Built for

FINANCE

Maximize savings, efficiency, and simplicity.

ACCOUNTING

Realize accuracy, efficiency, and compliance.

IT

Optimize control, costs, and security.

Stop looking.

Start seeing.

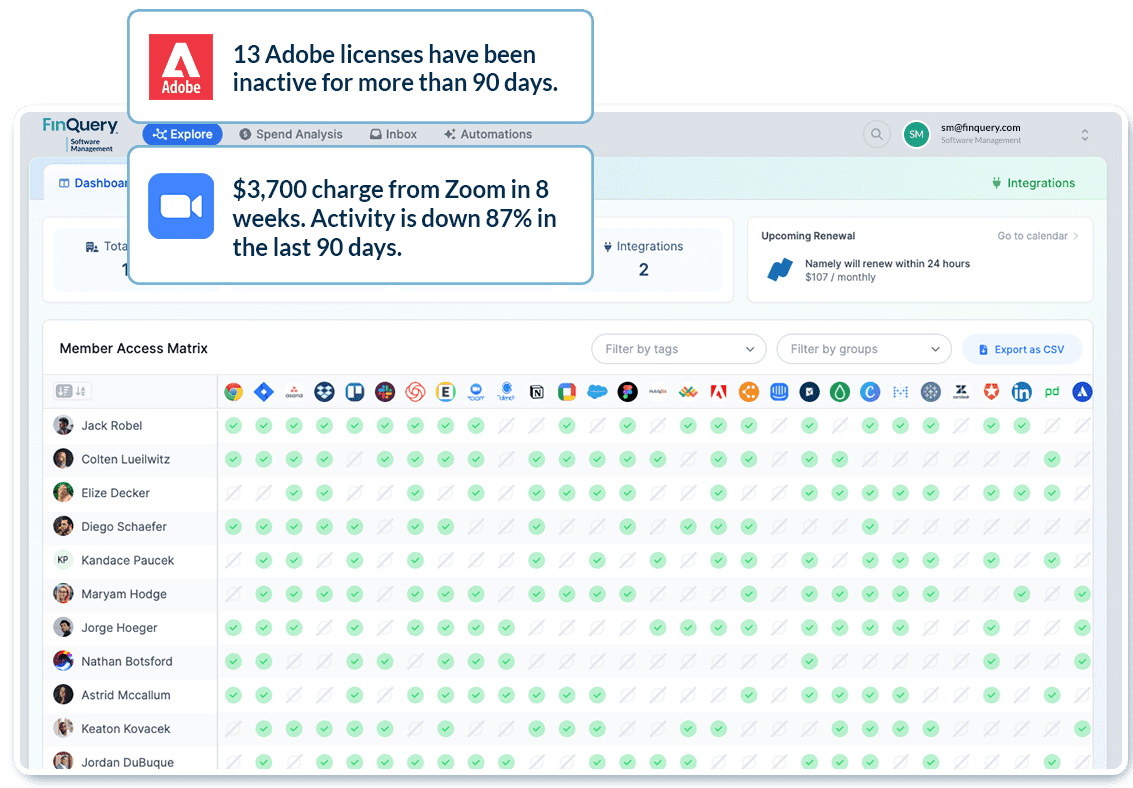

We’re FinQuery and we’re here to help you see your finances in a whole new way. Building on our accounting expertise, we’ve created a platform that will give you total visibility into your financial contracts, lease accounting, and software subscriptions for complete control, simplicity, security, and savings.

See what our contract and spend intelligence platform can do for your business.

Uniting Finance and IT.

8000+

SUPPORTED ORGANIZATIONS

250+

PARTNERS

4.8 / 5

AVERAGE RATING

One platform for your largest areas of spend.

We provide full visibility into financial contracts, leases, and software — what you have and what you are spending — as well as easy collaboration and security for stakeholders across multiple departments.