Lease Benchmark Report

Leases Return to Pre-Pandemic Levels…

But at Post-Pandemic Prices

For much of the past two years, organizations across every industry have been asking, “when will we

return to normal?”

The global pandemic has, of course, been a disruptive force, impacting every aspect of how and where business is done. It has been a tipping point for companies and consumers to reimagine everything—from the future of work to supply chains to physical vs. digital presence.

The 2022 update of Lease Benchmark Report, an expanded analysis of more than 2,000 companies’ lease liabilities, reveals that we may have returned to normal when it comes to lease portfolios, but costs are mounting in an inflationary environment.

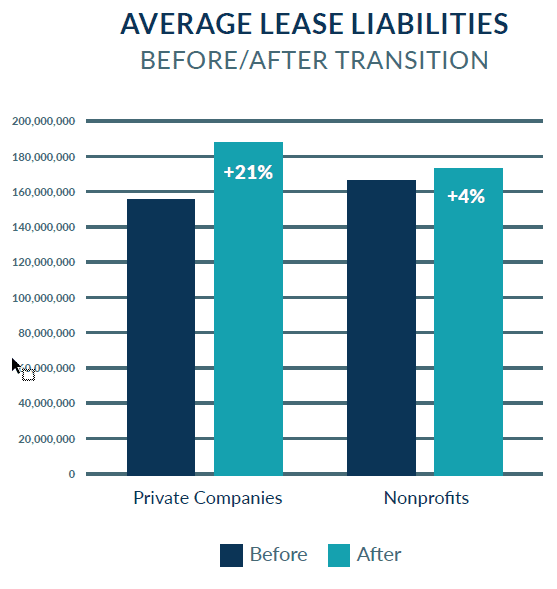

In the midst of this change, private companies and nonprofits are also working hard to prepare for landmark accounting changes under ASC 842, which moves all leases onto the balance sheet. The deadline is no longer on the horizon; it’s here, and organizations are now digging out from the transition to find increased lease liabilities and costs to manage as they plot their future.

The Last-Minute Transition

The private companies and nonprofit organizations that have already transitioned to ASC 842 have a better line of sight into their entire leasing portfolio, and the time is right to use that insight to optimize operations. For some companies in the professional services or retail industries, that may mean shedding office or storefront space made obsolete by hybrid work or e-commerce. For others in the healthcare or technology sectors, it could mean significant market expansion to take advantage of new opportunities and growth.

Average Number of Leases

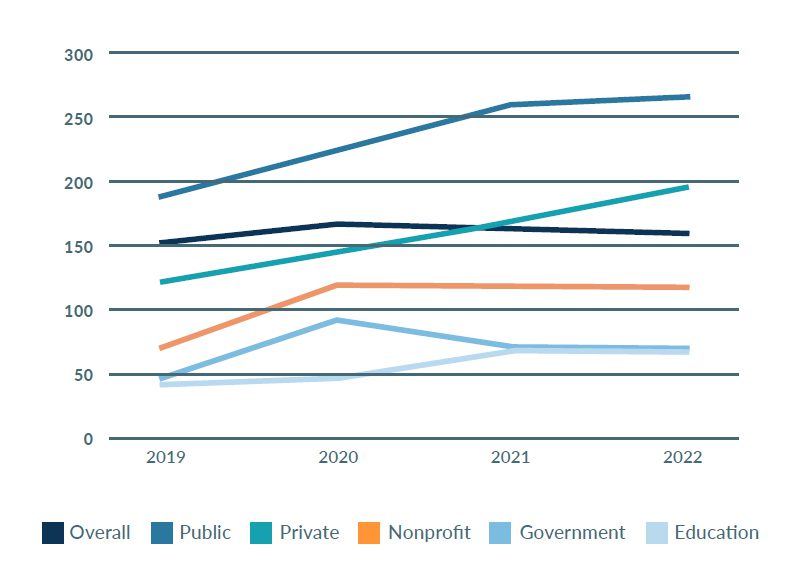

Across most organization types, the average number of leases has returned to or exceeded pre-pandemic levels—signaling impressive resilience in the face of unprecedented challenges.

The Office Isn’t Dead… Yet

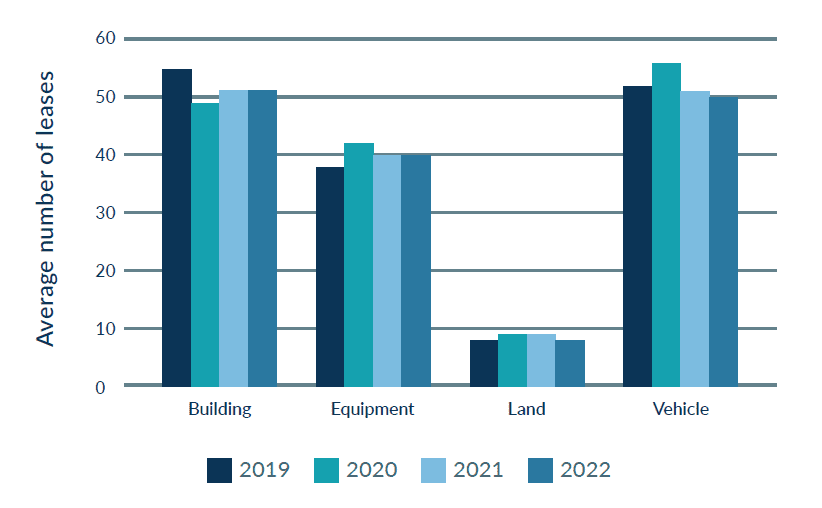

Year over year trends around the type of leases most in demand may also signal early shifts in organizational priorities. While land and equipment leases are relatively flat over the past few years, building leases have not returned to pre-pandemic levels.

Lease-type trends make clear that the headlines around the death of the office or storefront are greatly exaggerated…for now. The next year will reveal the post-COVID reality. JLL reports that leases for 243 million square feet of office space—11% of the market—will expire in 2022. We could see some significant reshuffling as companies reconsider their optimal physical presence and recalculate the risks of leasing vs. buying. But we expect they will do so with an eye toward flexibility and diversification rather than disappearing from the map altogether.

Land and equipment leases may see a surge in demand as companies seek additional flexibility in both the space and tools that enable their company and workforce to grow.

Lease Type Trends

The Tested 10

A Spotlight on the Key Industries Affected

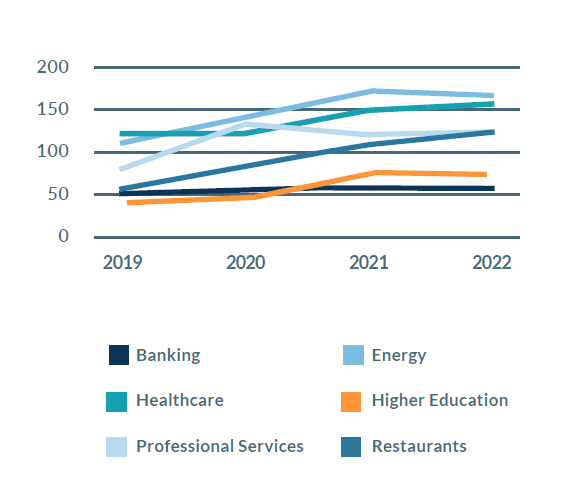

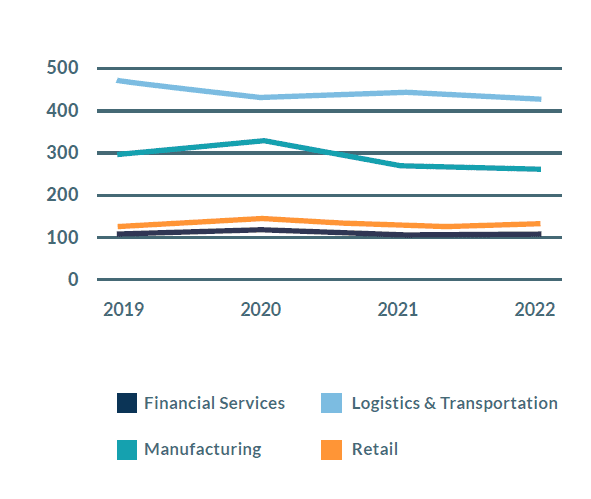

Every industry has a unique story, with conflicts rising and resolving as the economy evolves through the pandemic.

From healthcare managing surges in COVID-19 care amidst a return to previously delayed preventative and mental health care, to education developing the future of remote or asynchronous learning, the one common denominator is change.

Industry Snapshot: Expanding Leases

Industry Snapshot: Flat or Shedding Leases

Below, we spotlight the impacts on the 10 key industries most affected by both lease accounting and market changes: banking, energy, financial services, healthcare, higher education, logistics & transportation, manufacturing, professional services, restaurants, and retail.

Banking

With managing Payment Protection Program (PPP) loans and applications, funding entrepreneurs, and financing the housing boom, banks have been busy over the past few years. Moreover, the rise of fintechs seeking to disrupt the payment, lending and overall banking industries has been a catalyst for significant innovation.

From mobile banking to peer-to-peer payments, banks have invested significantly in their digital transformation to meet the needs of their modern customer and stay relevant in a fast-evolving sector. So far, it’s working. Bank and credit deposits continue to rise with the banking system holding about $3 trillion in “excess” deposits, according to the Office of the Comptroller of the Currency. While the growth in deposits may slow as businesses and consumers alike put cash to work, the banking industry remains in high-growth mode.

Average lease liabilities are up 20% over pre-pandemic levels, with banks remaining heavily involved in real estate leases for local branches and office space. Being knitted in, visible and accessible in the communities they serve remains a critical priority for banks, and while we may see some underperforming locations shed in the coming years, leases are likely to remain stable or expand.

| Banking | 2019-2022 Change |

| Average Lease Liability | +20% |

| Average # of Building Leases | +23% |

| Average # of Equipment Leases | -3% |

| Energy | 2019-2022 Change |

| Average Lease Liability | +16% |

| Average # of Building Leases | +51% |

| Average # of Equipment Leases | -6% |

Energy

Perhaps no industry is more synonymous with volatility at the moment than the energy sector. Oil and gas has been at the center of the global conflict between Russia and Ukraine that threatens to cut off or diminish the international oil supply. Meanwhile, the U.S. has sought to balance a need for cleaner energy with the goal of tempering skyrocketing gas costs which have reached new highs in early 2022.

On the renewables side, wind and solar energy continue to expand as traditional oil and gas companies work to build a more sustainable model and investors and shareholders focus more on ESG. Still, as EY reports, even with pressure mounting in all directions, “until fossil fuels are displaced at scale, oil and gas demand will grow alongside [renewables].”

All of this translates to growing needs for leases. Companies are seeking land for drilling, solar panels and wind turbines, as well as equipment to collect, store and transport energy across the world. Building leases are up 51% from pre-pandemic levels, and while the average number of equipment leases is down slightly, industry growth suggests an increase in the coming year.

Financial Services

Financial services companies, including credit card companies, insurers, real estate and financial advisors, have similarly seen a surge in demand as consumers and companies make significant shifts in their financial planning throughout the pandemic.

First by force, but increasingly by customer demand, financial services are going digital. Not only do customers now file and process insurance claims via an app, but they also meet with their wealth managers and settle credit card challenges remotely. The digitization of financial services, and rise of fintech disruptors, continues to raise questions around the amount of leased space and equipment required to usher forth the future of finance.

Whether it’s reconsidering branded high rises, optimizing building leases or shedding dated technology and equipment, financial services firms are reshuffling. Average lease liabilities and the number of building leases have increased notably from pre-pandemic levels, but more optimization may be ahead as companies seek to optimize costs in a digital industry.

| Financial Services | 2019-2022 Change |

| Average Lease Liability | +29% |

| Average # of Building Leases | +27% |

| Average # of Equipment Leases | -17% |

| Healthcare | 2019-2022 Change |

| Average Lease Liability | +26% |

| Average # of Building Leases | +32% |

| Average # of Equipment Leases | +4% |

Healthcare

Healthcare organizations continue to experience increased demand—both in COVID-related care and in managing a renewed focus on preventative care.

Expansion is on the agenda, with mental and physical health front and center amid the tolls of the pandemic. Even as hospitals managed additional surges in COVID-19 care, healthcare executives stayed focused on preparing for the future of health, investing in technology, facilities and talent to increase telehealth services and bring care closer to home.

Indeed, the hospital may still be the center of care in many communities, but the consumerization of healthcare is bringing more, smaller healthcare facilities to malls and other mixed-use properties. As a result, healthcare is one of the fastest-growing industries in terms of leasing with the average number of building leases increasing by 32% from 2019 to 2022.

Equipment leases are on the rise too–with digital and medical device monitoring equipment expanding amid the rise of home health care and the return to elective surgeries increasing the need for surgical and therapeutic equipment. Looking ahead, healthcare will remain a recession-proof industry, but more attention to costs–from consumers, regulators and shareholders–may cause further shifts.

Higher Education

Higher education has faced significant challenges over the past few years–from rising costs and political battles to student mental health and safety. As the costs of education rise–for administrators and students alike–the shift to remote and then hybrid education has put the overall value in question.

After decades of building and expanding, The Chronicle of Higher Education reports many campuses are “overbuilt” and starting to slow down, realizing they may have more space than they need.

At the same time, new types of higher education organizations and schools are growing to support new and emerging industries. From skilled trades training aided by virtual and augmented reality to digital-based schools, the industry continues to evolve, and so do leasing needs. As major campuses reconsider their owned and leased asset needs, average lease liabilities are on the rise, increasing 6% from 2019 to 2022. Building and office-related leases are increasing, but the largest growth is in equipment leases as schools invest in technology and tools to put in the hands of hybrid learners.

| Higher Education | 2019-2022 Change |

| Average Lease Liability | +6% |

| Average # of Building Leases | +92% |

| Average # of Equipment Leases | +293% |

| Logistics and Transportation | 2019-2022 Change |

| Average Lease Liability | +11% |

| Average # of Building Leases | -10% |

| Average # of Equipment Leases | -1% |

Logistics and Transportation

Supply chain turmoil has been one of the major headlines and economic challenges of the past two years, and it continues. Shortages and delays have caused headaches and losses for businesses and consumers around the world.

It’s also caused huge demand as companies look for workarounds and alternative paths to get goods from place to place. With demand high, logistics and transportation companies continue to outperform, being able to fetch a premium for their services, but the availability of leases–for ships, trucks, containers and warehouse space, appears to be on the decline.

While the industry has among the highest quantity of leases of any analyzed in this report, average lease liabilities and the numbers of building and equipment leases have not yet returned to pre-pandemic levels. Looking ahead, customer demand for speed and ongoing labor challenges are expected to present persistent challenges for logistics companies. Leasing, however, is likely to stabilize in the near-team as companies reassess where they need to match up with goods produced closer to home and their end customers.

Manufacturing

A recent Federal Reserve survey showed dire pressures on manufacturers, with one company calling the supply chain “chaos” and another noting material costs were “out of control.”

Over the past two years, there have been countless examples of goods in high demand–from cars to furniture to medical supplies–that manufacturers cannot fulfill due to unavailable or inaccessible raw materials or lack of access to workers.

The pandemic persists, and the global conflict between Russia and Ukraine has raised raw material prices again, creating more volatility in the supply chain. Indeed, with every touchpoint along the supply chain strained and squeezed, costs are also rising for manufacturers across the board.

Average lease liabilities are up 53% from pre-pandemic levels, while the average number of building and equipment leases is down. Land leases, however, were up precipitously as manufacturers work to expand and optimize production through automation, location and flexibility. Looking ahead, manufacturers will continue to fight for talent and the ability to fulfill orders, and we expect to see equipment leases rise as companies look to technology to help them solve their workforce challenges.

| Manufacturing | 2019-2022 Change |

| Average Lease Liability | +53% |

| Average # of Building Leases | -12% |

| Average # of Equipment Leases | -10% |

| Professional Services | 2019-2022 Change |

| Average Lease Liability | +197% |

| Average # of Building Leases | +22% |

| Average # of Equipment Leases | +26% |

Professional Services

Workers in the professional services industry – from lawyers to consultants to accountants are leading the conversation on the future of work. It’s hybrid, technology-enabled and more flexible to meet the needs of the modern workforce.

The ability to advise from anywhere will fundamentally reshape the leasing and real estate needs of professional services companies – both in the type of space and equipment needed and how it is laid out.

Office space will no longer be individualized, with campus shifting from a place to spend all day every day to becoming more of a convening and collaborative space, leading to a need for more conference rooms and fewer cubicles. Digital transformation continues to heavily influence the performance of professional services as well, with automation and AI enabling faster speed to market, enhanced efficiency, and better access to data.

But as the sector gets smarter, costs are on the rise too. Professional services talent can demand a premium in a competitive market. Moreover, as landlords look to replace lost revenue during the pandemic, many companies are seeing higher rents and costs. In fact, while the average number of leases increased notably from 2019 to 2022, costs increased at a faster clip. Average lease liabilities in the professional services sector are up nearly 200% from pre-pandemic levels.

Looking ahead, the sector is primed for further revenue and service growth, as well as M&A and consolidation.

Restaurants

Restaurants have been at the front line of many of the pandemic’s most significant challenges. The industry was already known for razor-thin margins, then forced closures, limited capacity rules, and staffing shortages caused an additional strain.

Labor costs have been particularly challenging for restaurants during the Great Resignation, with many workers leaving restaurant jobs for better paying or more flexible work. When it comes to costs of goods, prices are increasing, but not at the same rate as consumers’ costs at the grocery store. Baird Equity Research reports that grocery inflation continues to outpace restaurant costs, and the gap is at its widest since 2011. Weighing potential cost increases is likely to be a key consideration for restaurateurs in the year ahead.

The good news, however, is that the industry’s leasing trends show tremendous momentum and optimism. Average lease liabilities have not only returned to pre-pandemic levels but are 32% higher than in 2019. Building and equipment leases have increased notably, as restaurants seek new locations, expand presence to build ghost kitchens and enable delivery partners, and bolster point of sale and other in-store technology to improve the diner experience.

| Restaurants | 2019-2022 Change |

| Average Lease Liability | +32% |

| Average # of Building Leases | +65% |

| Average # of Equipment Leases | +520% |

| Retail | 2019-2022 Change |

| Average Lease Liability | -45% |

| Average # of Building Leases | -11% |

| Average # of Equipment Leases | -9% |

Retail

Retailers’ investment and focus in shifting more and more to the digital cart–improving the customer experience, reducing friction, and honing product assortment for exclusivity has been critical to maintaining stability.

Physical space appears on the decline–spurred both by a reshuffling in the industry and many brands optimizing their footprint to only the most important locations. Average lease liabilities in 2022 are down 45% from pre-pandemic levels.

But things seem to be stabilizing. While more than 8,300 stores closed in 2020, that number dropped to just over 5,000 in 2021 and was offset by another 5,000 store openings, according to Coresight Research.

While right-sizing a chain’s footprint is critical to managing costs, particularly in an inflationary environment, diminishing returns can result from too many closures. Coresight also reports that when retailers close a brick-and-mortar store, online sales in that area can decline by as much as 50%. Looking forward to the second half of 2022 and beyond, a delicate balance between brick-and-mortar and click-and-mortar will be essential to the future of retail.

What’s Next

The past two years have tested companies across every industry. Strategies were made obsolete, crisis plans took priority over growth plans, and as businesses emerged from the height of the pandemic, they found a new marketplace. Rising costs, labor challenges amid the Great Resignation, disruptive technology and new priorities around flexibility and speed are defining what’s next.

Nearly every business decision to address these trends could have an impact on leases. Entering a new market may require taking on new office or factory leases and adding to your team may involve leasing additional equipment.

Leasing trends can be a signal of growth, stagnation or decline across an industry—or simply a reimagining of strategy in a post-pandemic world. While we may never go back to the “old normal,” we are only in the early days of seeing the outcomes of this watershed event in history, and so the new normal has yet to be written.

The transition date to adopt the new lease accounting standard has passed, and for companies that have adopted ASC 842, the opportunities to optimize are plentiful.

About the Lease Benchmark Report

LeaseQuery’s Lease Benchmarking Report is an annual analysis of more than 2,000 public, private, and nonprofit organizations’ financial information as they implement the new lease accounting standards. The index is designed as a benchmarking resource to help companies assess and communicate changes to their stakeholders.

About LeaseQuery

LeaseQuery makes accountants’ lives easier by simplifying the complex with technology. More than 25,000 financial professionals globally rely on our cloud-based, CPA-approved solutions and in-house accounting expertise to comply with confidence across various FASB, GASB and IASB accounting standards. Our software helps businesses minimize risk, increase efficiency and reduce costs.