For private companies, the January 1, 2021 compliance deadline is nearing and your transition should be underway. However, with all you have to do, we understand that starting and completing this huge task isn’t at the top of your to-do list.

Nonetheless, beginning the transition now allots the proper amount of time to comply, saves money, and reduces the stress of completing this project. Waiting will only make compliance more difficult to achieve the closer it gets to the deadline. However, sometimes obstacles get in the way that can delay starting the transition process. Do any of the following ring true for you?

Gathering your leases

Pulling together your company’s leases, particularly those that aren’t obvious, is no easy feat. Evaluating your service agreements for embedded leases is even more complex and time-consuming.

Staff changes

Maybe your company has recently downsized, gone through an acquisition, or has experienced turnover (and the knowledge loss that comes with it). There are any number of reasons personnel changes happen and they all set back your transition project timeline.

Training

Lease accounting is a small niche within accounting, and it’s likely that you haven’t had much exposure to it. Seminars and training classes aren’t always scheduled on demand. Waiting for educational sessions can also throw off your timeline.

Not another regulation change!

The new lease accounting standards come on the heels of Topic 606 (Revenue Recognition). You’re going from one major regulatory change to another.

Why now is the time start your project

Even with all those obstacles in your way, you need to start your lease accounting transition project now. Putting it off can create serious problems down the line, making your transition more difficult and putting your compliance at risk. There is a such a thing as being too late.

You need time to evaluate and implement lease accounting software

Every day that goes by without comparing and making a decision on lease accounting software solutions puts you behind in implementation, which then pushes out your transition timeline. While most software providers should be prepared for the wave of new customers, waiting too long to start leaves you little wiggle room to complete implementation.

You need enough time to collect and analyze data on your leases before the deadline

Part of the transition process is recording every lease your company has. You’ll have to figure out how many leases you’re dealing with, including those that are embedded in service agreements. These article may help with that: How to Conduct an Inventory of Your Leases and How to Find and Address Embedded Leases.

During your audit, auditors will know the transition wasn’t done properly

If an auditor even suspects this, then it’ll be assumed that the chances you made mistakes are high (especially when it comes to the embedded leases). It’ll be costly to have consultants figure out the details then scramble to comply.

Balance sheet impact shock

With the new rule conversion comes an impact to the balance sheet under assets and liabilities. Both increase pretty significantly, especially if you have operating leases. This change has the potential to affect your lines of credit with banks. Banks require you to report accurate financial statements from which they calculate asset/liability ratios. If the ratios haven’t converted properly, they will be incorrect, causing misstatements and a potential violation of debt covenants.

The end-of-year crunch

The holidays are fast approaching. Staff and vendor vacations are certain, taking away valuable resources that you need to focus on big work projects. The work that may need to be done prior to January will end up being pushed back until January.

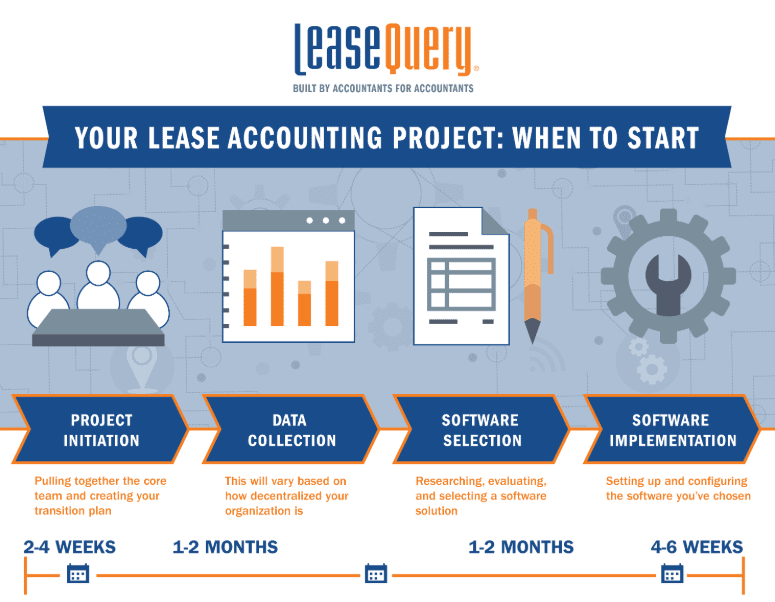

How long will it take for you to complete your lease accounting transition project?

You should prepare to spend roughly 3-6 months on your lease accounting transition. Here’s a breakdown of how much time you’d spend on each component:

This scenario doesn’t include the time you’ll need for staff training. It also assumes that your company is transitioning under normal business conditions. Acquisitions and mergers make your lease accounting transition much more complicated.

In those scenarios, you’ll have a mountain of unknowns to sift through – as well as restructuring and knowledge loss due to turnover. Those unknowns can double your workload. If you’re experiencing an acquisition or merger, it’s even more important for you to give yourself ample time to transition.

Make your transition manageable

Now that the time crunch is on, use our step-by-step lease accounting Transition Guide to make your project more manageable. It’ll take the guesswork out of your transition project. Click Here to Download!