2. GASB 87 vs. prior GASB guidance: Key differences

3. Key differences: GASB vs. FASB

4. Lessee vs. lessor accounting under GASB 87

5. Example: Accounting for a lease under GASB 87 with Excel

- Step 1: Calculate the initial lease liability

- Step 2: Calculate the initial lease asset value

- Step 3: Record the opening journal entry under GASB 87

- Step 4: Book subsequent journal entry

6. Five more articles to help you get ready for the GASB 87 effective date

7. Transition with ease with cloud-based lease software for GASB 87 built by accountants

What is GASB 87?

GASB 87 is the new lease accounting standard issued by the Governmental Accounting Standards Board, GASB. This new standard supersedes GASB 13 and GASB 62.

The goal of the new lease accounting standard is to:

- More accurately portray lease obligations

- Increase the usefulness of governmental financial statements

This article will walk through the key changes under the lessee accounting model for GASB 87 and provide a comprehensive example of lessee accounting under GASB 87. It will also discuss some basic differences between lessee and lessor accounting.

GASB 87 effective date

The new GASB lease accounting standard for governmental organizations, GASB Statement No. 87, Leases (GASB 87), was proposed during 2017 and released in June of 2017. It was initially effective for reporting periods beginning subsequent to December 15, 2019.

In May 2020, the GASB issued Statement No. 95, Postponement of the Effective Dates of Certain Authoritative Guidance, which delayed the GASB 87 effective date by 18 months. This pronouncement now requires the adoption of GASB 87 for all fiscal years beginning subsequent to June 15, 2021.

However, the requirement to restate all prior periods presented, if practicable, remains. Due to this requirement, organizations should ensure preparedness to comply with GASB 87 for the fiscal year prior to adoption.

GASB 87 vs. prior GASB guidance: Key differences

GASB 87 lease classification

The main differentiator between GASB 87 and the prior GASB guidance relates to lease classification, previously a key component to determining recognition in the financial statements. Under GASB 87, a single model approach exists, meaning a distinction between operating and capital leases no longer exists. GASB 87 now requires all agreements meeting the definition of a lease to be classified as finance leases.

The finance lease classification is a similar designation as the capital lease classification under the current GASB standard, just with a fresh nomenclature. The accounting treatment of a finance lease remains similar to the accounting treatment of a capital lease.

Accordingly, the majority of lease obligations will now be reflected as liabilities and assets on the statement of financial position. Lease payments will have a portion that reduces the lease liability and a portion that flows through the statement of activities as interest expense. A corresponding lease asset will also be recorded in the statement of financial position, which will be amortized over the lease term or the useful life of the underlying asset, whichever is shorter.

What is considered a lease under GASB 87?

With the new standard having such a profound impact on governmental financial statements, it is important to carefully review what exactly is considered a lease when conducting an inventory of leases.

Under GASB 87, a lease is defined as

“a contract that conveys control of the right to use another entity’s nonfinancial asset (the underlying asset) as specified in the contract for a period of time in an exchange or exchange-like transaction.” GASB 87, paragraph 4

The verbiage in this definition must further be dissected in determining what constitutes a lease under the new standard. GASB 87 defines “control” as

“the right to obtain present service capacity and the right to determine the nature and manner of use.” GASB 87, paragraph 5

GASB 87 defines the scope of leased assets as non-financial assets, such as land, buildings, equipment, and vehicles. Certain non-financial asset-based lease agreements are out of scope, such as:

- Leases of intangible assets

- Leases of biological assets

- Inventory leases

- Supply contracts

- Service concession arrangements

- Other certain agreement types, such as assets financed with outstanding conduit debt

Additionally, all short-term leases with a maximum noncancelable term of 12 months or less, regardless of whether all noncancelable terms (e.g., renewals) are expected to be exercised, can be excluded from recognition on the statement of financial position.

These definitions must be considered when assessing what contracts are to be recognized as leases.

Key differences: GASB vs. FASB

While the release of the government lease standard coincides with the other new lease accounting standards issued by the FASB and the IASB, the standards don’t exactly mirror each other.

Many similarities exist between the standards, because the ultimate goal is the same: to be more transparent in reporting lease obligations. The GASB’s approach is consistent with IFRS 16 in that the lessee will classify all leases as financing arrangements. Under ASC 842, a dual lease type approach is still employed, though both types will now be recognized on the balance sheet. There are a number of other key differences across standards.

One of the very specific differences is the effective date for each standard. ASC 842 was effective for public entities for reporting periods beginning after December 15, 2018. Subsequently, the effective date for nonpublic entities is for fiscal years beginning after December 15, 2021, while GASB 87 is required to be adopted for fiscal years beginning after June 15, 2021 (as stated above).

Additionally, the definition of what constitutes a lease differs between standards; this definition is a critical distinction as it determines the impact on financial statements.

In contrast to the definition above for GASB 87, the definition of a lease within ASC 842 is

a contract that “conveys the right to control the use of an identified property, plant, or equipment (an identified asset) for a period of time in exchange for consideration.” FASB ASC 842-10-15-3

As a result of GASB requiring an exchange or exchange-like transaction in contrast to ASC 842 specifying exchange for consideration, instances may occur where a contract is a lease under ASC 842 but not under GASB 87. For example, if an asset is leased significantly below market rate, the contract will be a lease under ASC 842, because consideration was exchanged, regardless of the value. However, the same contract would not be a lease under GASB 87, because GASB requires an exchange-like transaction – exchanging goods and consideration of equal value.

For an entity to claim control under ASC 842 they must demonstrate:

- The right to obtain substantially all of the economic benefits from the use of the identified asset, and

- The right to direct the use of the identified asset. FASB ASC 842-10-15-4

Due to two criteria required under ASC 842 to demonstrate control of the asset, instances may occur where a contract is a lease under GASB 87 but not under ASC 842. For example, if the lessor has substitution rights, the lessor may benefit from the substitution, and as a result the lessee would not have substantially all economic benefits. Therefore, a lease with substitution rights may not be a lease under ASC 842, but would still qualify as a lease under GASB 87.

The factor of whether a transfer of ownership occurs is also relevant. A contract in which ownership is transferred at the end of the lease should be reported as a financed purchase by the lessee or a sale of the asset by the lessor under GASB 87; in other words, the contract does not qualify as a lease. Meanwhile under ASC 842, a transfer of ownership is one of the criteria in the test to determine if a lease is classified as a finance lease and does not exclude a contract from the lease designation.

We have summarized some of the key differences between GASB 87 and ASC 842. To discover more details about how these standards compare to one another, read our article GASB 87 vs ASC 842: Five Differences from a Lessee’s Perspective.

Lessee vs. lessor accounting under GASB 87

Lessor accounting under GASB 87 essentially mirrors the guidance for lessee accounting. While the lessee will record a lease liability and related lease asset, the lessor will record a lease receivable and related deferred inflow of resources.

Both the lease liability and lease receivable are calculated as the present value of the remaining lease payments expected to be paid/received during the lease term. Additionally, both the lease asset and deferred inflow of resources will be equal to the lease liability or lease receivable, respectively, with a few adjustments for other items that must be reflected in those balances, such as prepaid or deferred rent. Read our blog on GASB 87 lessor accounting with a full example.

Example: Accounting for a lease under GASB 87 with Excel

In this detailed example, we will walk through the appropriate accounting for a lease as a lessee in accordance with GASB 87 using full accrual accounting. However, if your organization’s leases are recorded within a governmental fund, the modified accrual basis of accounting is used and a conversion entry will be necessary at year-end to create consolidated government-wide financials.

Note: This example will continue to utilize an adoption date in 2020, in support of early adoption advised by the GASB.

Here are the lease example details:

- Inception Date: July 1, 2020

- Payment due at Inception: $833

- Possession Date: January 1, 2021

- Lease Term: 10 years

- Payments (paid in arrears): $10,000/year

- Annual Escalation: 3%

- Discount Rate: 6.5%

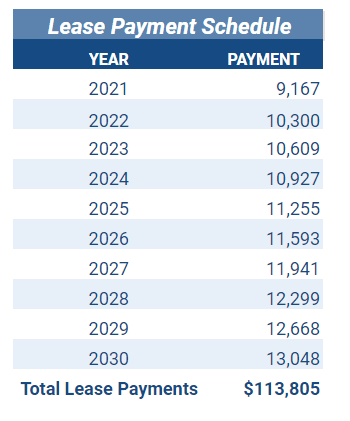

See below for the full lease payments schedule. All payments noted below are paid in arrears. Note that the total payments for 2021 are $9,167 because a prepayment of $833 was required on the lease inception date, July 1, 2020.

Step 1: Calculate the initial lease liabilty

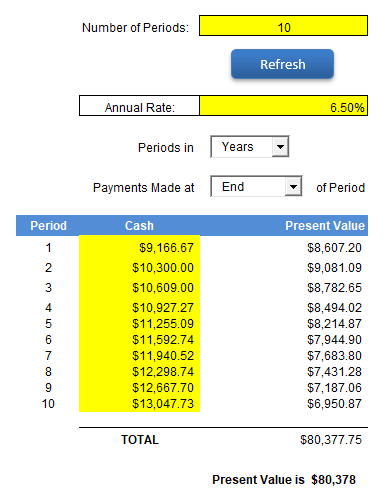

The lease liability is calculated as the present value of remaining future lease payments during the lease term.

The lessee accounts for the lease when the organization takes possession of the asset, which represents the date at which the organization has the noncancelable right to use the asset.

The lessee accounts for the lease when the organization takes possession of the asset, which represents the date at which the organization has the noncancelable right to use the asset.

In this example, the possession date (and the resulting lease commencement date) is January 1, 2021. Therefore the lessee will only include lease payments to be made on or after the commencement date in the lease liability calculation. The payment made at lease inception (i.e. July 1, 2020) is not included in the lease liability calculation, but instead is accounted for as a prepayment. The total payments for 2021 are $9,167 because the prepayment made on the lease inception date is relieved at lease commencement.

The discount rate utilized, per GASB 87, should be the interest rate implicit within the lease. If the implicit rate is not readily determined by the lessee, which occurs in most scenarios, the lessee should use the estimated incremental borrowing rate. The incremental borrowing rate is an estimate of the interest rate that would be charged for borrowing the lease payment amounts during the lease term.

Using the annual discount rate of 6.5%, the present value of future lease payments (calculated using LeaseQuery’s Present Value Calculator) is $80,378.

Step 2: Calculate the initial lease asset value

The lease asset value begins with the amount calculated as the lease liability. In addition to the present value of future lease payments, the asset value includes prepaid lease payments, less any lease incentives received from the lessor prior to the commencement of the lease term.

Based on this information, the lease asset will initially begin at the same value as the lease liability: $80,378. Next, the lessee will add the amount prepaid at inception to the liability value to calculate the full lease asset value. Thus, the initial lease asset value is calculated as $80,378 + 833 = $81,211.

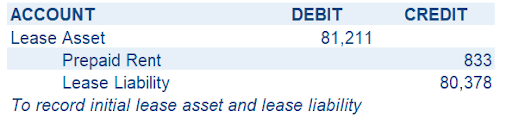

Step 3: Record the opening journal entry under GASB 87

The initial journal entry under GASB 87 will establish the asset and liability on the statement of financial position and relieve the prepayment from the lease inception. Below we present the entry to record the lease as of 1/1/2021.

Step 4: Book subsequent journal entry

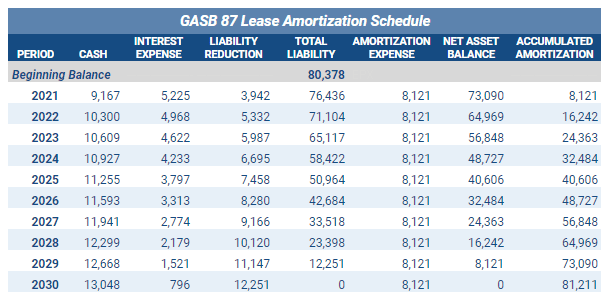

The lease asset should be amortized, reported as an outflow of resources, in a “systematic and rational manner” over the lesser of the lease term or useful life of the underlying asset. The Board notes this amortization expense represents an outflow synonymous to amortization expense; thus, we will refer to the finance leased asset amortization expense as depreciation expense.

Subsequent entries will also decrease the lease liability and record interest expense. Periodic interest expense is calculated similarly as interest expense has always been calculated for a capital lease – utilizing an interest rate (i.e., the discount rate used to measure the initial lease liability balance) multiplied by the ending liability balance of the prior period to determine the expense. The lessee will record interest expense and amortize the lease liability as the difference between the cash payment and the calculated interest expense.

See below for the lease amortization table for this lease asset and lease liability and an example of a subsequent entry:

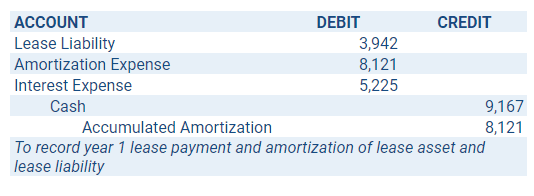

Utilizing the amounts established in the lease amortization table above, the journal entry for the activity in the first period is as follows:

Utilizing the amounts established in the lease amortization table above, the journal entry for the activity in the first period is as follows:

The lessee would continue to record subsequent journal entries using the approach above until the end of the lease term.

The lessee would continue to record subsequent journal entries using the approach above until the end of the lease term.

Five more articles to help you get ready for the GASB 87 effective date

We’ve compiled GASB 87 articles and resources below to help you get up to speed and keep up with the latest developments. Here are the top five articles and resources to help you transition to the new standard:

1) GASB Lease Accounting Transition Examples – LeaseQuery

In this article, we provide two full examples for lessees demonstrating how to transition from the legacy GASB guidance to statement number 87.

2) GASB Summary of Statement No. 87 – GASB.org

The GASB summary covers the main points of the new guidance for those who are new to learning the new standard. This overview is good for anyone who will be impacted by the new rules but won’t be involved in the day-to-day work of implementing them.

3) Lessor Accounting Example under GASB 87 – LeaseQuery

Read a full example of lessor accounting under the new governmental standard.

4) Identifying Embedded Leases under GASB 87 and ASC 842 – LeaseQuery

Learn how to identify leases that may be embedded in contracts.

5) Implementation Guides issued by GASB – LeaseQuery

Read both implementation guides issued by GASB for detailed answers to specific application questions: Implementation Guide No. 2019-3 Leases and Implementation Guide No. 2021-1 Implementation Guidance Update–2021.

Transition with ease with cloud-based lease software for GASB 87 built by accountants

LeaseQuery is dedicated to providing the best-available software for GASB 87 and GASB 96. Schedule a demo with us today and see how the system will ensure your compliance with the new standards.

Please remember to refer back to our blog frequently for important updates and changes to governmental accounting, including more guidance and insights on GASB 87 and GASB 96.