For a simple operating lease, calculating the straight-line rent expense involves summing the total cash payments and dividing the total payments by the number of months within the lease term. However, calculating the straight-line rent expense for a more complex operating lease can be challenging as there are several factors to consider, such as:

- What if the payments escalate throughout the lease term?

- What if complete access or rights to the underlying asset is not granted at the beginning of the lease term?

- What if a period of free rent is granted?

In our experience of talking to both small and large companies, understanding and remembering the timing of rent escalations and abatements can be difficult. These scenarios not only impact the rent expense, but will also affect the lease liability and ROU asset that must be recognized on the balance sheet under ASC 842. This article will explain how to properly account for rent abatement and periods of free rent under both ASC 840 and ASC 842.

What is rent abatement?

In a commercial lease agreement, rent abatement is a time period in which the tenant/lessee is not required to make rental payments or is granted reduced rental payments. Rent abatement can occur for a number of reasons, for example, a tenant may be granted early access to the leased asset without making additional rent payments. Rent abatement could also be granted during periods of construction to the underlying asset. We have read lease agreements that specify a rent holiday where the tenant is relieved of payment for a specific month (i.e. anniversary of lease commencement). Landlords may provide these types of rent abatements as lease incentives meant to induce the tenant to sign the contract.

Historically, these periods of free rent or rent reductions are offered during the normal course of business. We will walk through a comprehensive example of certain rent abatements in the normal course of business to understand the accounting treatment and the financial statement impact under both ASC 840 and ASC 842. However, if you have rent concessions as a result of COVID-19, you may be eligible for specific accounting relief options afforded by the FASB.

Accounting for rent abatement and rent-free periods under ASC 840 and ASC 842 example

Assume a tenant and landlord agree to the following lease terms:

Lease Commencement: July 1, 2020

Lease Term: 2 years

Property: 100,000 square feet (sq. ft.)

Payments: $200,000 per month

Escalation: 3% annually

Incremental Borrowing Rate: 2%

Significant improvements are required to get the property ready for the tenant’s use, so the landlord allows the tenant to use only 10,000 sq. ft. starting April 1, 2020. Because the space is in the same building, each square foot in the first 10,000 occupied is deemed to have the same fair value as each square foot in the total 100,000 sq. ft. building.

In addition, let’s assume the tenant was granted early access to the 10,000 sq. ft. space on January 1, 2020 and that there was no rent charged from January 2020 – March 2020.

After considering the facts above, the following inputs would be used in the lease analysis:

Rent-free Period: January 2020 – March 2020

Construction period: April 2020 – June 2020

Access during construction: 10,000 sq. ft.

Payments during construction: $17,500 per month

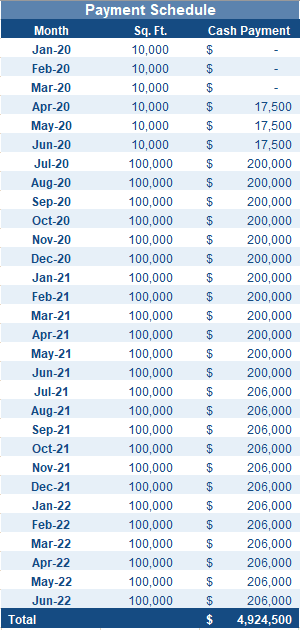

The payment details are presented in the payment schedule below:

Landlords often increase lease payments over the lease term to account for inflation and/or the time value of money. If the lease payments are not consistent throughout the lease term or escalate due to the lessee’s physical use of the asset, the tenant and landlord must begin the recognition of expense/revenue when the lessee takes possession of the asset on a straight-line basis, unless another systematic approach is acceptable. For the sake of our example, we will capture the expense on a straight-line basis.

As mentioned above, applying the straight-line method includes evenly recognizing the expense associated with the total payments throughout the lease term. In our example, the tenant will make lease payments of $4,924,500 over 30 months. However, because the lease did not relate to the same amount of space for the entire lease term, the straight-line lease expense recognized is not consistent over the terms of the arrangement.

Since some private companies may not have implemented ASC 842, we will walk through the accounting for these lease terms first under ASC 840 and then under ASC 842.

Financial statement impact of rent abatement and rent-free periods under ASC 840

Per ASC 840-20-25 paragraphs 4 – 5, if the rent escalation is in relation to an increase in the asset which the lessee has control over, it must be allocated proportionate to the fair value of the space that the tenant has control to use. In our example, the total payments must be allocated between the first 10,000 sq. ft. accessed from January to June and the additional 90,000 sq. ft. accessed starting in July 2020. As mentioned previously, each square foot in the first 10,000 occupied is deemed to have the same fair value as each square foot in the total 100,000 sq. ft. building.

The aggregate square footage the lessee has access to over the entire lease term is 2,460,000. To allocate the fair value proportionately, the lessee calculates the percentages in which it has access to based on the total square footage. The first six months of 10,000 sq. ft. access represent 2% of the total square footage (60,000 / 2,460,000). Two percent of the total cost is $120,110 ($4,924,500 x 2%). When $120,110 is divided by the number of months the tenant has access to only 10,000 sq. ft., the monthly expense is $20,018 ($120,110 / 6 months).

Starting July 1, 2020, the tenant obtains full access to the 100,000 sq. ft. space for the remainder of the lease term. Applying 98% (2,400,000 / 2,460,000) to the total cost results in $4,804,390 (98% x 4,924,500) that will be evenly distributed across the remaining 24 months of the lease term. The monthly expense of $200,183 ((98% * $4,924,500) / 24 months) is for the period July 1, 2020 through June 30, 2022.

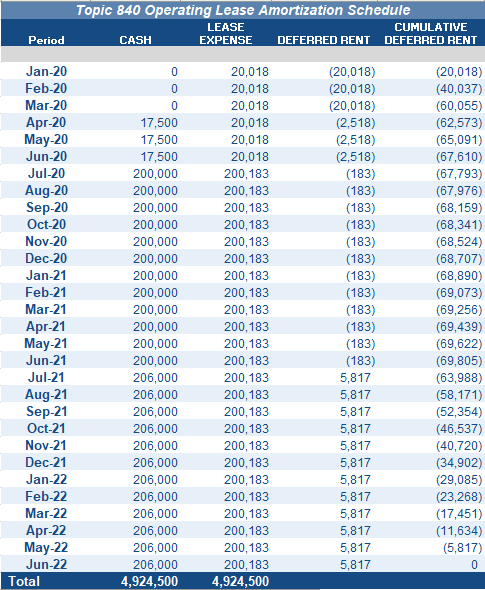

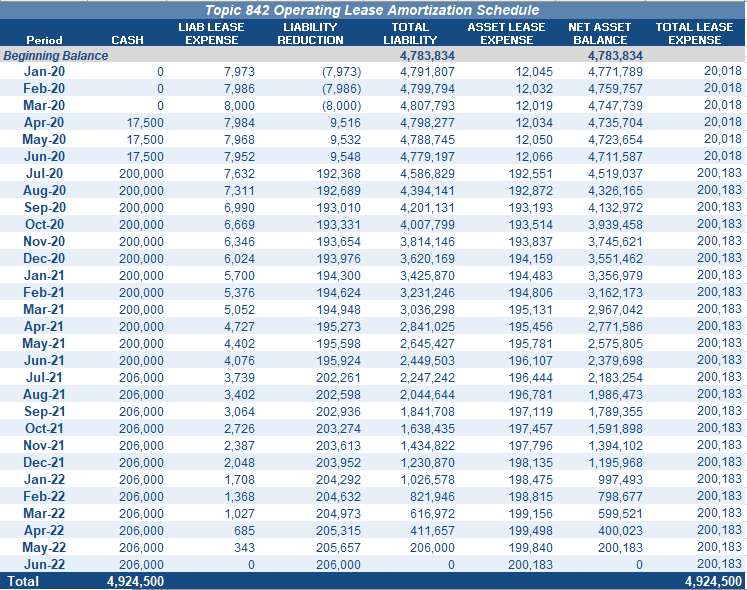

A private company that has not transitioned to the new lease accounting guidance would utilize the following amortization schedule for the lease scenario above:

The rent expense for the first six months is shown as the $20,018 we calculated above, and the rent expense for the next 24 months is shown as $200,183. As a result of the period of free rent, the rent abatement, and the July 2021 rent escalation, the expense is not equivalent to each month’s cash payment. Under ASC 840, the difference between the recorded expense and the cash paid is recognized as deferred rent or prepaid rent.

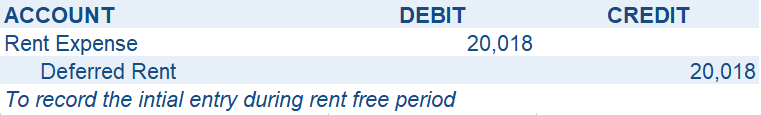

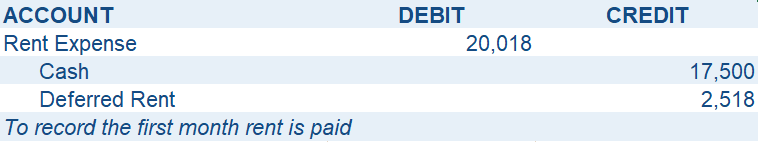

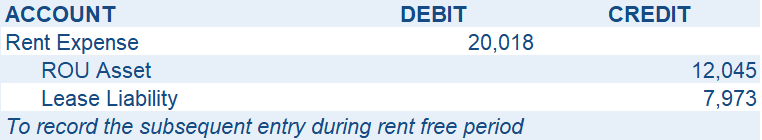

Starting January 2020, the tenant obtained early access to the space, but was not required to make monthly payments. Per ASC 840-20-25-3, when a lessee obtains possession or control of the physical asset, the lease has commenced, even if a lessee is not required to make lease payments. In our example, the lessee’s early access indicates the beginning of the lease term, in which expense should be recorded. As such, the journal entry is as follows during the rent-free period:

In April 2020, the tenant made its first payment of $17,500 for access to only 10,000 sq. ft. The journal entry for April is as follows:

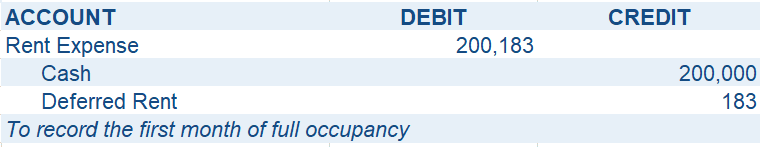

Finally, as of July 2020, the tenant will have full access to the 100,000 sq ft. building and the monthly rent payments will increase to $200,000. The journal entry for July is as follows:

By the end of the lease term, the lessee will have recorded total cash and total expense of $4,924,500, and thus will have reduced the balance of the deferred rent to zero.

Financial statement impact of rent abatement and rent-free periods under ASC 842

Per ASC 842-20-25-6a, lease cost is “allocated over the remaining lease term on a straight-line basis unless another systematic and rational manner basis is more representative of the pattern in which the benefit is derived from the right to use the underlying asset.” In that case, a company that transitioned to the new lease accounting guidance would record straight-line lease expense on an operating lease using the same expense calculated above. The tenant would allocate 2% of the total lease cost to the first six months of the lease term and the remaining 98% to the next 24 months.

However, deferred rent is no longer captured as a standalone account under ASC 842. If there is an outstanding deferred or prepaid rent balance at transition, it must be cleared from the books, with the offset decreasing/increasing the beginning ROU asset.

As with ASC 840, rent abatements and rent-free periods impact the total cost used to calculate the straight-line expense. Similarly, the new lease liability and ROU asset include the total lease payments, including the escalating payments, to determine the beginning balances.

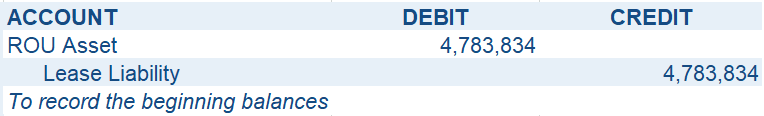

Under ASC 842, in the scenario we’ve outlined above, the tenant first determines the present value of the lease payments over the full 30 month lease term to be $4,783,834. This is the beginning lease liability balance. In this case, the ROU asset equals the lease liability calculated at lease commencement. The lessee records the following journal entry on January 1, 2020:

The below amortization schedule and corresponding journal entries demonstrate the accounting for our example over the life of the lease for a public company that has transitioned to ASC 842.

The amortization schedule shows the lessee making total cash payments of $4,924,500 and recognizing total lease expense of $4,924,500. Additionally, the lessee is amortizing the lease liability and ROU asset to $0 by the end of the lease term.

At the end of January 2020, the tenant recognized the rent expense and impact to the liability and ROU asset as follows:

Because there was no payment made in the first three months of the lease, the entries recognized in each of these subsequent months will result in an overall increase of the liability.

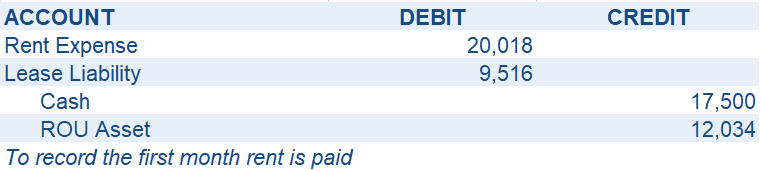

The tenant made its first payment of $17,500 in April 2020, which results in a portion of the payment allocated to reduce the outstanding obligation. The ROU asset continues to be amortized in the current month. The journal entry for April 2020 is as follows:

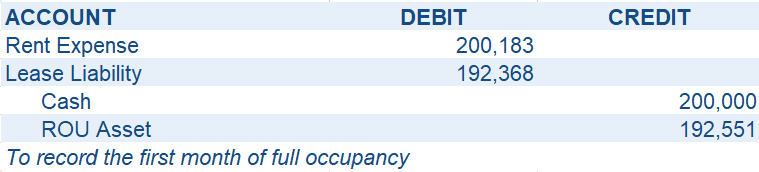

In July 2020, the tenant will have full access to the 100,000 sq. ft. building and the monthly rent payments increase to $200,000. The journal entry for July 2020 is as follows:

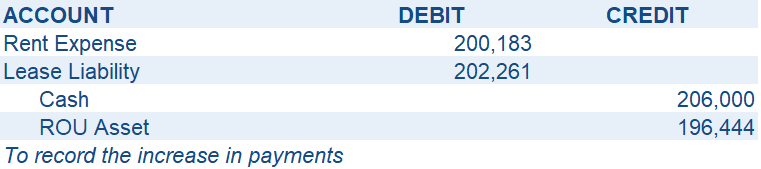

Finally, in July 2021, the monthly lease payments will increase by 3% and the tenant will record the following journal entry:

Summary

Rent abatement can include periods of free rent or reduced rent. Understanding the timing of the payments is important in determining the impact to both the income statement and balance sheet. Under both ASC 840 and ASC 842, rent expense of an operating lease is recorded on a straight-line basis unless another systematic and rational basis is more representative of the timing of the lease. Periods of free rent, rent abatements, and escalating payments are all factored into a straight-line rent expense calculation. For lease payments that escalate due to the tenant gaining access to additional assets, the expense will be recognized in proportion to the additional leased property.

The difference between the straight-line expense and lease payments is accounted as deferred or prepaid rent under ASC 840. While operating leases under ASC 840 are not recorded on the balance sheet as they are under ASC 842, rent abatements and escalations will have an effect on the deferred rent recognized in a period.

The lease liability and ROU asset recorded under ASC 842 are dependent upon the present value of total lease payments over the lease term. The initial lease liability and ROU asset are recognized at the lease commencement date, not on the date of the first payment. The timing and amount of payments or non-payment periods will impact the reduction of the lease liability and ROU asset.

If your company has been granted a rent-free period and/or rent abatements as a direct result of the COVID-19 pandemic, there are relief options offered by the FASB for which your company may be eligible. Please refer to our blog: COVID-19 Accounting for Lease Concessions