LeaseQuery: Cloud-Based Lease Accounting Software

Select Your Standard

ASC 842

IFRS 16

GASB 87

GASB 96

SFFAS 54

What is lease accounting software?

Lease accounting software provides the calculations and reports necessary to comply with the new accounting standards for leases, including ASC 842 as well as GASB 87, IFRS 16, SFFAS 54, and various others.

LeaseQuery software provides everything needed for organizations reporting under FASB, GASB, IFRS, and FASAB to be in compliance: amortization schedules for the lease liability and ROU asset, journal entries, reports, disclosures, and a knowledgeable support staff.

LeaseQuery provides compliant and accurate finance lease and operating lease accounting for lessees reporting under ASC 842 and IFRS 16 and for both lessees and lessors reporting under GASB 87 and SFFAS 54.

For GASB 96 accounting compliance, see our GASB 96 software.

Lease Accounting Software Solutions

Small Portfolio Lease Accounting

LeaseGuru lease accounting software makes it simple and secure to account for small lease portfolios, producing the amortization schedules, journal entries, and disclosures required for ASC 842 or IFRS 16 compliance. Create an account and enter your first 2 leases for free.

Find the Best Lease Accounting Software for your Business

Evaluate more than just cost

Occasionally, procurement teams and senior leaders push for the low-cost option, but the cheapest solution may not be best. Understand the software’s features to ensure it has everything needed for long-term compliance and what added value it might bring. Consider features like ad-hoc reporting, storage and management for non-lease contracts, and AI-enabled document extraction.

Read lease accounting software reviews

The best way to assess any technology is to hear from those who have used it. Over 66% of B2B buyers say reviews are “very important” in the buying process.

Most of LeaseQuery’s customer reviews are from the accountants who perform their company’s lease accounting. Several competitors have received good reviews, but from people in real estate, legal, and lease administration, rather than accountants.

When checking out a solution’s reviews, look for how many of those reviews were made by people who understand lease accounting specifically.

Seek feedback from your peers

Go beyond online reviews and reach out to your peers to find out which solutions they’re using. A one-on-one conversation allows you to ask questions you may not see addressed in a review.

Between the complexity of the new standards and pressure of a compliance deadline, some companies may have selected a solution without considering the features and support necessary for long-term compliance. Learning from the experience of your peers and having a keen eye for detail will help you make the right choice.

Check out lease accounting software reviews on these comparison sites

What to Look for When Comparing Lease Accounting Solutions

Knowledgeable support staff

No matter how simple a solution seems, it’s always good to confirm reliable help is available.

- Is the provider’s support staff competent with the system?

- Do they know how to apply the lease accounting guidance correctly?

- Are you able to get support in a timely manner?

These things will be crucial for a smooth implementation and ongoing compliance.

Automation and efficiency

The software you choose should provide accurate lease accounting and compliance right out of the box. When comparing solutions, be sure to ask:

-

- Are report exports built to comply with the standard’s disclosure requirements?

- Are practical expedients automatically applied once you’ve elected them?

- Does the software use AI to handle repetitive and rules-based tasks?

SOC reports

System and Organization Controls (SOC) reports – issued by a third-party CPA firm – examine a software company’s internal controls over various functions, including financial reporting, IT security, and data processing integrity. A SOC 1 Type 2 is the most relevant report for lease accounting software. Your vendor should be able to provide one, issued within the previous 12 months, to give assurance their controls are operating effectively.

Data security and support for

your internal controls

Don’t sacrifice security or controls. Providers should be able to show you how their lease accounting system’s built-in functionalities keep your data secure and reinforce your internal controls. Security features like unique user logins and data encryption are a must. Controls like data validation, appropriate approval processes, and lease change reporting will support Sarbanes-Oxley (SOX) compliance and a smooth audit process.

Lease Software Comparison Guide

Comparing lease accounting software solutions? Supplement the reviews and pricing info with considerations from our comparison guide:

-

- Evaluation of ASC 842, GASB 87 & 96, or IFRS 16 software

- Must-ask questions to check vendor expertise

- List of the top functionalities required for compliance

More Than a Lease Accounting Tool

LeaseQuery provides added value as:

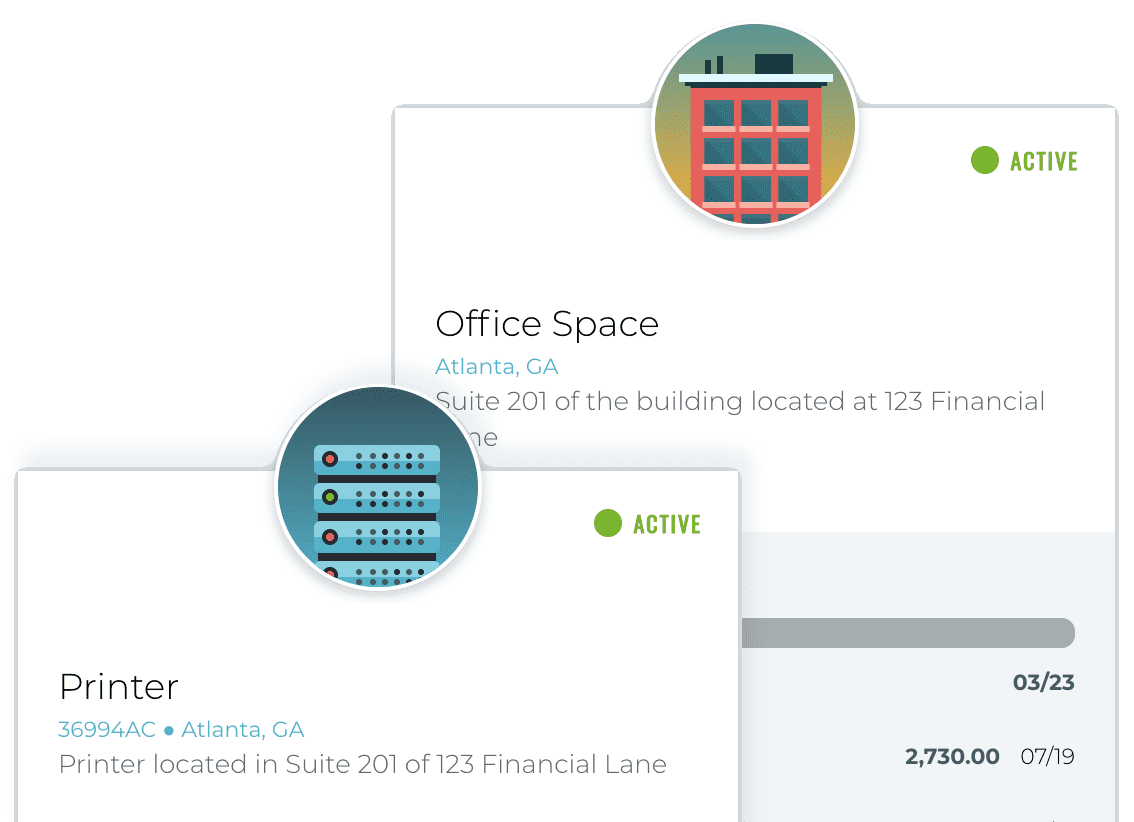

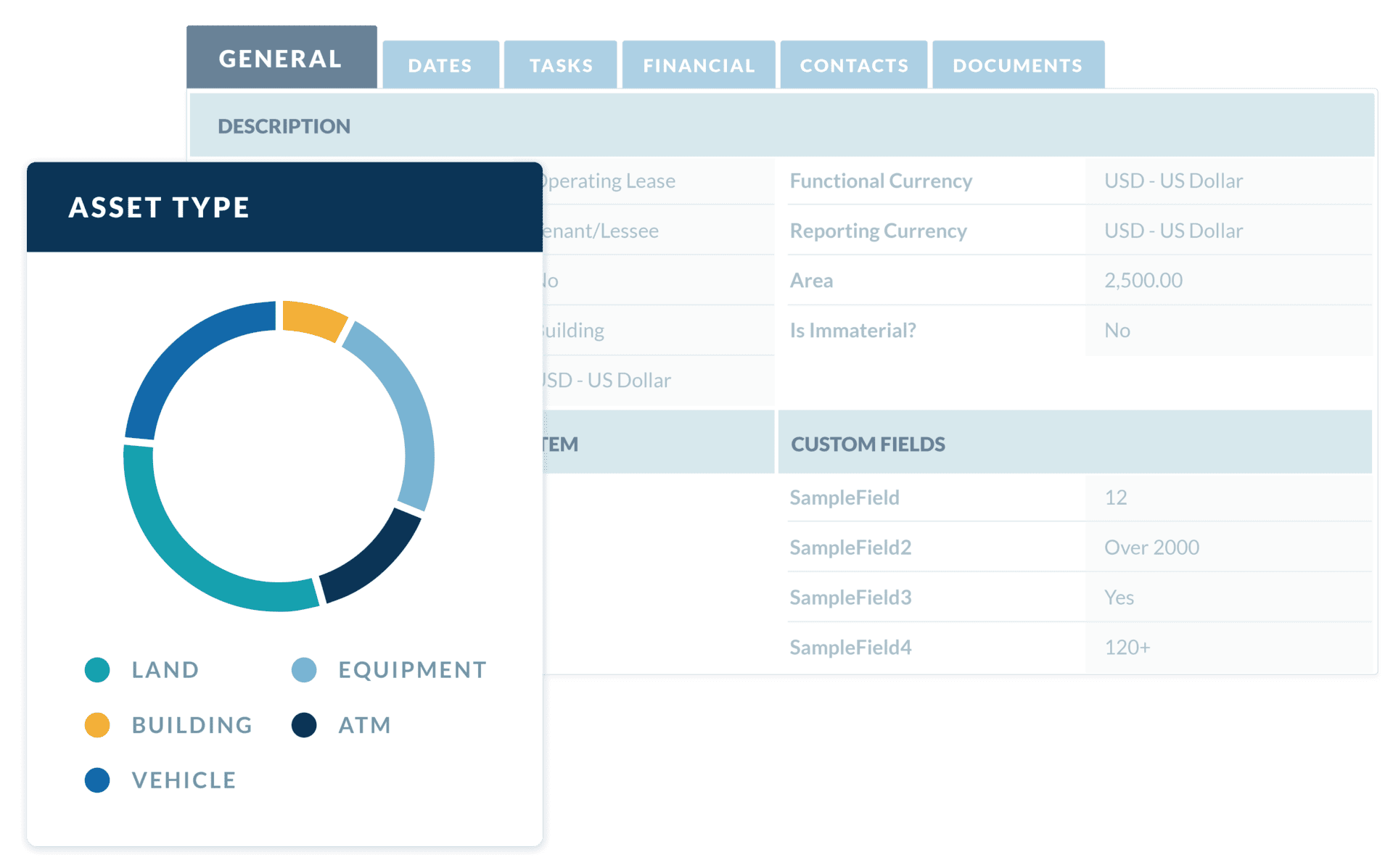

A Lease Database Software

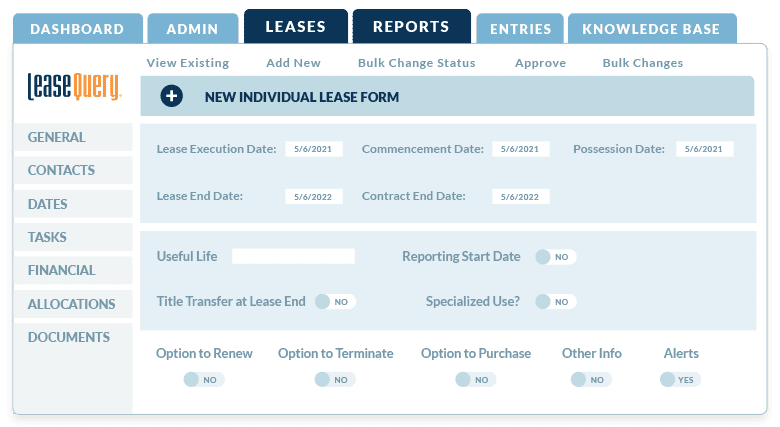

Our cloud-based software houses your leases and financial contracts in a centralized and secure database available anywhere with an internet connection and provides data integrity not possible with Excel.

Give departments and team members the appropriate level of access for their roles and they can create alerts for upcoming dates, set workflow notifications, or use the search function to quickly pull up contracts. You can even give auditors read-only access for a simpler audit process.

Financial Decision Support Tool

LeaseQuery reporting gives you insight into all the financial details of your leases. This new visibility enables better and easier forecasting, budgeting, and capital allocation.

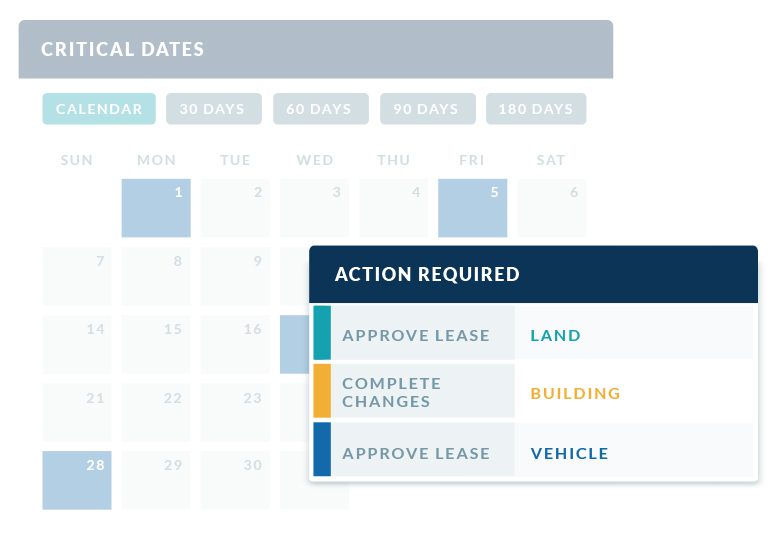

In addition, LeaseQuery reporting, along with critical date alerts, help you identify and address issues with your leases before they become problems.

Lease Management and Lease Tracking Software

Tracking leases is possible with Excel or a Google Sheet, but it’s not ideal. Failure to meet accounting compliance isn’t the only risk.

Relying on a spreadsheet and human accuracy can also lead to missed renewals, failure to escalate (or de-escalate!) payments, and miscommunication across departments.

Lease accounting software aids lease tracking and management to improve processes and catch errors before they can become bigger issues.