ASC 842, in continuity with the legacy FASB lease accounting standard, ASC 840, continues to require lessees to evaluate leases for appropriate classification between operating and capital (designated as “finance” under ASC 842).

In practice, equipment leases, which can encompass vehicles, forklifts, copiers, and other various types of equipment may more often meet the criteria of a finance lease. This article will cover common examples of equipment leases, including how such assets may commonly qualify as a capital/finance lease. Additionally, the article will cover the appropriate accounting for leased vehicles under a capital/finance lease, as well as an analysis on how to evaluate for leasing vs. buying equipment.

Capital/finance lease criteria

Capital and finance leases have commonalities to an owned or purchased asset, and the accounting requirements reflect this. Throughout the lease term, lessees will recognize interest and amortization on the income statement.

As mentioned previously, equipment and vehicle leases may often qualify as capital or finance leases, for a few reasons. See below for common examples.

Example scenarios of capital/finance leased equipment

An agreement automatically transferring ownership of the underlying equipment to the lessee at lease expiration essentially resembles a delayed purchase, thus qualifying the lease for the capital/finance designation.

Oftentimes, vehicle or warehouse equipment contracts may include a dollar purchase option to incentivize the initial agreement, all but guaranteeing the transfer of ownership at conclusion of the term. Once again, this transaction more closely resembles a delayed purchase, rather than a true borrowing.

Leases for items such as technology equipment, may not provide long-term value, so any lease term covering a majority of the asset’s useful life may also more closely resemble a purchase, which would qualify as a capital/finance arrangement.

Refurbished equipment may also experience a decrease in respective value, thus requiring a lessee to pay nearly the full value of the asset in lease payments. This may signal a likely qualification for the capital/finance designation.

Lastly, any highly specialized equipment with no additional value to the lessor after its initial lease term may also meet the finance/capital lease accounting criteria.

Below, we’ll follow a detailed example of how to appropriately account for a vehicle lease classified as a capital/finance lease.

Example: Equipment lease under ASC 842

For this example, let’s assume the lessee leases a delivery truck to utilize for logistical purposes. Due to the lessor’s recent inventory surplus, the contract includes an option for the lessee to purchase the asset for $500 at the end of the initial term. The remaining details are below:

- Commencement/delivery date: January 1, 2022

- Lease end date: December 31, 2024

- Payment terms: $650 per month, paid in advance

- Lessee’s incremental borrowing rate: 2.85%

- Delivery truck’s useful life: 84 months

Opening calculation

Based on the $500 discounted purchase option, the lessee will plan, beyond a reasonable doubt, to purchase the asset at the end of the initial lease term. This decision will qualify the transaction as a strong-form finance lease under ASC 842.

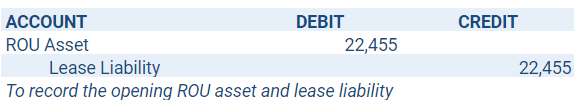

Using LeaseQuery’s free present value tool, the lease liability value on the commencement date (January 1, 2022) is $22,455, equal to the present value of the lease payments. Considering this transaction does not include any rent prepayments, lease incentives, or initial direct costs, the opening ROU asset will equal the liability at $22,455.

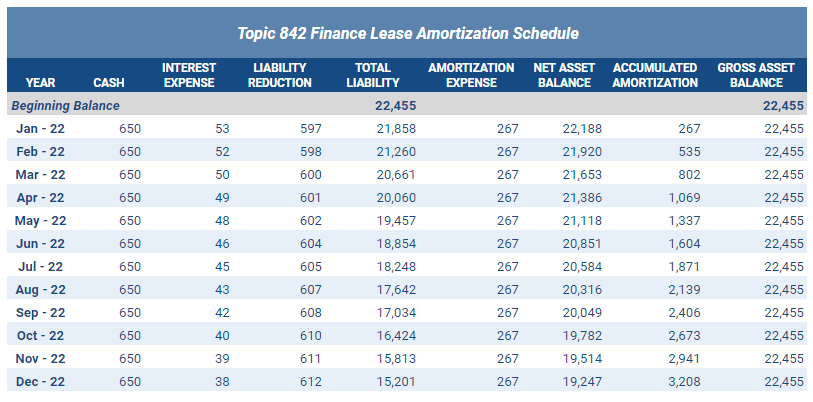

Amortization schedule

The lessee will calculate interest periodically over the term of the lease using the noted discount rate of 2.85%. The interest amount will decrease over time as the liability balance decreases.

Because we identified this finance lease as strong-form (due to the assumed purchase), the lessee should depreciate the asset over its useful life, given the asset’s expected life exceeds the term of the lease agreement.

Below provides a look at the initial year’s amortization of both the lease liability and ROU Asset.

Journal entries

The initial journal entry, recorded on the date of commencement, will appear as the following:

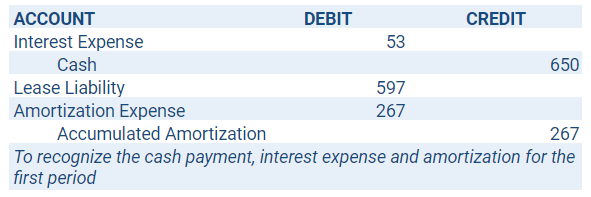

The second entry, at the end of the initial month, will include the recognition of both interest expense and amortization expense.

Leasing vs. buying equipment

Analyzing whether to purchase or lease equipment does not always end with a clear decision. Below, we’ll cover the benefits and potential pitfalls of each option, as well as how the decision may impact the bottom line.

Benefits of leasing

Organizations that choose to lease more frequently will often benefit from enhanced liquidity. Most lease agreements require payment throughout the term of the agreement, rather than a lump sum up front. The more delayed one’s payment requirements are, the smaller the true present value obligation.

Additionally, lessees who rent equipment or vehicles may often obtain the sought-after benefits of ownership without actually assuming the explicit ownership risk. For example, vendors often provide services for maintenance when leasing out equipment, which can make life easier for the lessee when assets need repairs.

Benefits of buying

Beyond simply removing the need to renegotiate at the end of the initial lease term, one can view the purchase of fixed assets as a long-term investment, depending on the asset. If one believes the useful life of an electric delivery truck may significantly surpass the perceived current value, paying the market rate up front may make for a better decision, given that lease agreements for similar assets may include escalations to mirror the fair value over time.

Additional key areas to consider

- Budget – Can the business afford to spend more up front, given the current economic status of the business?

- Expected use – Will the assets need significant specialization for your business? If so, you may want to avoid having to negotiate the improvement allowance with a vendor and simply make the improvements at your own choosing.

Financial statement impact

Now that ASC 842 requires all long-term leases to have representation on the balance sheet, negotiating an operating lease does not remove the balance sheet impact. The main driver in evaluating the impact of the lease vs. buy decision simply involves the estimation of total income statement impact during term of use.

For both finance leases and owned assets, you’ll recognize amortization/depreciation throughout use of the asset. For owned assets, one would almost certainly need to consider additional necessary expenditures, such as property tax, insurance coverage, and routine maintenance expenses. Lessees may often have to reimburse vendors for such expenses; however, understanding the structure of a lease agreement from that perspective may assist in the lease vs. buy decision. Ultimately, if the expected interest expense over time outweighs the expected outlay for ownership, that may lead an organization to choose purchasing over leasing.

Summary

As noted above, capital/finance leases for equipment will continue to recognize interest expense and amortization expense during the term of the agreement. Certain qualitative and quantitative characteristics of an agreement may lead to qualifying for the capital/finance designation. Businesses should not only continue to evaluate whether their agreements are classified as operating or finance type leases but should also evaluate whether, ultimately, the best investment would be to obtain outright ownership.