Annual Accountants Survey: Top Challenges & Tech Wishlist

Accountants Investing in Tech to Improve Client Service & Quality

Accountants play a critical role in our economy, from instilling trust in our financial markets to helping small business owners manage their cash flow. LeaseQuery’s latest survey of more than 200 accounting professionals, both from industry-specific organizations and accounting firms, found that they need help as well.

Demands are mounting and since accountants can’t buy more hours in the day, they are looking for technology to gain efficiencies, streamline workflows and add value to clients.

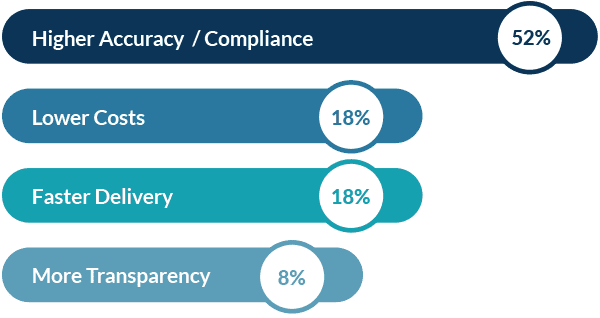

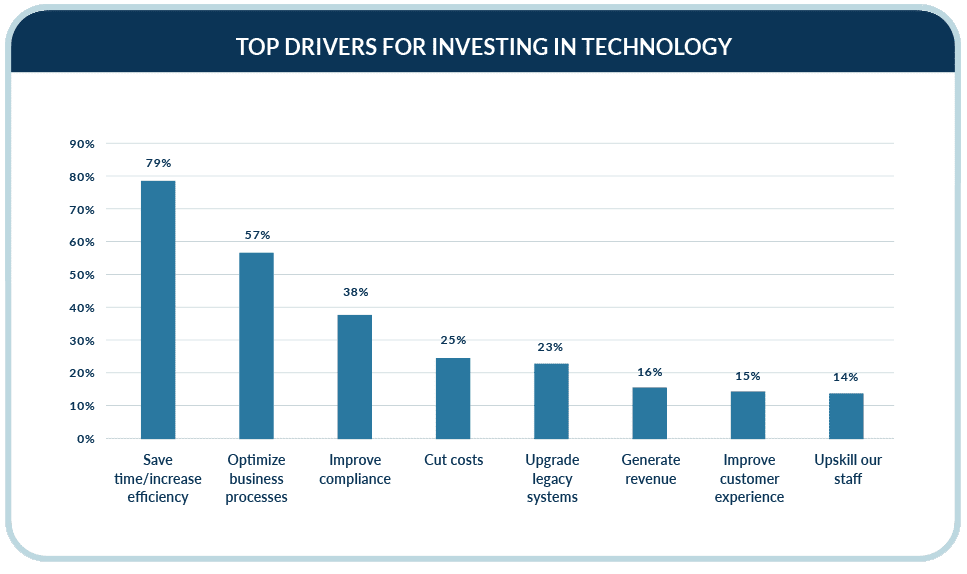

According to our survey, the push towards more investment in technology is driven first and foremost by improved accuracy and compliance, followed by lower costs and faster delivery. The main levers to pull for increased client satisfaction are speed and accuracy—both areas technology is built to improve.

Top Priorities for Technology Investment

Technology Use & Wishlist

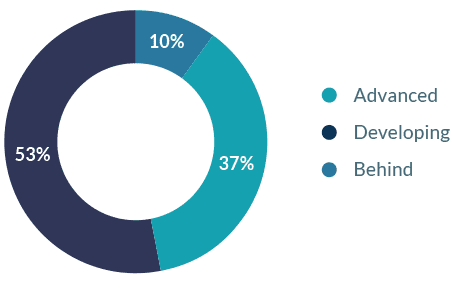

Current Technology Maturity

When asked about their company’s technology maturity, accountants are clear that more progress is needed. Nearly two out of three report they are developing or behind in their technology journey, with the majority actively working to invest, implement and evolve quickly to capture opportunity.

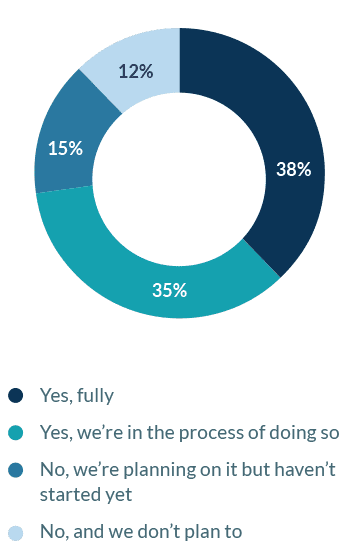

Have you transferred your

data to the cloud?

Nearly three out of four accountants are well on their way, with 38% saying their data is fully in the cloud and 35% saying they are in the process of migrating. However, for the 27% of accountants who are not currently transitioning to the cloud, they risk falling far behind.

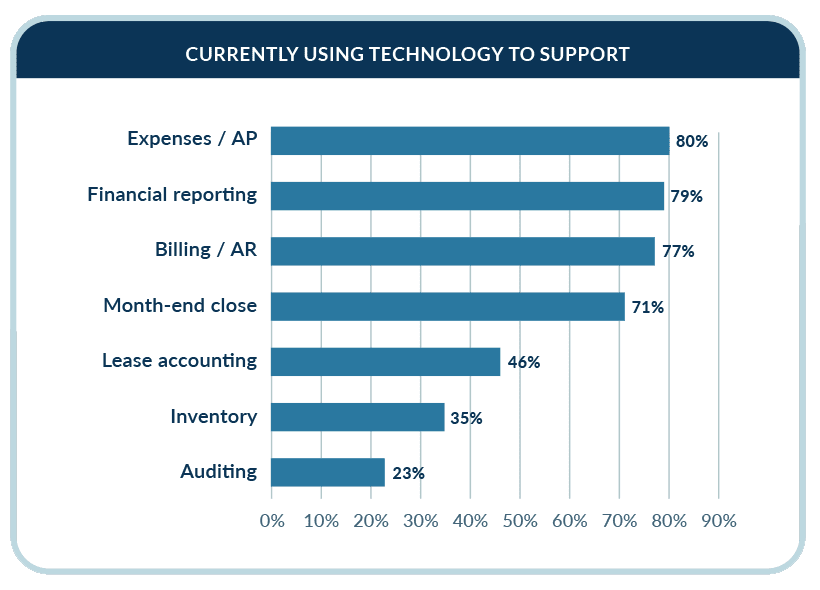

Critical functions from expenses, billing and AP, to month-end close and financial reporting are now by and large performed with the aid of technology. However, a small minority of accountants are still using manual or paper-driven processes for these functions.

Accountants Currently Using Technology to Support

Other key functions, like lease accounting, inventory and auditing are prime for technology enablement and likely where many will invest next.

Today, less than half (46%) of accountants report using technology for lease accounting, which means too many organizations are still relying on spreadsheets and tracking down contracts buried across departments or in drawers.

While some small companies may be able to sustain this in the short-term, inefficiency is particularly costly in a downturn, and leveraging software to track and manage leases can not only save time and avoid compliance headaches but also reveal cost-saving opportunities.

Today, less than half (46%) of accountants report using technology for lease accounting, which means too many organizations are still relying on spreadsheets and tracking down contracts buried across departments or in drawers. While some companies may be able to sustain this in the short-term, inefficiency is particularly costly in a downturn, and leveraging software to track and manage leases can not only save time and avoid compliance headaches but also reveal cost-saving opportunities. Audit technology is another area in the early days of transformation. While the largest companies have been investing in tech-driven audits for several years, many others are taking their first steps after being forced to audit remotely during the pandemic.

Audit technology can help with everything from document requests and testing analysis, to communications and questions – saving critical time during what is often a stressful process for companies and accountants alike. This cloud-based audit technology can be incredibly helpful for internal audit departments that may be visiting locations throughout the country.

Automation is now an accountant’s best friend.

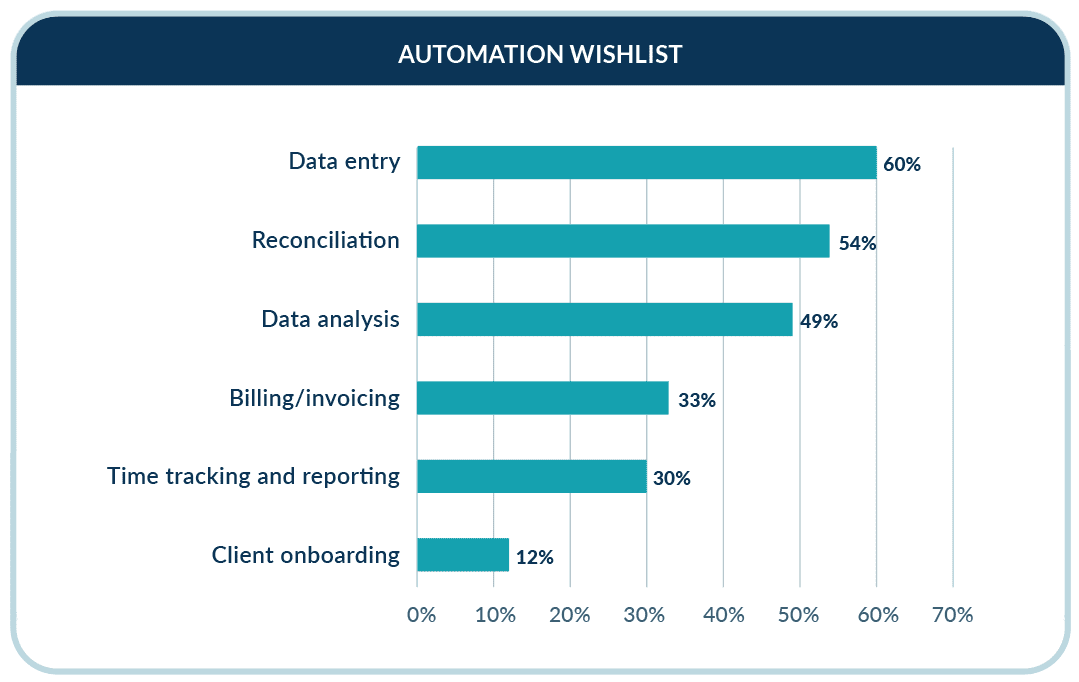

Accountants have a long list of responsibilities they wish automation could simplify. Automation frees up time by replacing manual tasks from data entry to time tracking, so accountants can focus on higher-value work. As accountants’ roles become more analytical, and clients request new services, faster reports and more insights, automation is a critical strategy to meeting those needs.

At the top of accountants’ automation wishlist… the dreaded task of data entry.

While accountants know firsthand how critical data accuracy and integrity are, the manual, hands-on process of moving information from a document or invoice into a general ledger is tedious. Not to mention error-prone. Another benefit of automation is reducing, if not removing, the potential for human mistakes like typos or keying errors. It can also simplify and speed up reconciliations, another critical pain point for accountants.

Outside of data entry, accountants are also looking for automation to streamline time tracking and reporting, and client onboarding. This trend is likely to continue, even amid economic and cost pressures. According to a Gartner survey, 98% of CFOs say they will not be cutting tech investments and will actually invest further in automation to reduce costs and increase efficiency.

Automation is recession-proof and resilience-enabling, keeping accountants flexible to meet emerging needs and client demands.

Tech Tip

For practices and firms looking to invest in more automation, start with your current tech stack and explore whether features or add-ons exist that could be integrated into your existing SaaS or software solutions.

A surge of investment and growth is occurring in accounting technology solutions to meet the needs of any size practice. While implementation may require some time and training, ROI will shortly follow with accounting professionals’ job satisfaction.

Technology Investment

However, accountants are clear on their needs and drivers for tech investment: capabilities, compliance and costs.

Both of the top two cited drivers for technology investment are related to increasing capacity to perform individual roles—through efficiency and optimized processes as well as time-saving automation. This is more essential than ever as accountants continue to serve a wide range of needs from traditional tax and audit services to more consultative and advisory capabilities that include CFOs and supporting strategic decisions.

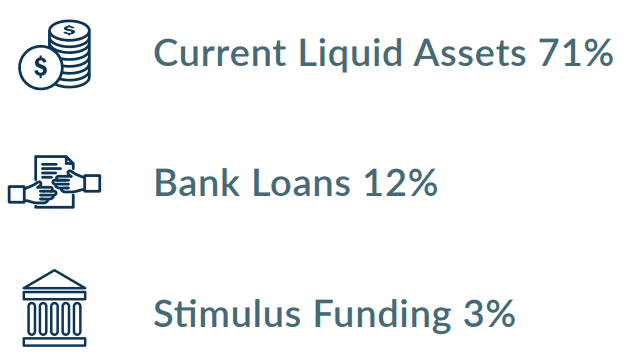

Top Funding Sources for Tech Investments

ROI of Previous Accounting Technology Investments

Additionally, technology is now a proven value and tool for compliance. From ensuring data is correct and treated appropriately, to making sure deadlines are met and filings are submitted, technology helps accountants lower risk for their companies or clients—generating loyalty in the process.

But as with any investment, it comes down to the bottom line. While 25% of accountants are investing in technology to cut costs, they will be laser-focused on the ROI of their spend.

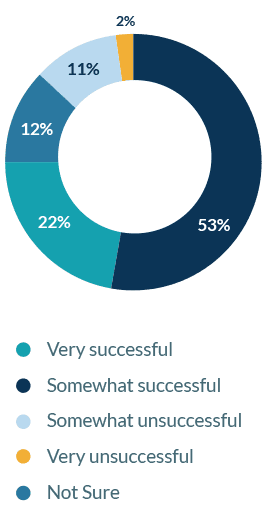

That’s due in part to previous challenges. Just 22% of accountants say their prior investments in accounting technology were very successful. There’s room for improvement for the 53% who reported they were only somewhat successful.

In fact, some accountants may have lingering challenges from previous mistakes or technology initiatives that failed in the past. About 13% report previous efforts were very or somewhat unsuccessful, which could be informing the 10-15% of firms who are behind in their maturity and cloud use.

In short, they may have been burned in the past by the wrong solution or insufficient training and are therefore reluctant to try again.

Technology Challenges

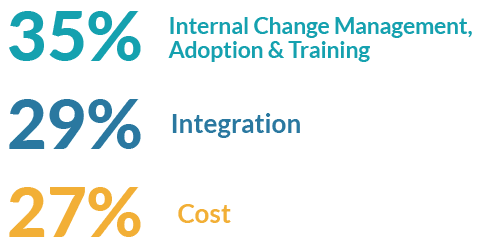

It turns out accountants’ biggest problem with technology isn’t anything very technical at all… it’s people.

When asked about their top challenges with accounting technology, internal change management, adoption and training was the most cited option.

Too often, accountants will have a limited number of champions in their firm or organization for buying into new technology, only to have it stall in the rollout. Change management is one of the biggest hurdles and the hardest for which to solve because no simple solution exists, and it requires coordination, consistency, communication and proof points to keep up the momentum.

Tech Tip

To increase or speed up adoption, ensure you have executive buy-in and sponsorship at the highest levels of the organization, in addition to champions across departments or practices. From there, look for ways to capitalize on early wins – if a colleague begins to save time during month-end close, make sure to share the case study so others are motivated.

Biggest Accounting Technology Challenges

Cybersecurity Risks Escalate

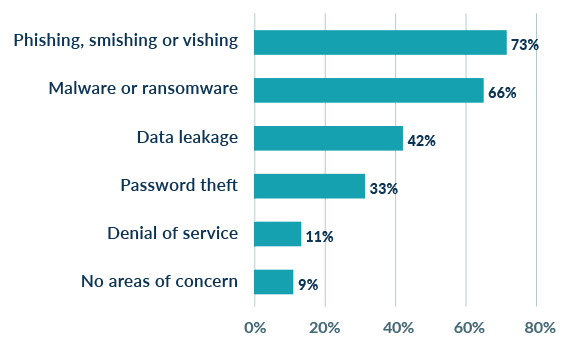

Accountants and their clients are also rightfully putting more resources and attention to battle emerging and persistent cybersecurity threats. It’s no secret in the profession or among would-be hackers that accountants possess a literal treasure trove of data – from proprietary company financial information that could move markets, to employee and personal data, to credit card and transaction information.

Their concerns are understandably broad – phishing, smishing or vishing attacks seeking sensitive info via email, phone or text continue to wreak havoc on companies across all sizes and industries, as do malware breaches and denial of service attacks. The Herjavec Group reports there were 5.5 ransomware attacks per minute in 2021, and accountants face significant risk.

Top Cybersecurity Concerns

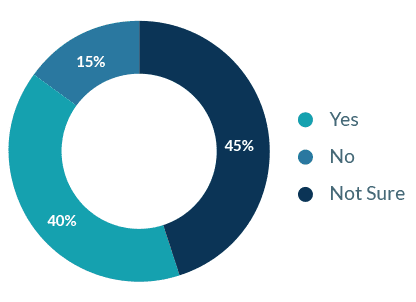

Are you investing in additional cybersecurity protections in the year ahead?

However, the good news is the industry continues to take security seriously: 40% will invest more in cybersecurity protections in the year ahead. While cybersecurity risk management is an organization-wide strategy and imperative, technology is a critical part of the conversation. The cloud is generally regarded now as the safest option for data storage, however, as accountants expand their roster of technology tools and SaaS solutions, it’s important to consider third-party access and security practices.

Tech Tip

Accountants can do simple due diligence to make sure any vendor or partner takes security seriously. Look out for clear signs like SOC compliance and other evidence vendors are practicing good cybersecurity hygiene, including ongoing employee training about digital and physical security best practices.

Whether you’re looking for an urgent solution to a challenge like lease accounting or rebuilding your technology infrastructure to ensure sustainability and success as an accounting firm ready for the future, digital tools and software present a clear value and opportunity. Although accountants have not always been at the forefront of innovation, they have been at the forefront of client service. The industry is poised for further growth as more tech-enabled services and processes expand.

Check out our 2021 FASB Innovation Summit to learn more

About the Survey

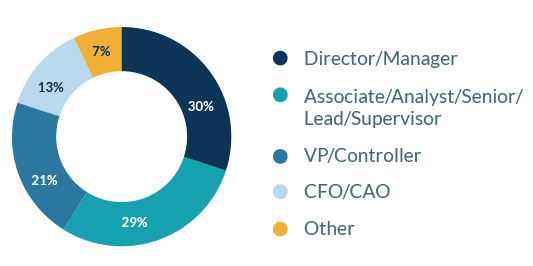

LeaseQuery’s Accounting Technology Wishlist Survey polled 237 accounting professionals

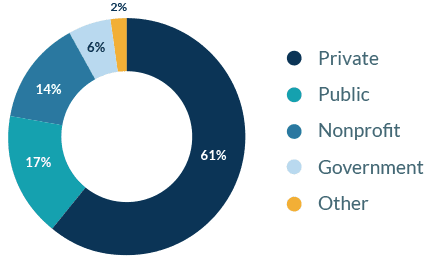

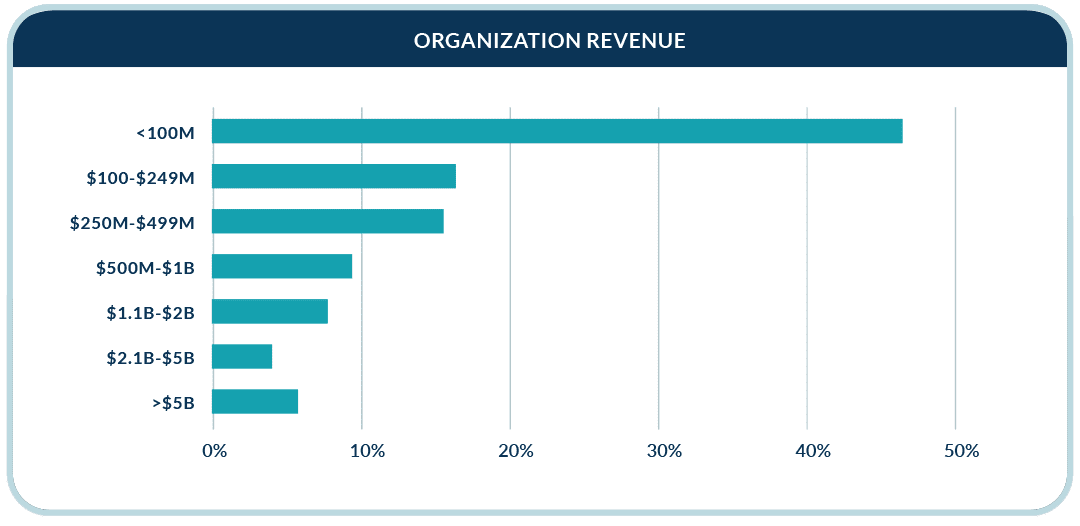

across public, private, nonprofit and government organizations in September of 2022.

Survey Respondents

Organization Type

About LeaseQuery

LeaseQuery makes accountants’ lives easier by simplifying the complex with technology. More than 25,000 financial professionals globally rely on our cloud-based, CPA-approved solutions and in-house accounting expertise to comply with confidence across various FASB, GASB and IASB accounting standards.

Our software helps businesses minimize risk, increase efficiency and reduce costs. Learn more about LeaseQuery’s core lease accounting solution, which focuses on easing the mandatory transition to ASC 842, IFRS 16, GASB 87 and GASB 96, or explore additional accounting tools.