The international and United States lease accounting standards have been updated to provide further transparency in companies’ financial reporting. The Financial Accounting Standards Board (FASB) issued ASC 842, Leases, whereas the International Accounting Standards Board (IASB) issued IFRS 16, Leases. While similar with regards to the recognition of leases on the balance sheet, the standards have many differences in application. Below are a few notable differences between IFRS 16 and ASC 842.

Transition approaches and application date

The IASB mandated the same effective date for both public and private companies, which was for annual reporting periods beginning on or after January 1, 2019. With US GAAP, however, two different deadlines were used. Public companies had to adopt ASC 842 for fiscal years beginning after December 15, 2018, while the effective date for private companies was for fiscal years beginning after December 15, 2021.

US GAAP and IFRS also require different approaches for transition accounting. US GAAP originally outlined one approach – the modified retrospective approach, meaning the new standard would need to be applied to the earliest period presented in the financial statements. However, the FASB provided a popular practical expedient which allows companies to adopt the guidance as of the effective date (i.e. beginning of the fiscal year) and to avoid the recasting of historical information.

IFRS offers two transition approaches. The first approach, called the full retrospective approach, is applied at lease commencement and requires companies to restate all periods dating back to the oldest lease active as of transition as if the entity had always applied IFRS 16.

For example, if an entity’s oldest active lease as of transition began in the year 2000, the company would apply the guidance to its identified leases beginning in 2000, and then restate financials for every year affected, from 2000 to 2019.

The second approach, the cumulative approach, can be applied two different ways with regards to the ROU asset calculation. The cumulative approach applies the effect of adopting IFRS 16 to retained earnings as of the current effective date and calculates the lease liability at that date regardless of which option is applied to the ROU asset.

However, the ROU asset can be calculated using one of the following options:

- Calculate the ROU asset as of the beginning of the lease term, but using the lessee’s incremental borrowing rate (IBR) as of the effective date of IFRS 16. The asset is then amortized up until the point of transition but ultimately recognized on the balance sheet at the application date of IFRS 16.

- Recognize the ROU asset at the application date of IFRS 16 as equal to the lease liability, adjusted for any outstanding balance of deferred or prepaid rent on the balance sheet.

For a full summary and example of IFRS 16, read IFRS 16 Leases: Summary, Example, Journal Entries, and Disclosures.

Scope

During a company’s scoping process, they may discover leases meeting the definition of short-term. This means the company can elect a practical expedient to exempt these leases from the new lease accounting standard treatment, for both IFRS 16 and ASC 842. However, while short-term leases can be excluded for both standards’ balance sheet application, the definition of a short-term lease differs between the two standards.

Per IFRS 16, a short-term lease is a lease with a term of 12 months or less that does not include a lease purchase option.

Per ASC 842, a short-term lease is a lease with a term of 12 months or less that does not include an option to purchase the underlying asset the lessee is reasonably certain to exercise.

While these definitions look similar, detailed differences exist. Under IFRS 16, the likelihood the purchase option will be exercised is not taken into account. The mere existence of the purchase option exempts the lease from falling into the short-term lease bucket.

Additionally, a difference between the standards occurs related to materiality. Under IFRS 16, lessees do not have to account for low-value leased assets on the balance sheet. Generally, low-value is defined as an asset having an individual value of less than $5,000 but each company can determine their own low-value threshold. For example, if a company is leasing computers or golf carts worth less than this threshold, a company does not need to record the lease on the financial statements.

With ASC 842, however, the guidance does not establish a threshold for materiality. Companies may choose to elect a capitalization policy regarding the materiality threshold for which leases will be recorded on the balance sheet.

Lease classification for lessees

ASC 842 continues to retain two classifications of leases for lessees – operating and finance (formerly capital leases under ASC 840). Overall, the determination of lease classification under ASC 840 and 842 is similar. Under ASC 842, a lease is evaluated in comparison to five criteria and if a lease meets any of the five criteria, it is classified as a finance lease. Since both operating and finance leases are recorded on the balance sheet under ASC 842, the difference in classification primarily relates to the recognition of expenses related to the lease.

IFRS 16 accounts for one type of lease for lessees: finance leases. Unlike ASC 842 which contains specific lease classification criteria, no specific finance lease classification rules exist for lessees under IFRS 16.

Variable payments based on an index or rate

Under IFRS 16, lessees are required to remeasure the lease liability for any changes in future lease payments. Therefore, for leases with payments tied to an index, each time a change occurs in the index, the company is required to remeasure the lease liability. For example, lease payments based on the Consumer Price Index, (CPI) will require the lessee to remeasure the lease liability and ROU asset every time CPI is adjusted.

Under ASC 842, the lease liability is calculated based on future fixed lease payments, plus any variable lease payments subject to an index or rate as of the initial measurement date. Any fluctuations in payments based on changes to the index or rate are recognized as variable payments and expensed as incurred in the current period. For example, if in the second year of a lease, the payments increase by $50 because of a change in CPI, the lessee recognizes the additional $50 as a current period expense and does not reassess the lease liability.

Interest rates

While both ASC 842 and IFRS 16 require lessees to use an interest rate in the calculation of the lease liability and ROU asset balances, differences in what type of rate to use, as well as how certain rates are defined occur within the respective standards.

One significant difference is the availability of the risk-free rate for use under ASC 842. For companies adopting ASC 842, one of the more difficult and time-consuming aspects of adoption is finding and applying the correct discount rate. Therefore, the FASB provided an option for non-public companies to utilize the risk-free rate as opposed to the implicit rate (which is often not readily available) or the incremental borrowing rate (which can be difficult to obtain).

Under IFRS 16, the risk-free rate is not permissible, because a difference in application between public and non-public companies does not exist. Therefore, if the interest rate implicit in the lease can not be readily determined, the lessee must use the incremental borrowing rate in calculating the lease liability.

Another difference lies in the definition of the IBR between the two standards. While similar in concept, subtle differences are present. Under ASC 842, the lessee’s IBR is the rate they would pay to borrow, on a collateralized basis over a similar term, an amount equal to the lease payments in a similar economic environment.

Under IFRS 16, the lessee’s IBR is the rate they would pay to borrow over a similar term, and with a similar security, the funds necessary to obtain an asset with a value similar to the ROU asset in a similar economic environment.

This means for the same lease, if the lessee has reporting requirements under ASC 842 and IFRS 16, theoretically two different rates could be used if the amount equal to the lease payments differs significantly from the cost of the asset, which would cause the opening liability and ROU asset to differ for the same lease.

For a full discussion on interest rates under ASC 842, read our article, Interest Rates under ASC 842 Explained: Implicit, Incremental Borrowing, Risk-Free .

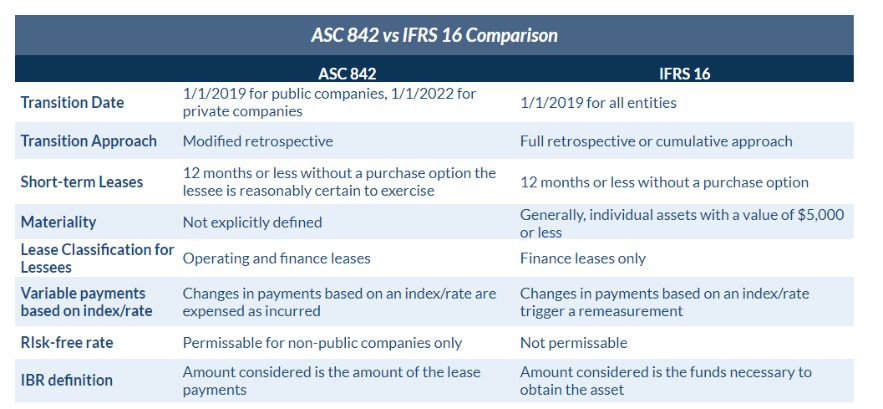

To easily compare the differences we’ve outlined above, we’ve created a table below comparing ASC 842 and IFRS 16:

Above we have highlighted a few of the key differences between the new lease standards under US GAAP and IFRS. Because of these variations, many companies have difficulties reporting under both pieces of guidance. The key is finding the right software to assist with dual reporting. To learn more, schedule a demo and consultation today.