ASC 842, Leases, is a comprehensive change from previous guidance that requires both finance and operating leases to be recognized on the balance sheet, where only finance (historically called capital leases) were recorded previously. In conjunction with the change of accounting treatment, the guidance also includes expanded disclosure requirements for all leases.

A focus on quantitative disclosures for lessees

In this article, we’ll provide an overview of the new disclosures and also discuss the necessary supporting data that will need to be accumulated for your company’s annual disclosures.

The disclosure requirements for lessees include both qualitative and quantitative elements specifically:

- Discussion on the lease arrangements

- A description of significant judgments made in applying ASC 842 to the lease population

- Information about the operating and finance lease amounts recognized in the financial statements

Following is a discussion on the expanded quantitative disclosures.

Why software makes generating disclosures more accurate and efficient

Without assistance from a software provider, accumulating the supporting data for the quantitative lease disclosures can be a time consuming task. After compiling the necessary data and performing the required calculations, the company then has to validate the accuracy of the spreadsheet calculations for its internal control requirements and its auditors. Additionally, these calculations need to be updated on an ongoing basis for any modifications, lease additions, or terminations during each subsequent period. LeaseQuery’s reporting studio includes an ASC 842 Complete Disclosures Report that can be generated for the entire organization. This allows a company to quickly aggregate the data to complete its lease footnote in accordance with ASC 842. The guidance does not require a specific format of these disclosures. However, the examples within ASC 842 present the information in a tabular format. LeaseQuery has established its reporting in a similar tabular format.

This gif demonstrates how to easily run the complete listing of disclosures required under ASC 842 in LeaseQuery. The full report can be exported to Excel, allowing users to quickly copy/paste the quantitative data in a company’s footnotes.

Looking at quantitative disclosures in four “buckets”

The quantitative disclosures required under ASC 842 can be considered in four buckets – Lease Costs, Other Information, Weighted Averages, and Maturity Analysis.

Lease costs

Lease costs are the total costs attributable to entering into a lease agreement – otherwise known as the expense. This is the sum of the fixed and variable considerations within a lease contract. ASC 842 requires separate disclosures of operating and finance lease expense, and also disclosure of lease expense for companies that have elected the practical expedient to treat short-term leases similar to ASC 840 accounting requirements.

To the extent that a company’s lease agreements include variable lease expense, the annual cost should be disclosed. And, if a company has entered into any sub-lease arrangements, the income on these arrangements should be disclosed. The net of these transactions results in annual consolidated lease cost.

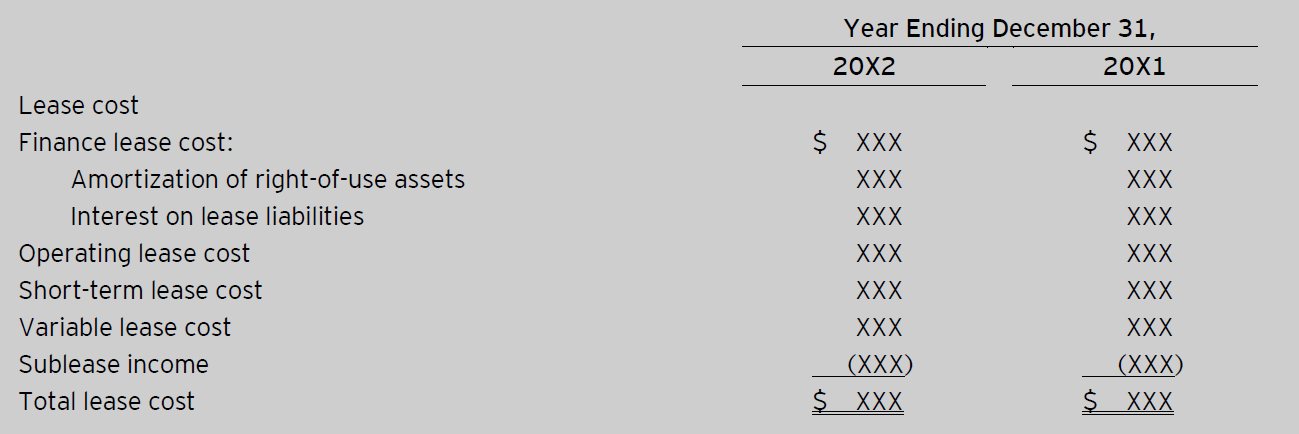

ASC 842 includes an example to illustrate the full quantitative disclosure requirements.

This is an excerpt of the portion related to lease cost:

The Complete Disclosure Report generated by LeaseQuery (in the gif above) can be exported into Excel and used as the basis for these quantitative disclosures.

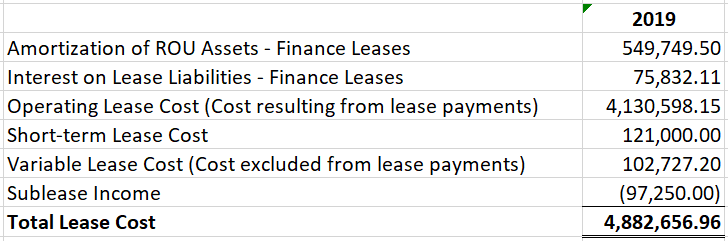

See below for the excerpt related to lease cost:

In our experience, most companies will elect the practical expedient to not disclose comparative information within its financial statements and will instead adopt ASC 842 on the transition date. However, if a company chooses to present comparative information, this is configured during the company’s set-up of LeaseQuery. These reports generate the required comparative financial information upon transition.

In addition to summary company level information, LeaseQuery software provides the ability to drill down within each disclosure calculation. For example, summary information at any level of the entity’s organization (i.e. business unit, or region results) could be reviewed, along with the data at the individual lease level. This allows users to perform the necessary reconciliations of the balances disclosed in the financials.

The gif below demonstrates how additional details can be viewed for the Amortization of ROU Assets – Finance Leases. For example, the $549,749.50 presented on the Complete Disclosure Report agrees to the total balance in the Amortization of ROU Assets – Finance Lease detail.

Other information

Other information disclosures required by ASC 842 include cash flow and supplemental non-cash information related to lease liabilities. This information is included to facilitate an investor’s understanding of the cash flows and operations of the business. Additionally, ASC 842 requires a lessee to disclose cash paid for amounts included in the measurement of lease liabilities, segregated between operating and financing cash flows. This translates into a requirement to disclose the operating cash flows for all finance and operating leases, as well as the financing cash flows for finance leases.

For each operating lease, lessees will disclose operating cash flows as the sum of the liability reduction recognized over the 12-month period—which is the difference between the cash the lessee pays and the expense recognized. For each finance lease, lessees will disclose financing cash flows as the sum of the liability reduction booked over the 12 month period. The lease expense recognized during the reporting period for the finance lease will also be disclosed as the financing cash flows from finance leases.

LeaseQuery makes the compilation process for these disclosures simple by accumulating the applicable amounts for all leases within the portfolio and summarizing this information in the disclosure report.

ASC 842 requires a lessee to also disclose supplemental non-cash information about finance and operating lease liabilities arising from obtaining right-of-use (ROU) assets. The Complete Disclosure Report in LeaseQuery will summarize noncash changes to ROU assets and lease liabilities to facilitate a company’s disclosures.

To the extent that a company has entered into sale leaseback transactions, the gain/loss from this transaction must be calculated by the company and presented in the lease footnote.

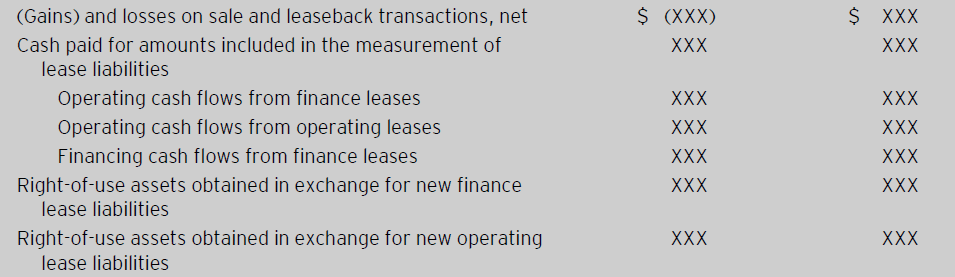

This is an excerpt from the guidance:

This is a screenshot of the Complete Disclosure Report extracted from LeaseQuery:

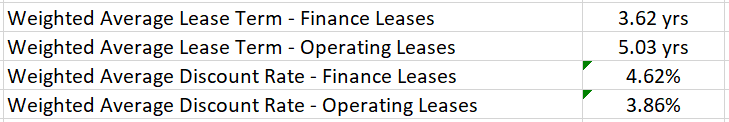

Weighted averages

Weighted averages may be the most difficult and confusing disclosure to capture under the new lease accounting standard. As such, companies will find it very helpful to choose a reliable software provider that can calculate the disclosure accurately and efficiently. The provider must also understand the accounting behind the calculations driving the disclosures, should assistance be needed.

ASC 842 indicates that a lessee should calculate the weighted-average remaining lease term for both operating and finance leases based on the remaining lease term and the lease liability balance for each lease as of the reporting date.

A lessee will need to follow these three steps to calculate this disclosure:

- Collect the lease liability balance and the remaining lease term for each lease at year-end.

- Multiply each lease liability balance by the corresponding remaining lease term.

- This amount is then divided by the sum of the lease liability at year-end to arrive at the weighted-average remaining lease term for both operating and finance leases, respectively.

ASC 842 requires the lessee to calculate the weighted-average discount rate based on the discount rate used to calculate the lease liability balance and the remaining balance of the lease payments for each lease as of the reporting date.

A lessee will need to follow these two steps to calculate this disclosure:

- On a lease-by-lease basis, multiply the remaining payments by the discount rate.

- This amount is divided by the sum of remaining payments for the operating or finance leases, resulting in the weighted-average discount rate for each type of lease.

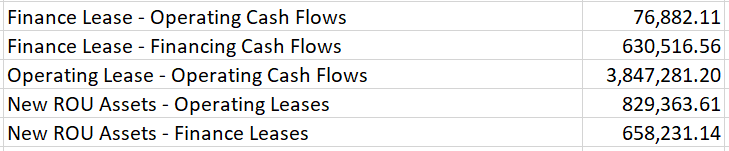

This is an excerpt from the guidance:

This is a screenshot of the Complete Disclosure Report extracted from LeaseQuery:

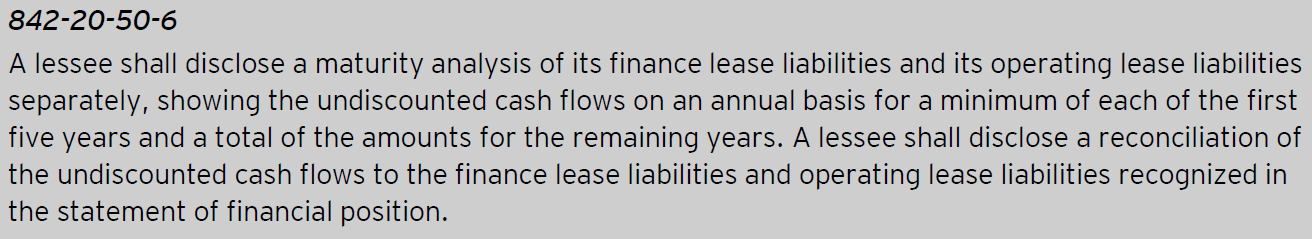

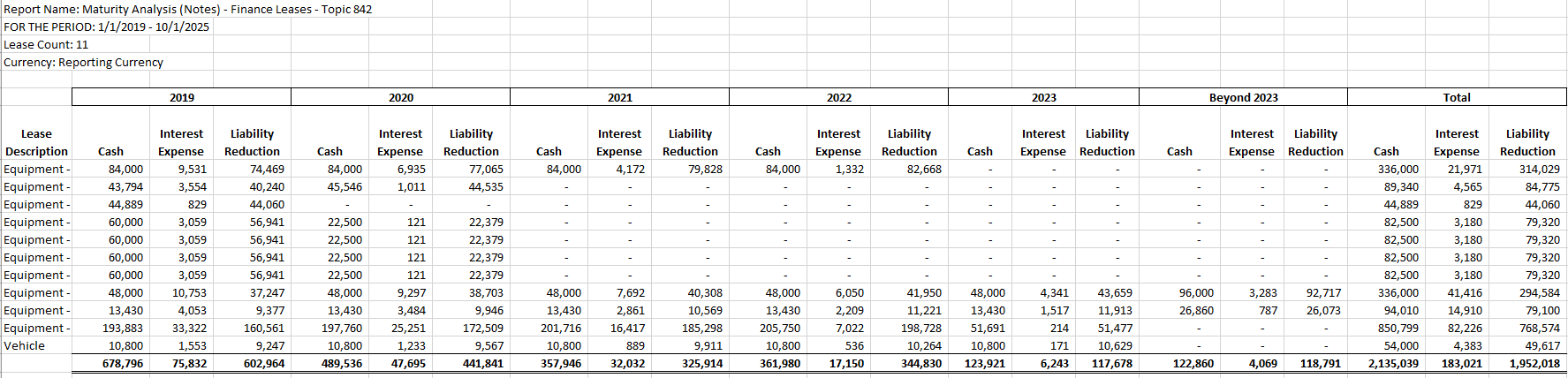

Maturity analysis

The maturity analysis requirement is an annual projection of the undiscounted cash flows over a five-year period and all remaining years after that for both operating and finance leases.

This is an excerpt from the ASC 842 guidance on the requirements for the maturity analysis disclosure:

LeaseQuery summarizes the maturity analysis information to facilitate disclosure. Here is an example of the maturity analysis of finance leases within a lease population:

Wrap-up

Using the appropriate software provider will facilitate the preparation of a company’s lease disclosures and ensure the accuracy of the information disclosed. This will allow the company to focus its efforts on the qualitative requirements of the disclosure: descriptions of its leases, features of lease arrangements such as variable lease payments, and residual value guarantees, and its accounting policies with regards to discount rates, lease and non-lease elements, and short-term leases.