four. Company A must pause recognizing future losses to prevent recording a “negative” investment.

The entry on Company A’s books for year four is as follows:

If loss recognition is paused due to a zero dollar investment balance, the investor must continue to track cumulative earnings/losses and their impact to the investment balance even though they are not recorded in the financial statements. In this case, Company Z tracks an unrecognized loss amount of $25,000 for year four.

Year 5

In year five, Company Z records total earnings of $50,000. Company A’s proportionate share of income is $12,500 ($50,000 x 25% = $12,500). However, Company A does not make an entry this year to record income because the cumulative loss balance of ($25,000) exceeds Company A’s proportionate share of income in the current year of $12,500. Instead, Company A will track amounts not recorded, rather than booking an entry to record income.

Year 6

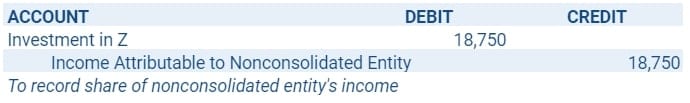

In year six, Company Z records earnings of $125,000. Company A’s proportionate share of income for the year is $31,250 ($125,000 x 25% = $31,250). As shown in the table above, Company A has cumulative losses of ($12,500) at the end of year five. Therefore, during year six Company A records income from their investment in Company Z of $18,750 ($31,750 – $12,500 = $18,750), representing the difference between their current year share of income and remaining cumulative losses.

The journal entry on Company A’s books is a follows:

Year 7

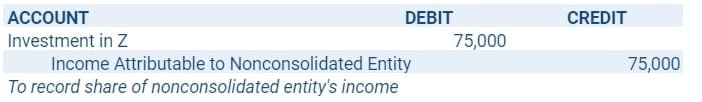

During the seventh year of operation Company Z records earnings of $300,000. Company A’s proportionate share of the earnings is $75,000. No cumulative losses remain to offset the income, and as such, Company A records its full portion of the income from its investment in Company Z of $75,000 ($300,000 x 25% = $75,000):

Company A’s equity investment in Company Z: Years 1 – 7

Summary

In this article, we specifically discuss how to account for losses on investments as outlined in ASC 323 Investments – Equity Method and Joint Ventures. In summary, after the initial investment is recorded, the value of the investment is increased/decreased by the investor’s portion of the investee’s income/loss, distributions, and dividends. Subsequently, if an investment balance is reduced to zero as a result of cumulative losses, the investor will generally pause the recognition of losses. However, the investor continues to track cumulative earnings/losses and their impact to the investment balance. The investor only begins recording equity income again when their share of earnings exceeds the accumulated losses resulting in the investment balance returning to zero.

This was one part of our equity method series. Stay tuned for additional articles further discussing specific and increasingly complex scenarios and examples under equity method accounting.