2020 SURVEY

Post-Transition

Lease Audit Playbook

What Companies Need to Know to Prepare

CONDUCTED IN PARTNERSHIP WITH ENCOURSA

VIEW THE PDF

For the last two years, LeaseQuery conducted surveys to assess where organizations stood in their lease accounting transition.

Now that operating leases are required to be recognized on the balance sheet, the first post-transition audit for an organization looks much different than its previous audits.

In 2020, LeaseQuery conducted a survey of companies in partnership with Encoursa to assess organizations’ first audit post-transition to the FASB ASC 842 and IFRS 16 accounting standards. Responses provide deeper insights into the obstacles companies are facing before, during, and after the audit.

News of yet another transition deadline extension was likely welcomed by organizations across the world in the wake of a global pandemic. However, this is only an extension. The deadlines are still on the horizon, and the challenge of a post-transition audit still looms for those that have yet to transition.

LeaseQuery previously surveyed hundreds of companies on their preparation for lease accounting. Review the 2019 results in The Accountant’s Journey Towards Adoption.

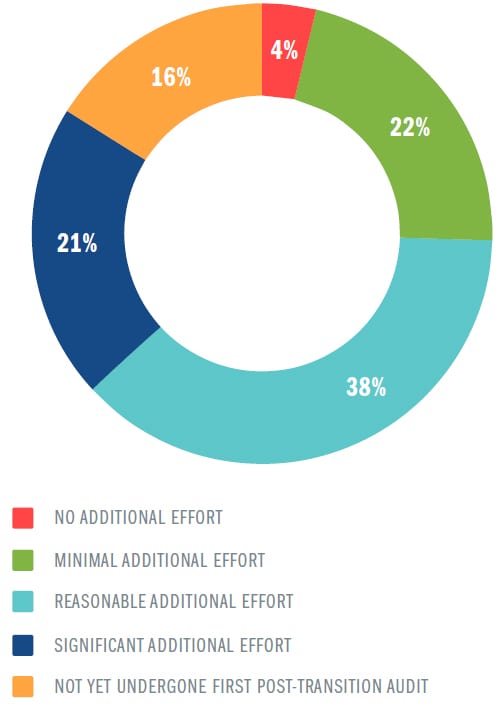

How much additional effort was devoted to your audit due to the lease accounting transition?

How Complex Can It Be?

When the FASB released its new lease accounting standard in 2016, and GASB in 2017, the changes were hailed as some of the biggest to accounting in decades. However, the reality is that preparing for any audit is cumbersome, and the demands of an organization’s audit are compounded by adding operating leases to the balance sheet.

LeaseQuery’s Lease Liabilities Index Report revealed that the new lease accounting standard led to average balance sheet lease liabilities increases of 1,475%. The bottom line is, no matter how it is approached, the first post-transition audit will require more time than it did previously.

Out of those who have completed their first post-transition audit, over 50% report reasonable to significant additional effort was needed.

Organizations Aren’t Approaching

Their Audit Empty-Handed

With such massive changes to audits on the horizon, accounting teams must begin preparation early on, becoming familiar with the lease accounting tools and resources available to them.

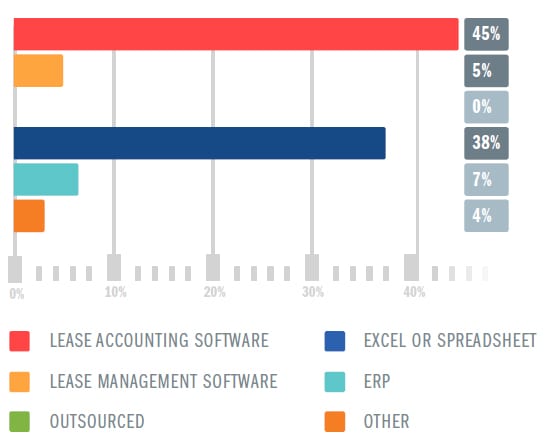

Excel is not the answer.

One of the most popular responses on technology used for transition was Excel. Excel’s lack of accuracy, efficiency and audit trails will likely lead to a challenging and time consuming post-compliance audit. But those aren’t the spreadsheet tool’s only faults. Using Excel also requires setting aside time to educate the organization’s auditors on how spreadsheets have been set up and calculated, adding significant time to an already burdensome audit process.

Lease accounting software, on the other hand, can provide auditors read-only access to reports. A lease accounting tool with a simple interface and custom reporting features will allow auditors to quickly log in and create their own reports, such as leases added in the last 12 months, to make it easier on themselves and the firm and minimize the amount of additional information requested.

Additionally, as a result of the 2020 COVID-19 pandemic, many leases are being renegotiated. Many organizations that originally thought Excel would do the trick for minimal lease changes are now facing difficulties accurately accounting for these changes.

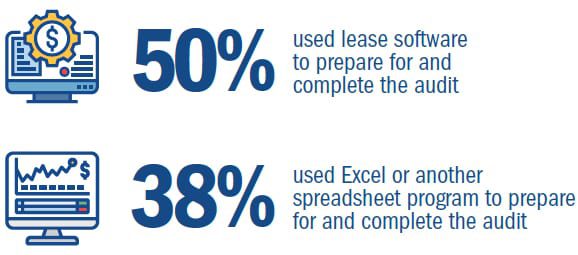

What type of solution/technology are you

using for the transition?

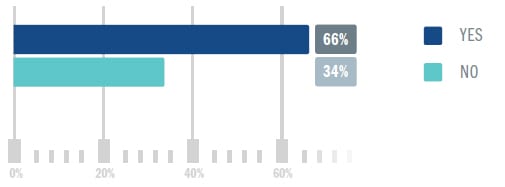

Did auditors have full access to the solution?

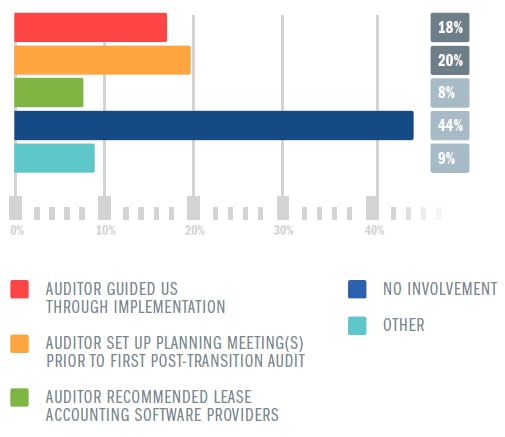

What was your auditors involvement in your lease accounting process leading up to the first post-transition audit?

Auditors Want to Do Their Part

There’s no doubt efficiencies and improvements to the audit process make everyone’s lives easier. Having one solution that both a company and its auditors can quickly log into and pull supporting documents/reports from will make finding evidence for internal controls easier.

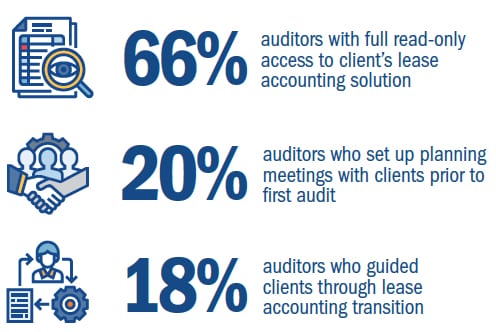

Although 44% of survey respondents said their auditor had no involvement in their lease accounting transition process leading up to the first post-transition audit, auditors want organizations to succeed.

Opening up a line of communication with auditors before the audit, or even before the transition, will leave less room for surprises and fewer questions later. It will create peace of mind knowing they agree with judgment calls and interpretation of the standards in advance.

The Silver Lining: Post-Audit Discoveries and Efficiencies

All the time and effort spent transitioning and preparing for a first post-transition audit can be worth more than a one-time success story. Preparing for such a comprehensive audit enhances data transparency and access, enabling departments to work better together.

The sooner organizations start looking into what it will take to complete their transition and future audits, the sooner they benefit from these deeper insights.

The first post-transition audit will require all hands on deck, but implementing various tools and resources should make the process go more smoothly. On a go-forward basis, however, the audit process should be easier as lease accounting policies will be established, and only the activity relating to adding new leases, modifications, and terminations is likely to be the focus of the audit.

Uncovered Embedded Leases

With embedded leases going on the balance sheet, there’s no shortcut to ensuring they have all been captured. Because a lease accounting tool serves as a repository for the lease contracts and is also where lease agreements are accounted for, users have more centralized access to efficiently evaluate contracts for embedded leases.

Improved Internal Controls

As documented internal controls can significantly affect a company’s efforts to establish lease accounting compliance, internal lease accounting proficiencies can help to set up controls and processes for transitioning to the new standard and post-compliance reporting.

Increased Department Efficiencies

Companies are benefiting from software solutions to help automate key tasks like data entry, document collection, bill payment, calculations, reports, and journal entries.

Uncovered Embedded Leases

With embedded leases going on the balance sheet, there’s no shortcut to ensuring they have all been captured. Because a lease accounting tool serves as a repository for the lease contracts and is also where lease agreements are accounted for, users have more centralized access to efficiently evaluate contracts for embedded leases.

Improved Internal Controls

As documented internal controls can significantly affect a company’s efforts to establish lease accounting compliance, internal lease accounting proficiencies can help to set up controls and processes for transitioning to the new standard and post-compliance reporting.

Increased Department Efficiencies

Companies are benefiting from software solutions to help automate key tasks like data entry, document collection, bill payment, calculations, reports, and journal entries.

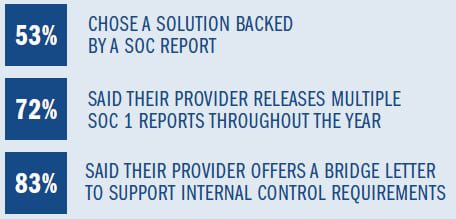

The SOC Situation

When selecting a lease accounting solution to help ease the transition and audits moving forward, be sure the provider offers SOC reporting throughout the year. Additionally, a provider that will support you with a bridge letter at your year-end is an important internal control procedure for your company – and will likely be requested as a part of your audit.

System Organization Control (SOC) reports —issued by a third-party CPA—are performed in accordance with requirements issued by the American Institute of Certified Public Accountants (AICPA). The reports examine the internal controls over financial reporting within the organization.

Before you select a software solution, understand the extent of testing covered by a SOC 1. For example, obtaining an understanding of the company’s internal controls surrounding accuracy and completeness of the information (i.e. reporting and journal entries) is a plus.

An effective SOC 1 can significantly reduce the required testing performed by the company and auditors to complete their financial statement audit.

Easing Into the First Post-Transition Audit

Completing a lease accounting audit post-transition isn’t just a learning curve for businesses. Each new accounting standard presents a learning curve for auditors as well. It is important to recognize that all parties involved are in this process together and everyone wants it to succeed.

Here are a few actions an organization can do to set themselves

up for a successful post-transition audit.

Research what to expect for the first post-transition audit.

Each regulatory change brings the potential for frustration in the audit process. A lot of effort has gone into implementing the new lease standards, and the first audit puts that hard work to the test.

Be proactive and communicate with auditors before they come on-site or begin remote review.

Ask what can be expected from them during the first audit under the new standards. Provide information regarding policy elections and the company’s approach to transition.

Arrange a planning meeting with auditors specifically around lease accounting.

Discuss what their plan is for that audit area and ensure all the evidence they will be looking for will be ready to go.

Implement a lease accounting solution built specifically for compliance.

Having a compliant solution backed by an unqualified SOC-1 report enables a more efficient audit process. Auditors rely on system controls tested within the SOC report to minimize the testing needed for the company audit. Additionally, the capabilities of the software can drive efficiencies in the audit, as an auditor can easily access the population of leases and use the search function to pull reports and data they need to complete a successful audit.

An organization’s first audit is the moment of truth after transitioning to the new lease accounting standard. It is important that all the right steps are taken to establish some peace of mind before embarking on the audit.

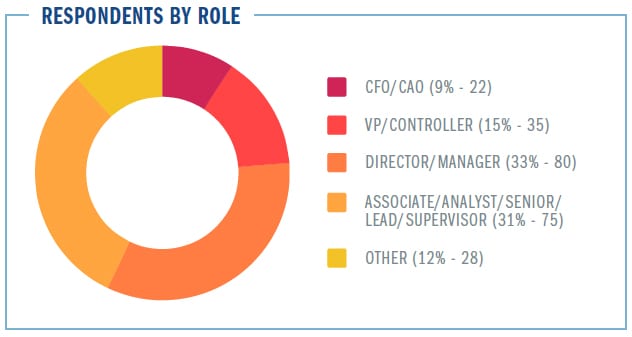

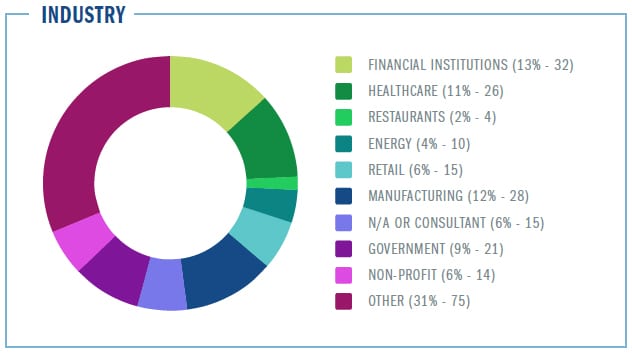

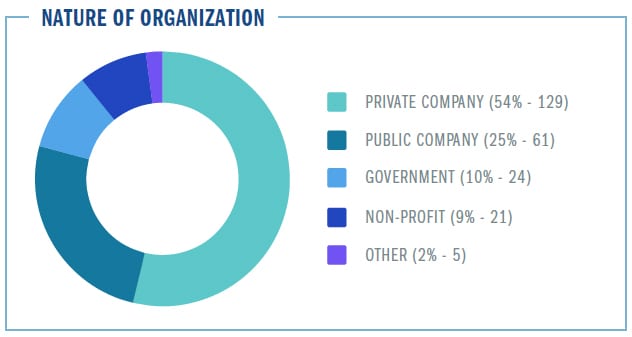

LeaseQuery conducted this survey in partnership with Encoursa.

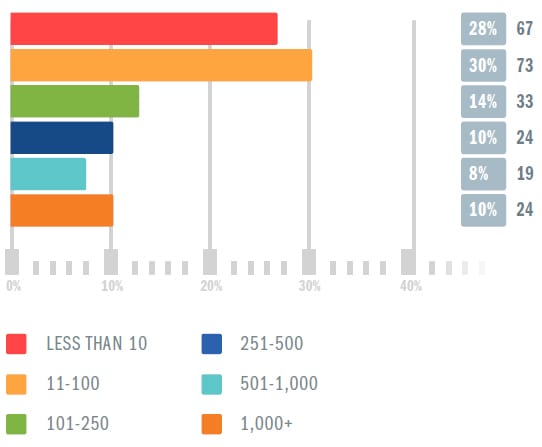

The results in this report are based on the responses of 240 accountants, 100 of which have completed their first post-transition audit.

The findings uncovered insight on audit challenges and opportunities, and how organizations are preparing for their next audit.

How many leases are in your company’s portfolio?

Like this survey? Check out some of our free tools.

Free Lease Accounting Software

Comply with confidence for free under ASC 842 & IFRS 16.

GASB Lease Accounting RFP

Use our GASB specific RFP to start evaluating software vendors today.

Lease Accounting Software RFP

Use our RFP to start evaluating lease accounting software vendors today.

Lease vs Buy Calculator

Perform a break even analysis with our free Lease vs Buy excel template.

GASB Lease Tracking Template

Use this free tool to create an inventory of your leases.

Embedded Lease Test

Use this free tool to determine if your contract contains a lease.

Lease Asset Tracker

Use this free tool to easily document your leases.

Capital vs. Operating Lease Test

Use this free tool to determine your lease classification.

Present Value Calculator

Use this free tool to calculate the present value of your minimum lease payments.