Deferred rent is one of the most commonly discussed items regarding the transition to ASC 842. This article discusses the accounting treatment for deferred rent and how the changes in the lease guidance may impact the treatment of deferred rent as an organization transitions to the new lease accounting rules.

Note: Read this article to learn more about negotiating rent deferment with your landlord.

What is deferred rent?

Deferred rent is a liability resulting from the difference between actual cash paid and the straight-line expense recorded on the lessee’s financial statements for an operating lease. This was an account specifically used under ASC 840 lease accounting. Under ASC 840, total rent expense is required to be recognized on a straight-line basis over the lease term even if rent payments vary.

The lessee records rent expense on a straight-line basis and captures any difference between the cash paid and the expense recognized by debiting and crediting deferred rent. Most often, deferred rent is a liability that increases over the first part of the lease term as payments start low and gradually increase. It then decreases to zero by the end of the lease term.

At the end of the lease, the total cash paid and the total expense recognized will be the same, and therefore the cumulative balance in the deferred rent account for each individual lease will always equal zero.

Deferred rent examples under ASC 840 and ASC 842

Example #1: Deferred rent under ASC 840

Assume that a lessee leases a building from a lessor, and the lease is classified as an operating lease. Other facts related to the lease are as follows:

- The lease term is 10 years.

- Rent payments are $100,000 in the first year, escalating by 3% per year.

- Payments are made in arrears.

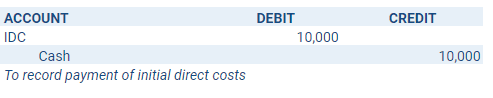

- The lessee incurred $10,000 of IDC related to the lease.

- Lessee has a tax rate of 30%.

- The lease is a true tax lease for income tax purposes and that rent is deductible as paid for tax purposes.

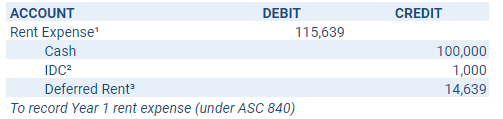

Deferred rent journal entries for year 1

Note 1: Total lease payments of $1,146,388 + $10,000 initial direct costs divided by 10 years.

Note 2: $10,000 IDC divided by 10 years.

Note 3: The deferred rent in this example is calculated as the straight-line expense less the cash paid each year. (Deferred rent in year 1 equals rent expense of $115,639 less cash paid of $100,000 for the first year’s rent).

Example #2: Deferred rent under ASC 842 with ROU assets and lease liabilities

ASC 842 requires the recognition of total rent expense on a straight-line basis over the lease term for leases classified as operating. Generally, accounting for the same lease under ASC 840 (before a company transitions to ASC 842) and then under ASC 842 (after a company’s transition) will have no impact on a company’s net income. As illustrated below the straight-line lease expense recognized under ASC 842 is the same as the straight-line rent expense recognized under ASC 840 for a lease with the same terms.

What changes upon transition to ASC 842 is the requirement that lessees record operating leases on the balance sheet. As a result, lease liabilities, which represent the present value of the lessee’s future obligations, and right-of-use (ROU) assets, which represent the lessee’s rights to use the underlying assets, are recorded at lease commencement.

Although the deferred rent account used under ASC 840 is eliminated under ASC 842, the difference between the straight-line rent expense and the cash paid is still reflected on a company’s books. Under ASC 842, the net activity in the lease liability and ROU asset accounts each month is essentially deferred rent.

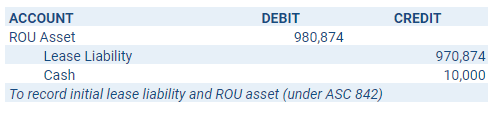

Following is a full example of operating lease accounting for a lessee under ASC 842. Assume the same facts used in the example above, but the lessee has adopted ASC 842. In this example, we will also assume that the lease agreement has met the criteria for an operating lease. The entity has determined that the discount rate at lease commencement for this lease is 3%. The lease liability at lease commencement is the present value of the lease payments ($970,874) and the ROU asset is calculated as the lease liability plus the $10,000 of IDC ($980,874).

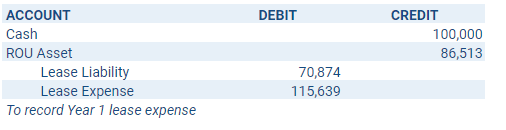

Deferred rent journal entries under ASC 842 for year 1

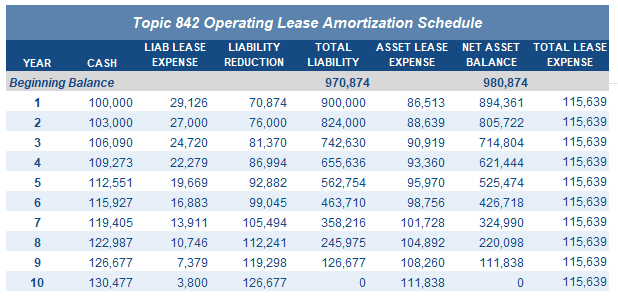

Using the facts presented in this example, the amortization table below is for the entire term of the lease:

The entry the lessee makes at the beginning of the lease agreement under ASC 842 is to record the initial ROU asset and lease liability. Along with recognizing the asset and liability, the lessee also pays $10,000 of IDC which is recorded as an increase to the ROU asset.

The total lease expense of $115,639 is recognized at the end of the first year. Total lease expense is the sum of the liability lease expense of $29,126 and asset lease expense of $86,513. The credit side of the entry at the end of the first year will include the cash paid for the first year of $100,000.

Deferred rent under ASC 840 vs. ASC 842

Looking back to the amortization table at the beginning of this section, it is apparent that deferred rent is not being separately calculated and identified as it was under ASC 840. The deferred rent account no longer exists under ASC 842, but the accounting for the difference between cash paid and straight-line expense continues to be recognized each period in the financial statements.

Observing the activity in the lease liability and ROU asset columns, we are still accounting for the difference between the recognized expense and cash paid on the balance sheet. The difference between the year one lease liability reduction ($70,874) and the ROU asset reduction ($86,513) is $15,639:

$70,874 – $86,513 = ($15,639)

Further, the balance sheet variance ($15,639) less the amortization of IDC costs ($10,000/10) equals the amount we recorded to deferred rent under ASC 840:

$15,639 – $1,000 = $14,639

Additionally, total lease expense in year one is the same as year one rent expense for an operating lease under ASC 840, as the total cash payments required over the lease plus the cash paid for initial direct costs recognized in expense on a straight-line basis over the term of the lease:

($1,146,388 + $10,000) / 10 years = $115,639 per year

Under both accounting standards, we are recording a cash payment of $100,000 and total lease expense of $115,639. Under ASC 842 periodic lease expense is made up of the periodic interest and asset depreciation shown in columns “liability lease expense” and “asset lease expense,” respectively. The periodic cash payment is now being applied to reduce both the accrued interest and the balance of the lease liability as we amortize the present value of the remaining lease payments over the term of the lease.

Treatment of deferred rent during transition to ASC 842

The comparison of the treatment of deferred rent under each lease accounting standard may trigger the question – if deferred rent does not exist under ASC 842, what happens to the accumulated balance of deferred rent for an operating lease during the transition from ASC 840 to ASC 842?

The new lease accounting guidance explicitly states that following the commencement of an operating lease, the ROU asset will be adjusted for several items, including any prepaid or accrued lease payments. Deferred rent, depending on whether it is a cumulative positive or negative amount, is either accrued rent or prepaid rent.

Deferred rent is most often a liability, or negative balance, representing accrued rent expense – the total rent expense recognized is more than all of the cash payments made through that specific point in time. The excess expense recorded over the total cash paid has been accrued or deferred until the cash payments are larger than the expense recognized and the accumulated liability is depleted to zero.

At transition, the accumulated deferred rent, or accrued rent, for an operating lease is an adjustment to the ROU asset related to the lease. The journal entry to record for transition is a debit (or credit) to the deferred rent account for the total amount of deferred rent related to the operating lease and a credit (or debit) to the ROU asset established for the same operating lease. With this journal entry, the accumulated deferred rent is removed from a standalone account to become part of the new ROU asset.

Summary

Deferred rent is a liability created when the cash payments and straight-line rent expense for an operating lease under ASC 840 do not equal one another. The transition to ASC 842 will result in the elimination of the deferred rent account from the balance sheet, but will generally not impact net income. Under ASC 842 any differences between expense recognized and cash paid are recognized in the lease liability, ROU asset, and rent expense.