Organizations may still have ongoing questions about the new lease accounting standards, despite the various adoption deadlines passing over the last several years, mainly due to the complexity of the new rules. Each standard has its own set of challenges, but one aspect of all of the guidelines is especially challenging — the identification of embedded leases.

What is an embedded lease?

An embedded lease is a lease agreement existing within a contract. A lease is defined as a contract that conveys the right to control an identified asset for a period of time in exchange for consideration. Because the lease is embedded in another contract, it is fairly common for these arrangements to historically not have been accounted for as leases, especially if the management of the contract has been handled within a department versus reviewed by accounting. Properly identifying embedded lease agreements can be like a scavenger hunt, and many organizations fail to recognize service contracts often contain embedded leases.

Unfortunately, it’s not as simple as doing a “CTRL+F” search on all of your contracts for the words “lease” or “rent.”

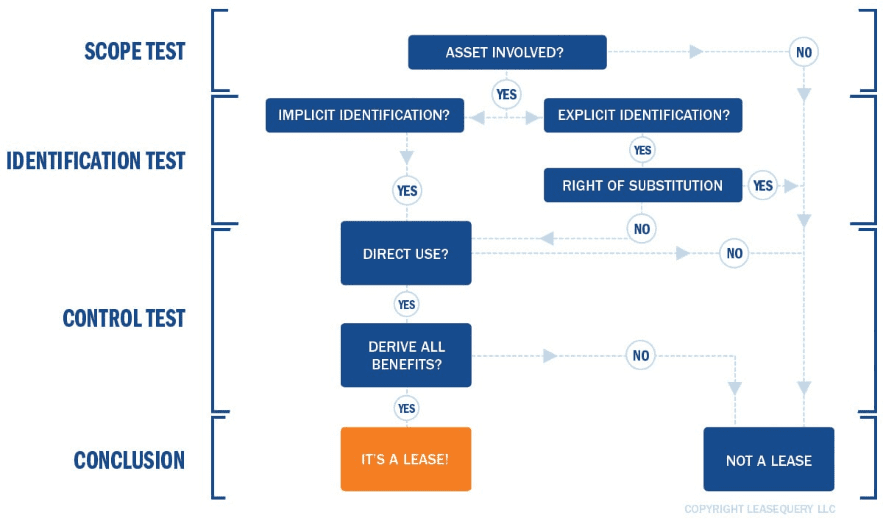

A contract contains a lease when the following two criteria are met:

- A specific asset is identified, and

- Control of the identified asset is transferred to the lessee.

These two requirements are explained in more detail in the following section.

How to identify embedded leases

Organizations that typically have service contracts often have embedded leases. In today’s environment, this means most companies or organizations are impacted.

Requirement 1: A specified asset is identified

To identify an embedded lease, the first step is to determine if an asset is identified within the contract. An asset is deemed to be identified in a contract if the contract specifically describes or defines the physical asset to be used in performing the service, whether explicitly or implicitly.

Explicit identification occurs when the underlying asset is identified in the service contract. For instance, a transportation service contract may require the supplier of the service to use Truck # 3340 to deliver the customer’s goods.

On the other hand, an asset is implicitly identified when the only way the supplier can satisfy their obligations under the contract is to utilize a specific asset. For instance, using the example above, a transportation service contract may require the supplier of the service to move the customer’s goods using a refrigerated truck, however, the supplier has only one truck meeting those specifications. To satisfy its obligations under the contract, the supplier must use that truck. As a result, the truck is implicitly identified.

Please note, however, if the vendor has the “right of substitution,” that is if the vendor can substitute the truck with another one without the lessee’s consent or approval, then the truck is not really identified. Put another way, if the vendor has the ability and the right to provide the required services by using an alternative asset other than that which was specifically described in the contract, you do not have a lease.

Also note contract terms that allow or require a supplier to substitute other assets only when the underlying asset is not operating properly (e.g., a normal warranty provision) or when a technical upgrade becomes available would not create a right of substitution.

In contrast, GASB 87 allows for substitution of an asset and the contract will remain a lease. Within GASB 87, the right to control the asset relates to the service capacity of the underlying asset, and therefore substitution of an identical asset maintains the lease arrangement. In opposition, ASC 842 and IFRS 16 require more analysis to determine the impact of substitution rights on the definition of the lease. If the contract grants the supplier the right to substitute one asset for another, it is practical for the supplier to substitute and the supplier would benefit economically from doing so, then the substantive substitution right means a lease does not exist.

After an organization has determined a contract contains an identified asset, the organization must then determine if control of the identified asset will be transferred to the lessee.

Requirement 2: Control of the identified asset is transferred to the lessee

Control of an identified asset has been passed to the lessee when they can:

- Direct the use of the identified asset and

- Derive the benefits from the use of the identified asset.

Examine these requirements individually, starting with:

- Directing use: At the risk of oversimplifying this concept, the easiest way to think of this is if the lessee can determine “who, what, when, how, and where” as it relates to the asset. The lessee can direct

- Who operates the asset,

- What the asset is used for,

- When the asset is used,

- How the asset is operated, and

- Where the asset is utilized.

- Derive substantially all of the benefits from the use of the asset: The lessee should obtain substantially all of the potential economic benefits from using the asset during the contract term. The lessee can obtain economic benefits directly or indirectly through the asset’s primary outputs (i.e., goods or services) and by-products (e.g., renewable energy credits).

Bringing back the truck example from earlier, if during the term of the agreement, the truck is used to transport only the lessee’s goods, then it is fair to say they are getting almost all the benefits from the use of the truck.

Specifically for governmental entities, when evaluating if there is a lease, consider that GASB 87 indicates lease agreements can have interruptions in usage. An organization only has to obtain the present service capacity during the period of use, not uninterrupted control of the asset.

For example, if your organization rented a piece of equipment for two days a week, with another organization renting it for the other five, under GAAP, it is not a lease because you are only obtaining 40% of the lease’s service capacity. Under GASB, however, the lessee can have a lease component in which they only utilize the assets for certain portions of a time. This arrangement represents a lease of the equipment for two days a week over the term of the arrangement.

The following flowchart visually represents the steps to identify a lease:

How the new guidelines impact embedded leases

Under legacy lease accounting guidance, service contracts containing embedded leases were often treated the same as service contracts without an embedded lease. This is because often a P&L impact difference did not exist, so companies did not identify and separately account for service contracts and operating leases.

To avoid material misstatements under the new lease accounting rules, organizations need to identify whether service contracts contain a lease. If so, they must bifurcate the contract into lease and non-lease components. This could have a significant impact on the balance sheet now that organizations are required to capture an ROU asset and corresponding lease liability. The organization would then recognize the lease component of the embedded lease.

Where can you find embedded leases?

Reach out to the supply chain, procurement, and IT departments to get an understanding of their service contracts to determine if these agreements contain embedded leases. To validate the completeness of this inventory, partner with the accounts payable function and obtain a listing of all the payments being made on service contracts to determine if any additional contracts should be evaluated.

Logistics, transportation, warehousing, and data center service contracts are among the most common places to find embedded leases. For banks, ATM service contracts could be another source of embedded leases. Since those contracts often don’t contain the word “lease,” look for language that says “exclusive use,” “solely,” “Identification Number,” etc.

Summary

After the initial implementation of the new lease accounting standard, it is important to continue to properly identify embedded leases as they come in, or risk potentially missing new lease liabilities and falling out of compliance. Any new contracts should be evaluated to determine if a lease exists, and as a best practice, organizations should either develop their own questionnaire or should try out using LeaseQuery’s Embedded Lease Test, a tool that simplifies this decision-making process. It walks you through step-by-step to help you determine whether your contract contains an embedded lease.