Government agencies are entering into more and more subscription‐based contracts granting them the right to use vendor-provided information technology (IT). These contracts are often for more than one year at a time, which creates a financial liability for the government agency extending further into the future than one year’s statement of activities will properly reflect. The GASB’s primary concern was that the old financial statement presentation did not reflect these future obligations which could result in incorrect assumptions being made by users of the financial statements.

GASB Statement No. 96, Subscription-Based Information Technology Arrangements, is new guidance issued by the governmental accounting standards board which is largely based on GASB 87 and applies to subscriptions for software.

The new standard will, for the first time, require a subscription asset and a corresponding liability to be recognized on the statement of financial position for any SBITA arrangements a government has with software vendors. Because of this, additional quantitative and qualitative disclosures are required.

Here is the link to the full text of Statement No. 96 issued by the GASB.

Qualitative disclosures

Requirements

In addition to the quantitative disclosures outlined below, GASB 96 requires the government to disclose a general description of its SBITAs, which includes the basis, terms, and conditions on which variable payments not included in the measurement of the subscription liability are determined.

Similar to GASB 87, some types of variable payments are included in the subscription liability, such as variable payments fixed in substance, and others are not, such as customer support fees. All variable subscription payments will need to be tracked and disclosed. Still, a distinction between those included in the liability and those captured solely as inflows/outflows exists, and governments must explain their distinction between these two types of payments as part of their qualitative disclosure.

Quantitative disclosures

Paragraph 60 of GASB 96 outlines all disclosure requirements for SBITAs other than those considered short-term. They are listed and expanded upon below.

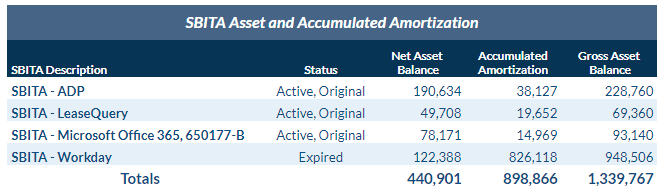

Subscription asset disclosure

GASB 96 requires governments to recognize a subscription asset associated with their SBITA agreements. Therefore, one of the required disclosures is the total amount of subscription assets, and the related accumulated amortization, disclosed separately from other capital assets. See below for an example of this disclosure:

Outflow of resources

Along with the subscription asset, GASB 96 requires governments to recognize a subscription liability associated with their SBITA’s, measured as the present value of the remaining subscription payments.

Governments may also make other variable and additional payments not included in the subscription liability. GASB 96 requires disclosure of the amount of outflows of resources recognized in the reporting period for variable payments not previously included in the measurement of the subscription liability, and disclosure of other one-off payments such as termination penalties also not previously included in the measurement of the subscription liability, except for those related to short-term SBITAs.

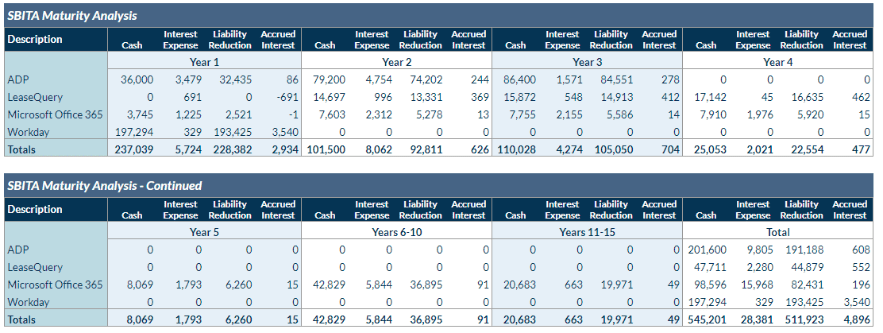

Subscription liability disclosure and maturity analysis

The government must also present a maturity analysis of its subscription liability balance as part of the required quantitative disclosures. This disclosure reports both the discounted and undiscounted future cash flows related to SBITAs. Per GASB 96, this disclosure shows principal and interest requirements to maturity, presented separately, for the subscription liability for each of the five subsequent fiscal years and in five-year increments thereafter.

Below is an example of a maturity analysis of the government’s subscription liability:

Future SBITA commitments

Governments must also disclose commitments under SBITAs not yet commenced. This quantitative disclosure presents future cash commitments for SBITAs not yet commenced as of the reporting period that the government is contractually obliged (i.e. a contract has been executed but commences after the reporting period).

Impairment loss

Over a subscription term, circumstances may lead to a change in the government’s manner or duration of use of the underlying asset, and the asset may be impaired. If the government impairs a subscription asset during the reporting period, the components of the impairment loss and any change in the subscription liability must be disclosed.

Exemptions

Short-term SBITA’s: Exempt from capitalization

GASB 96 provides an exemption for short-term SBITAs, defined as a subscription with a maximum possible noncancellable term of 12 months or less, including any options to extend, regardless of their probability of being exercised. Like the treatment of short-term leases under GASB 87, the GASB only requires subscription payments for short-term SBITAs to be recognized as outflows of resources when incurred.

Immaterial SBITA’s: Exempt from capitalization and disclosure

At the end of Statement no. 96 is a comment which reads “The provisions of this Statement need not be applied to immaterial items.” As with GASB 87, GASB 96 does not provide an explicit materiality threshold for governmental entities to apply to their SBITA portfolio, but it does allow for the exemption of immaterial SBITAs. Fortunately, governments making policy elections for GASB 96 can adopt methodology and thresholds similar to their determinations for lease or asset capitalization.

Presentation on financial statements

If we take a step back into the GASB 34 guidance for consolidation into the ACFR, all information disclosed on the statement of net position should be divided into major classes of capital assets, including a separate presentation of GASB 96 totals for subscription assets arising from subscription-based information technology arrangements.

A government’s total subscription asset balance is considered intangible, and presented separately from other intangible assets on the statement of net position. The subscription liability will mirror this as an intangible liability, also on the statement of net position.

If a SBITA is expected to be paid from general government resources, the SBITA should be accounted for and reported on a basis consistent with governmental fund accounting principles. An expenditure and other financing source should be reported in the period the subscription asset is initially recognized. Subsequent governmental fund subscription payments should be accounted for consistently with principles for debt service payments on long-term debt.

Summary

GASB 96 requires new qualitative and quantitative disclosures which did not previously exist for subscription-based information technology arrangements. These disclosures require more detailed information and can be cumbersome to prepare, especially for government entities with a large number of subscription assets.

Using a software solution can facilitate the preparation of the necessary quantitative disclosures and mitigate the risk of material misstatement from the manual manipulation required if using Excel. A system like LeaseQuery can assist with these quantitative disclosures through its software solution.